There is nothing like a significantly stronger currency to get central banks to take pause.

I cannot recall in recent memory a time where a little known (or under-appreciated?) Deputy Director of the Bank of Canada made a notable impact on the Canadian dollar. Such an event occurred on Monday, September 18th. Deputy Director Timothy Lane spoke at the Saskatoon Regional Economic Development Authority in Saskatoon, Saskatchewan. Lane discussed international trade in a talk titled “How Canada’s International Trade is Changing with the Times.” There was one quote in the prepared speech that presumably snapped currency traders to attention (emphasis mine):

“Now, economic data show that growth in Canada is becoming more broadly based and self-sustaining. We are seeing widespread strength in business investment and exports, in conjunction with a global economic expansion that is becoming more synchronous… Imports are also expanding; the increases we are seeing in imports of machinery and equipment and of various intermediate products are early signals of rising business investment. It was in this context that the Bank of Canada decided, in July and again earlier this month, to raise our policy rate. We will be paying close attention to how the economy responds to both higher interest rates and the stronger Canadian dollar.”

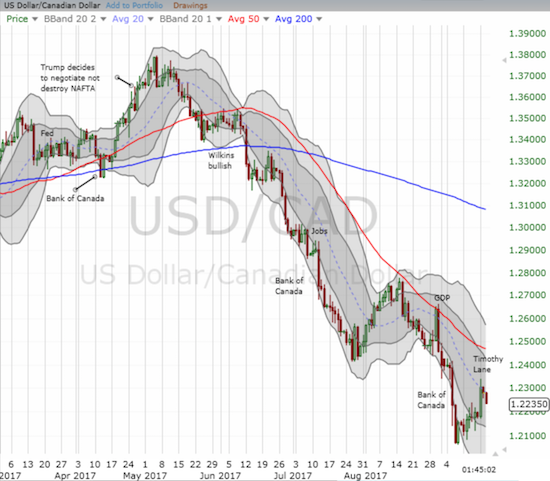

That last sentence put the currency market on notice: the Bank of Canada’s future monetary policy decisions may depend on the strength of the Canadian dollar (FXC). When the Bank of Canada cut rates in the wake of the collapse in oil prices, the Bank floated its hopes for driving stronger exports to ease Canada’s transition. While exports did not rebound as strongly as expected, the economy as a whole seemed to benefit. It makes sense that the Bank is now wary about how well the economy can or will absorb a stronger exchange rate. USD/CAD last traded at current levels in May, 2015.

The market’s swift reaction came right around the time of Lane’s speech. I assume the prepared text was released around that time and that algorithms and speed readers were able to push the “sell CAD” buttons in a flash. The response was so swift that the flurry of it all ended in about 15 minutes with the vast majority of the move coming in the first 5 minutes. Even when Lane further highlighted his comments on the currency in the Q&A session, the market failed to fire up again (Q&A began almost 28 minutes after the speech started). Indeed, USD/CAD drifted lower for the next 7 hours or so before buyers showed up again. The 5-minute chart below highlights the trading action.

Source: FreeStockCharts.com

The host asked the first question in the Q&A period, and he got right to the point. He asked about the Bank’s expectations for rate changes in Canada and the U.S. given the level of exchange rates. Lane first reminded the audience that each meeting on monetary policy is “live” where the Bank makes data-driven decisions. He affirmed that low rates still appear appropriate given the Bank does not know how the economy is going to react to recent rate hikes. After noting how a strong Canadian dollar earlier dampened exports, Lane indicated that the Bank is closely watching the strengthening Canadian dollar. He even went as far to say that the Bank will take the exchange rate into account “pretty strongly” in making its decisions. (Lane did not offer his opinion on what the U.S. Federal Reserve might do).

That answer validated the market’s reaction to Lane’s speech although I think the move was overdone. I highly doubt Lane even intended to cause the currency to weaken significantly. Still, Lane put the market on notice that the additional rate hikes might be postponed if currency strength appears to impede progress in the economy.

On the other hand, Lane answered a question about a potential housing bubble in Canada by including low interest rates on the list of culprits. Exceptionally low rates have allowed Canadian households to service more and more expensive loans. Lane reminded the audience that current levels are not likely to persist throughout the life of a mortgage. He also called out domestic speculation that has households and investors over-reaching on their housing purchases. The over-heated housing market has motivated the Bank to amplify its warnings about the housing market over the past year. While the Bank may find success with “macroprudential regulations” like the United Kingdom, I strongly suspect that Lane’s comments suggest that the Bank of Canada is eager to take away some of the fuel for the housing market that comes in the form of extremely low interest rates.

Lane also expressed concerns about the recent moves toward protectionism. First, he emphasized the benefits of international trade to the Canadian economy:

“…the progressive lowering of trade barriers worldwide has had outsized effects. Trade agreements have enabled much closer economic integration, and trade flows have burgeoned, leading to increases in productivity and living standards…

Looking ahead, Canada’s openness to international trade is an important determinant of Canada’s economic growth potential—that is, of how fast the Canadian economy can grow without giving rise to inflationary pressures. That growth potential could be greater than we think—if businesses find new ways to engage with GVCs [Global Value Chains] and develop new products and processes to make them more productive and competitive. As in the past, further expanding Canadian firms’ access to markets and to imported inputs could unlock more opportunities. An example is the Canada–European Union Comprehensive Economic and Trade Agreement, most of which will be implemented in the next few days.”

Thus, protectionist rhetoric and policies threaten the Canadian economy:

“…Populist movements in some of our major trading partners are demanding new trade barriers. However, such protectionist measures would undoubtedly mean less trade, which would reduce economic growth…

But some other developments are more concerning. With the rise in protectionist sentiment in some parts of the world, we have been entering a time of heightened uncertainty about the rules of the game on international trade. The possibility of a material protectionist shift—particularly regarding the outcome of negotiations on possible changes to NAFTA—is a key source of uncertainty for Canada’s economic outlook…”

I shared those worries in a post I wrote to explain why I shortened the leash on my long trades on the Canadian dollar (mainly short USD/CAD). Shortly after that, strong economic data and a bullish Bank of Canada gave me renewed confidence, but I still did not return to my previous level of aggressiveness. That lingering caution paid off as I watched USD/CAD soar and put my small short position into the red. I added to my short as I saw the impact of the move fade so quickly; moreover, I am always skeptical of quick trigger currency that burn out so quickly. It was probably no accident that the reaction stopped short of reversing USD/CAD’s loss in the wake of the BoC’s last rate cut. Downtrending resistance from the 20-day moving average (DMA) also held. At the time of writing USD/CAD continues to fade ahead of the Federal Reserve Meeting.

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: short USD/CAD