A month ago, Trulia published an article on the potential for renting out the spare rooms of Baby Boomers to millennials called “Boom-mates: How Empty Nesters Could Help Ease a Housing Shortage.” It was an interesting twist on the concept of multi-generational housing that generated a lot of related headlines. I took interest in the article because it looked like an idea that could provide yet one more counter to the doomsday concept of the “senior sell-off.” The senior sell-off is a demographic and market moment where aging boomers can no longer maintain their over-sized homes and are forced to sell their homes essentially en masse. The sell-off leads to a housing calamity or crash because the market will be devoid of buyers who are interested in the housing preferences from the past. The focus rests primarily on the mismatch in preferences between up and coming millennials and baby boomers (but I wonder when has a generation EVER preferred the housing choices of the people two generations older?).

Starting in May, 2013 I began writing a series of critical articles that cast doubt on the notion of a senior sell-off, especially on the predicted timing of 2020. Arthur C. Nelson, the demographer who came up with the concept of the senior sell-off, has since extended his doomsday clock out to the mid to late 2020s. While that timeline is now late enough again to allow for anything to happen, I remain very skeptical. “Boom-mates” is one of several new reasons.

Trulia author Cameron Simons ponders the possibilities of millennials and baby boomers collaborating to solve their specific but related housing problems: millennials are facing skyrocketing housing costs relative to their budgets and boomers cannot move even if they want to because of those same costs. While many boomers have paid off their homes, they still need ways to reduce the cost of aging in place. Simons speculates that boomers are sitting on 3.6 million empty rooms that could be rented. The estimated economics are a win-win:

“For retired or soon-to-retire boomers, extra rooms are an opportunity to supplement income and offset cost-of-living increases – as much as an additional $14,000 a year. For many older Americans, renting a room provides an economic boost that may help them stay in a home longer.

For young adults, renting a room as opposed to a one-bedroom apartment could save them up to $24,000 annually.”

The opportunities vary by region of course. Simons determined that the Washington D.C. metro area tops the list. Simons also described the positive non-financial aspects of multi-generational housing: passing down wisdom, buffering against loneliness, and learning new technologies.

This idea ties in well with the growing sharing economy. Pundits have focused on the ways in which the sharing economy has facilitated delays in in millennial household formation and home buying. Yet, there remains little reason to believe this delay will translate into the complete foregoing of these rites of American adulthood. In the meantime, while millennials are figuring things out, perhaps boom-mates could produce a new rite of passage that produces millennials who are even better prepared for the challenges ahead in running a household.

America is so far from a senior sell-off that Nightly Business Report went so far as to pin a good deal of blame on aging-in-place boomers for the shortage of supply of existing homes. In “Housing recovery suffers, but don’t blame the millennials” Diana Orlick delivers this telling quote from Laraine Camera Goldberg who, along with her former husband, bought a 5-bedroom, 3,000 square foot home 40 years ago in North Potomac, Maryland:

“‘I don’t know where to go from here because everything is so expensive. I’m stuck,’ Goldberg said. ‘It’s actually less expensive to stay here and metro into the city than move into the city. So I’m stuck, but I’m in a neighborhood by myself that really I don’t belong in.'”

There are at least two key tells in this otherwise simple quote. First, note that Goldberg has sufficient access to the city from her suburban home. Second, and more importantly, note that Goldberg feels like she does not belong. I assume that reference to mean her neighborhood has refilled with younger families, parents raising children. If these are not millennial households, they are certainly the often forgotten households of Generation X, sandwiched between the millennials and boomers. In other words, there is plenty of demand for large suburban homes, just not enough supply of affordable city dwellings. I am betting this same demand will still exist in another 7+ years.

Pundits have held out cities as the new mecca for young Americans, but the rising expense caused by the demand for scarce supply is increasingly becoming a roadblock for the migration. Books like 2014’s “The End of the Suburbs: Where the American Dream Is Moving” by Leigh Gallagher will be wrong for a long time to come. America’s core cities simply lack enough affordable room for all who prefer that style of living. Indeed, in some of the most expensive areas of the country, like the SF Bay Area, the big moves are occurring TOWARD the suburbs. For example, the exodus from San Francisco to Oakland and the somewhat related gentrification-induced move out to far flung suburbs like Antioch.

Moreover, city-living is never going to cut it for the majority of American families who still want a modicum of space for raising their children. A classic anecdote comes from a young man I know who lived in San Francisco with his wife until a few months ago. After the recent birth of their first child, they decided to move all the way out to Pleasanton where they could buy more space for their money. Pleasanton is 40 miles southeast of SF with a direct connection by public train transit. Why overpay for access to expensive restaurants and fancy night life when evenings are spent caring for small children and, when possible, catching up on sleep? This basic truth is not changing for the foreseeable future.

The extent to which people will go to AVOID the expense of living in cities is storied in the Bay Area where 5% of commuters spend at least 90 minutes getting to work each way. The national average is 3%. One poignant and recent one comes from the New York Times about a 62-year old woman (which puts her in the middle of the boomer range) who makes $81,000 a year but left the increasing rents in the city of Alameda directly across the bay from San Francisco. She picked up and moved 80 miles east of San Francisco to Stockton…where 8% of the commuters, like her, have commutes lasting as long as 90 minutes. When this woman retires and is figuring out how to live on a fixed income, I highly doubt she will find a solution in moving BACK to the urban core of the Bay Area.

So, yes, my deep skepticism about a senior sell-off remains. Here is a short list of some additional developments which could nullify a senior sell-off by making life outside the city easier and more convenient for young people and aging-in-place boomers alike.

- Air B&B: house-sharing platforms provide tools for facilitating boom-mates and other ways to make efficient use of the supply of unused housing space.

- Telecommuting: virtual reality could take remote meetings to another level beyond today’s video conference calls.

- Ride shares: the near ubiquitous availability of low-cost rides at almost any time and place mean young people can easily get to the city and the elderly need not worry about getting stranded.

- Driverless vehicles: without the need to drive, the elderly could become newly independent and mobile.

- Online dating: digital communications have greatly lowered the bar for meeting new people and have greatly reduced the premium for physical proximity.

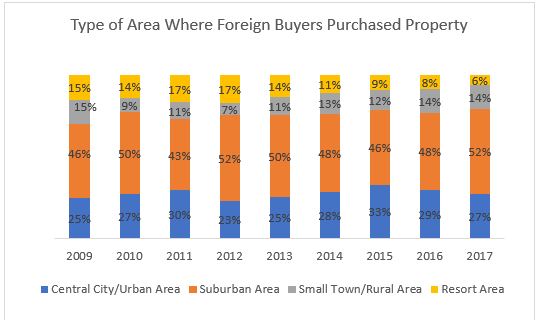

On the macro side, the U.S. remains a hot housing market for foreigners. The dollar value of home purchases hit a record $153B in July, 2017. While Chinese buyers kept the #1 spot in dollar value for the fourth year in a row, the surge to a new record was led by a sharp growth in Canadian buying. The graphic below shows that foreign buyers have strong, consistent, and stable preferences for the suburbs. In other words, they are yet one more potential backstop for a senior sell-off. Boomers can age in place in even more comfort.

Source: National Association of Realtors

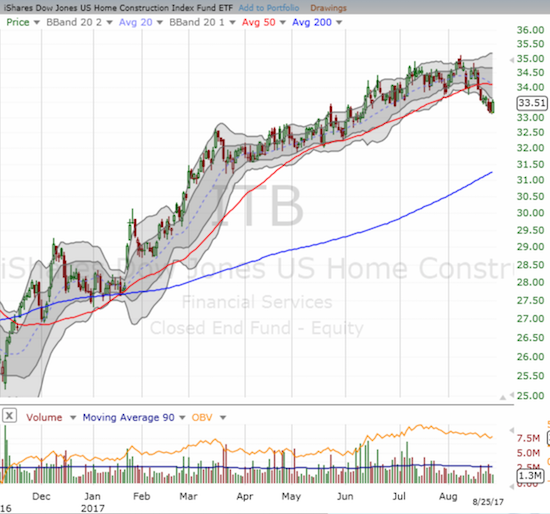

There are some reasons to be worried about housing in the U.S. A senior sell-off continues to rank at the very bottom of my list.

Source: FreeStockCharts.com

Be careful out there!