(This is an excerpt from an article I originally published on Seeking Alpha on August 14, 2017. Click here to read the entire piece.)

On June 12, 2016, I effectively threw in the towel on the Teucrium Corn ETF (CORN) and switched to a shorter-term trading strategy. Less than a month later, I concluded that CORN had a bottomless behavior. {snip}

Source: FreeStockCharts.com

During this trading range, I checked in from time-to-time on crop conditions and the like but never saw anything that changed my overall conclusion. I had a moment of weakness on October 14, 2016 when CORN surged above its 50-day moving average (DMA), and I bought the presumed breakout. {snip} I decided to hold on thinking that this growing base for CORN was building the conditions for an imminent and more sustained breakout. That expectation diminished greatly after the market’s reaction to the latest World Agricultural Supply and Demand Estimates (WADE) from the U.S. Department of Agriculture (USDA).

{snip}

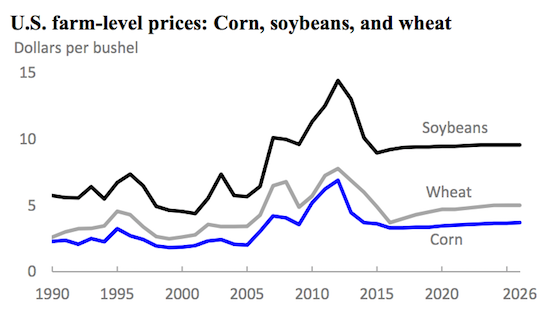

While the USDA guessed that 2017 delivered a bottom for the price of corn, the trajectory going forward rises very slowly…{snip}

Source: USDA

{snip}

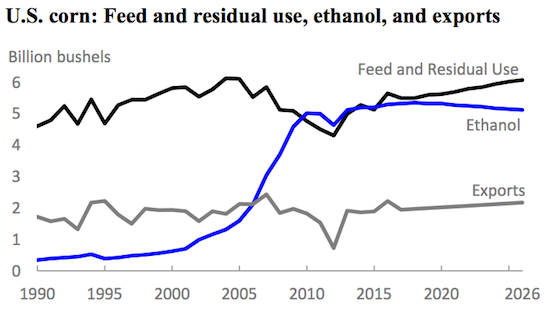

Source: USDA

Also assuming the USDA is generally correct, at least I do not have a strong reason to sell CORN unless I need to free up short-term cash for better performing asset classes/trades. It even makes sense to trade the range more aggressively: buy around current levels and sell above $19.50 or so.

{snip}

Be careful out there!

Full disclosure: long CORN

(This is an excerpt from an article I originally published on Seeking Alpha on August 14, 2017. Click here to read the entire piece.)