The Trump-wind blowing against the Mexican peso is officially over.

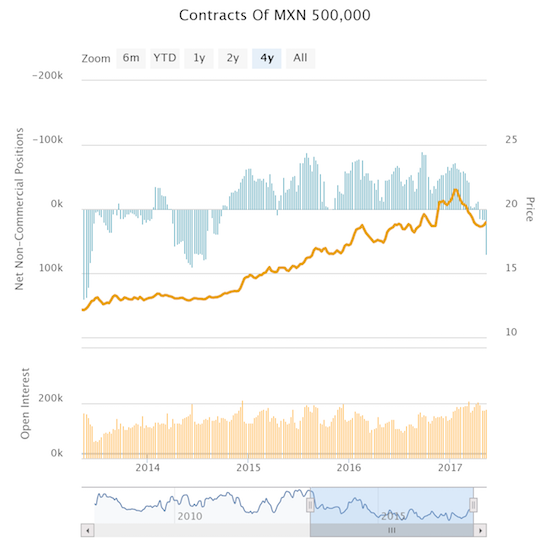

In late April, I noted how net non-commercial positions (speculators) in the Mexican peso flipped bullish for the first time in two years just as the peso completely reversed its losses from the election of Donald Trump as U.S. President. I showed how prior changes in peso positioning were related to the collapse in the price of oil. Whatever latent hesitation I had in chasing the peso bull were pretty much wiped out by the sudden surge of net long positioning by currency speculators.

Source: Oanda’s CFTC’s Commitments of Traders

I hesitated earlier because I wanted to see the peso follow-through on its Trump reversal with additional gains. Indeed, when I wrote about the Mexican peso, USD/MXN was testing resistance at the downtrending 50-day moving average (DMA). USD/MXN achieved a breakout just last week as a part of its last peak. Since that peak, USD/MXN has declined 5 straight days and perhaps going on a sixth day. The 50DMA downtrend may be in the middle of a confirmation which should in turn lead to the breakdown that I want to see to confirm the peso’s on-going strength.

Source: FreeStockCharts.com

My newfound bearishness against the U.S. dollar index (DXY0) is helping me get bullish on the peso (bearish on USD/MXN). I have started with a very small position short USD/MXN to test the waters. A new post-election low for USD/MXN will increase my bullish on the peso.

Be careful out there!

Full disclosure: short USD/MXN

An important element to the peso’s story that I have neglected at the rate hikes from the Mexican central bank. The yield on the peso is very juicy for carry trades! Even against the U.S. dollar.

http://money.cnn.com/2017/03/30/news/economy/mexico-central-bank/