(This is an excerpt from an article I originally published on Seeking Alpha on August 28, 2016. Click here to read the entire piece.)

Going into the Jackson Hole Economic Policy Symposium, various “Fed heads” were interviewed about the prospects for the next rate hike. The chorus in the days and weeks before Jackson Hole seemed to lean into a September hike. Here is at least a sampling of relevant quotes since the Fed’s July 26-27 meeting. {snip}

Federal Reserve Chair Janet Yellen appeared to confirm the heightened likelihood of a September hike and was further reinforced, or at least not contradicted, by CNBC interviews afterward with Fischer and Bullard.

{snip}

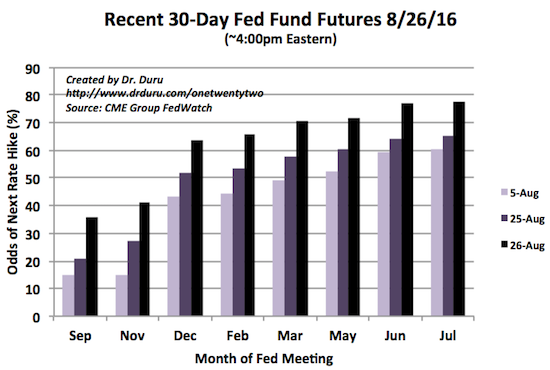

Anecdotally, it appears the conventional media interpretation of the sum of all this Fed-speak points to putting a September rate hike in play. Yet, as is often the case, financial markets disagree. In fact, a rate hike in September looks extremely unlikely although much more likely than at the beginning of August. {snip}

Source: CME Group FedWatch Tool

The market is about as close to certain as it can get about the next rate hike coming in December. {snip}

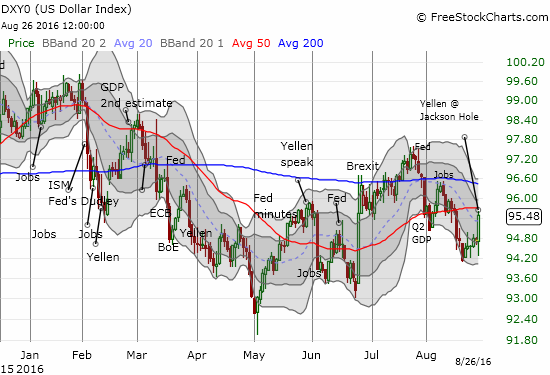

Source: FreeStockCharts.com

As the dollar firmed and rallied, precious metals wavered. {snip}

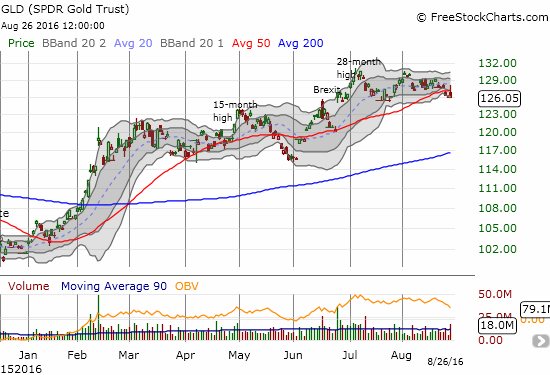

Source: FreeStockCharts.com

From a technical standpoint, this time is a bit different in that the setup is more bearish even as support from the post-Brexit gap up has yet to crack. {snip} The Fed’s own forecasts for future rates warns us of the potential volatility in expectations. Per Yellen:

{snip}

This juncture is important for GLD because gold remains a crowded trade from the perspective of speculative positions. {snip}

Source: Oanda’s CFTC’s Commitments of Traders

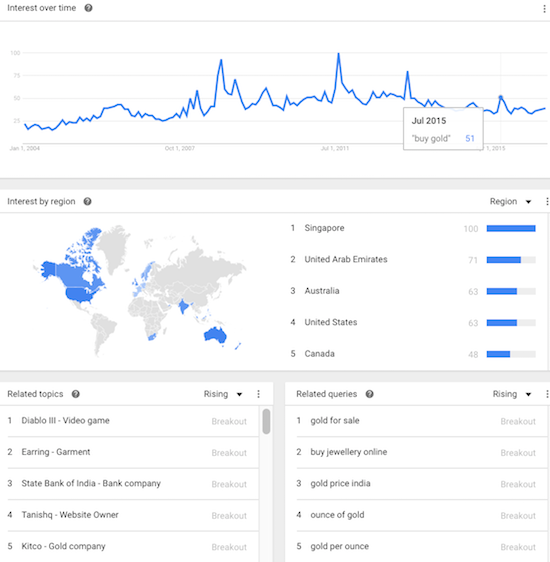

My test for gold sentiment using Google search trends suffered a setback of sorts. {snip}

Source: Google Trends

The trading implications for GLD remain the same for me: per my strategy, I am holding my long-term core position and abstaining from trading (long) around my position.

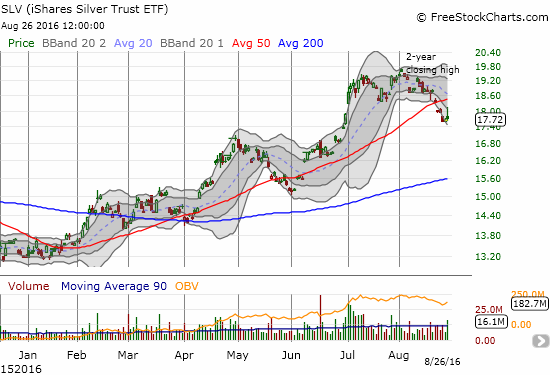

Silver (SLV) is a different story. I decided to try a hedged bet ahead of Jackson Hole in anticipation of a big move up or down by mid-September. {snip}

Source: FreeStockCharts.com

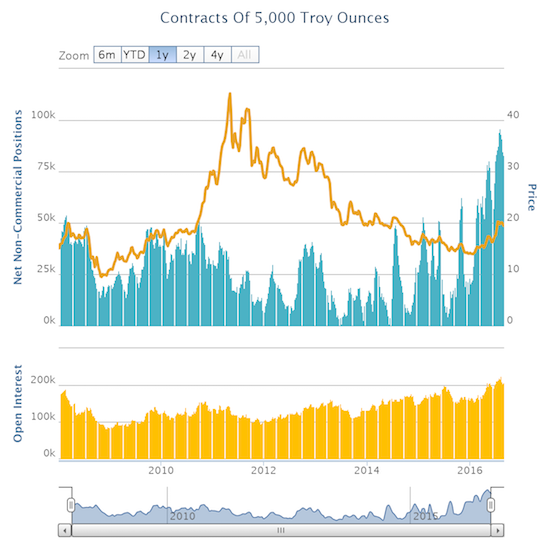

Source: Oanda’s CFTC’s Commitments of Traders

As the chart above shows, the short-term technical picture for SLV more mixed than that of GLD. {snip}

Be careful out there!

Full disclosure: long GLD, long SLV shares and call options, long ZSL call options

(This is an excerpt from an article I originally published on Seeking Alpha on August 28, 2016. Click here to read the entire piece.)