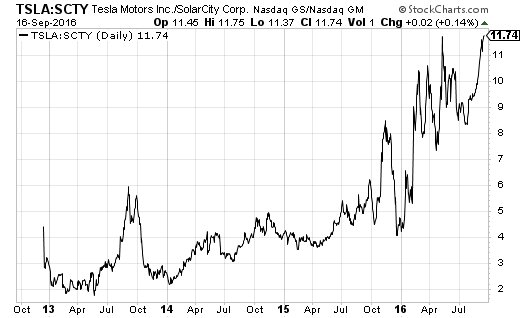

A little over two weeks ago I made the case for implementing a pairs trade on Tesla Motors (TSLA) long versus Solar City (SCTY) short. What unfolded from there rolled out according to my first scenario: SCTY continuing to sell-off and TSLA outperforming. Indeed, TSLA’s outperformance has returned to the all-time high level set earlier this year.

Source: Stockcharts.com

As a result of SCTY’s continued sell-off, I was able to log a profit on the pairs trade which expired on Friday, September 16. I will relaunch the pairs trade hopefully in the coming week, but I am going to pick my spot carefully.

SCTY is making a bid for a triple bottom. Friday in particular featured a break below the two previous lows of 2016 followed quickly by buyers who managed to close out SCTY with a gain. The resulting pattern is called a hammer. It describes a set-up where sellers finally exhaust themselves and buyers rush into the vacuum. All SCTY needs is follow-through; confirmation of a (short-term?) bottom could come with a close above the recent consolidation range (around $18.25 or so).

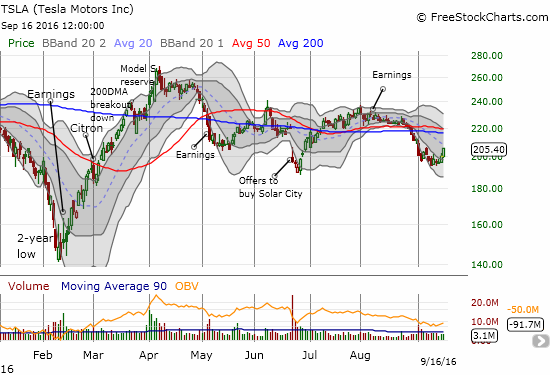

TSLA also looks like it is carving out a bottom after a near test of the June lows. The move is not quite as dramatic as SCTY, but TSLA did start the month with intense selling. TSLA’s bottoming is less seller’s exhaustion and more buyer’s resolve.

Source for charts: FreeStockCharts.com

For the pairs trade, I am not interested in playing a potential bottom. Instead, I am sticking with the primary scenario: TSLA drops its bid for SCTY whether for regulatory reasons or shareholder disapproval. Under this scenario, TSLA should rally and SCTY should sell-off. I see the current bid as an attempt to save SCTY from bankruptcy, so the trade with the greater potential is a bet against the acquisition. There is likely no upside in betting on a successful acquisition. I also see a TSLA sell-off and a SCTY rally as the least likely scenario. Thus, my pairs trade is long TSLA and short SCTY. If I can fade a rally on SCTY, I will get the best price on this pairs trade. The chart of the TSLA/SCTY ratio also suggests that SCTY is overdue to outperform TSLA.

My first pairs trade was a test. The next pairs trade will be more substantial and targeted for a longer timeframe, perhaps somewhere between January and March.

Be careful out there!

Full disclosure: no positions