(This is an excerpt from an article I originally published on Seeking Alpha on April 25, 2016. Click here to read the entire piece.)

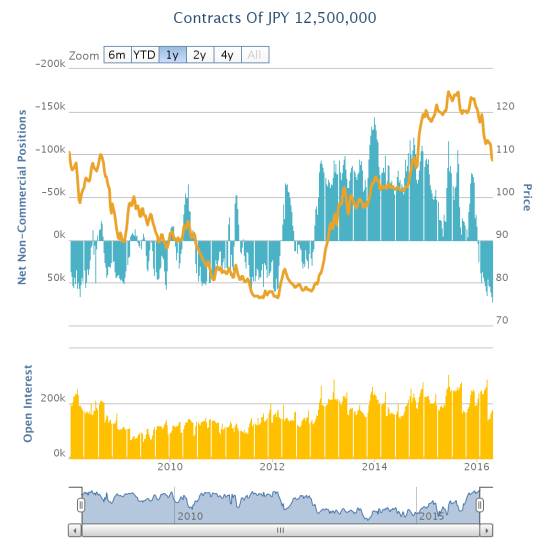

Currency speculators are at “maximum bullishness”: bullish bets on the Japanese yen (FXY) have reached levels unseen since at least 2009.

Source: Oanda’s CFTC’s Commitments of Traders

Facing off against this bullishness is the Bank of Japan (BoJ). The rapid appreciation in the Japanese yen threatens the BoJ’s efforts to hit its inflation targets and shepherd GDP growth. {snip}

Source: FreeStockCharts.com

At its 2016 peak on April 11th, FXY had gained 11.6% for the year. On that very day I happened to write “Watch Out For The Nuances Of The Japanese Yen’s Relationship To The S&P 500” where I described my trading strategy on the yen:

{snip}

If Friday’s trading is a sign then that “inevitable” reversal may have already begun.

While yen bulls may be finally unwinding positions ahead of the BoJ meeting, the release on Friday of a series of reports from the BoJ may have helped to grease the skids for FXY. {snip}

The BoJ just cannot win with negative rates it seems. Clearly, negative interest rates are not yet working as hoped in Japan. The run-up in the currency since implementation of the negative rates has acted as a double-whammy. {snip}

Interestingly, one of many of the BoJ’s talking points on solutions is to cooperate more with central banks. That sounds like the underpinnings for “currency cooperation”…

{snip}

The absence of ANY mention of the Japanese yen stuck out like a sore thumb in this article. FXY’s loss on Friday erased all its gains for April, so the catch-up may be underway. There is a lot more room to go if this reversal of maximum yen bullishness picks up support.

Be careful out there!

Full disclosure: long USD/JPY, short GBP/JPY, short AUD/JPY, short euro

(This is an excerpt from an article I originally published on Seeking Alpha on April 25, 2016. Click here to read the entire piece.)