(This is an excerpt from an article I originally published on Seeking Alpha on February 24, 2016. Click here to read the entire piece.)

Americans do not get to vote as a nation on anything unless it is something like American Idol or Dancing With the Stars; definitely nothing political. Our nation’s founders sought fit to disperse power across the states and set up an electoral college system that diffuses the power of the popular vote. So, it can seem a bit odd from this side of the Atlantic to see and read about all the fuss being made about national referendums in Europe. Over the past 18 months, we have witnessed in Europe example after an example national referendums on issues weighty enough to make headlines in the U.S. and even impact financial markets, particularly currency markets. It has been quite a spectacle from this perch.

{snip}

Now, here we are again. The referendum ruckus returns to the United Kingdom in the form of another separation vote. This time, the people of the UK have the opportunity to bail completely on the European Union, aka “Brexit.” {snip} While global investors wring their hands about the devaluation of the Chinese yuan, the real-time devaluation of the British pound is in many ways more breathtaking even if the impact is not as global.

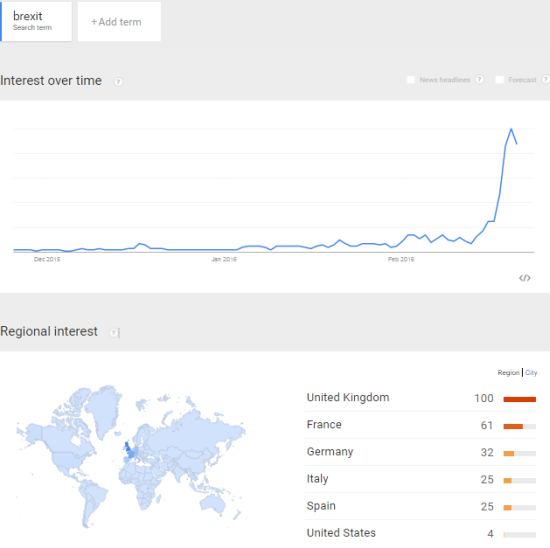

It is hard to pinpoint exactly when Brexit fears really took off, but I think Google Trends acts as a sufficient proxy for a launchpad. {snip}

Source: Google Trends

{snip}

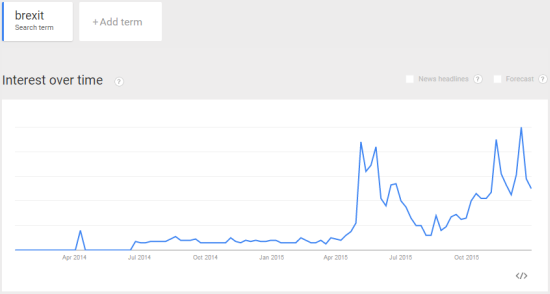

Source: Google Trends

From this view, May, 2015 looks like a good starting point for significant interest in Brexit. May, 2015 also happens to be a point where the British pound began topping against the U.S. dollar. {snip}

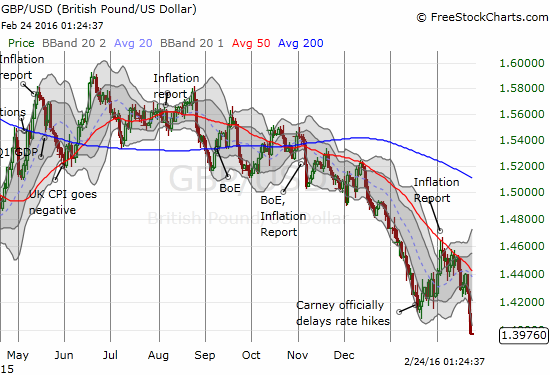

Source: FreeStockCharts.com

The correspondence between Google Trends interest and currencies is clearest in GBP/USD. {snip}

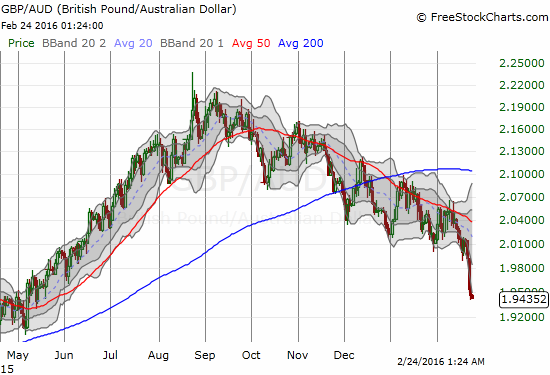

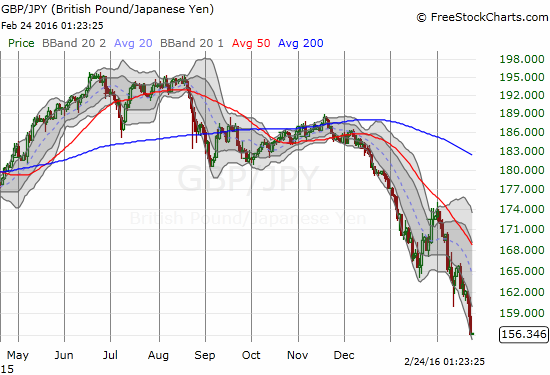

Source: FreeStockCharts.com

{snip}

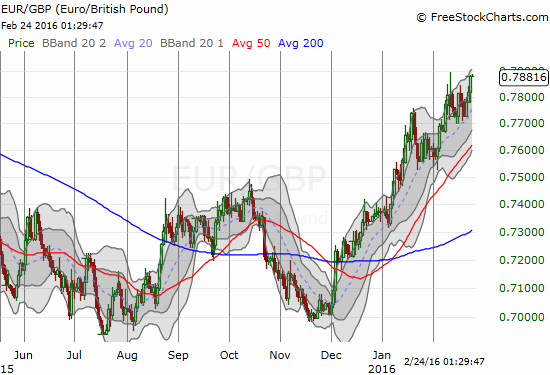

EUR/GBP is a special case because the European Central Bank’s bumbling attempts to devalue the euro caused enough noise to delay the euro’s (FXE) rise against the pound until this year. {snip}

Source: FreeStockCharts.com

Now following Google Trends to its logical conclusion, the British pound’s losses SHOULD at least decelerate if not abate altogether sooner than later…assuming Google Trends does not experience a fresh spike even higher. {snip}

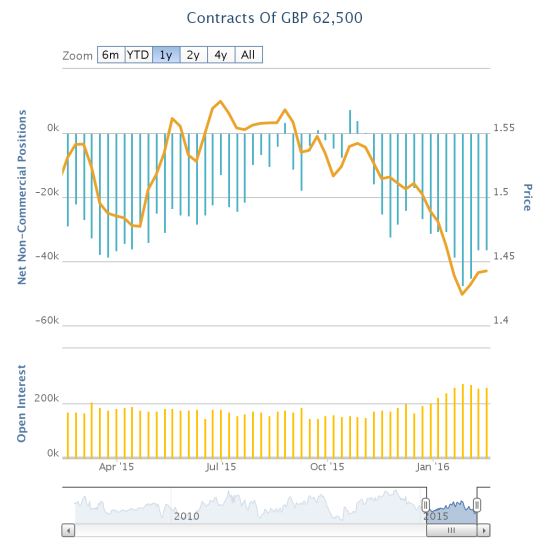

Source: Oanda’s CFTC’s Commitments of Traders

This near panic and selling seems excessive when the outcome of a referendum remains four months away with plenty of uncertainty along the way. {sniP}

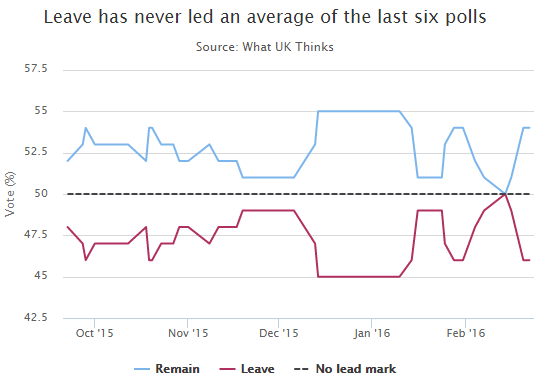

Source: The Daily Telegraph

This additional point suggests further that Brexit is not likely to happen:

{snip}

However, financial markets are not paying attention to the polling. As the Daily Telegraph points out, and as the currency markets so clearly demonstrate, the markets are sitting firmly in fear of Brexit. {snip}

In other words, the large downside skew likely tilts the “expected value” of the referendum to a substantial loss on the pound. {snip}

So what we have here is a trend feeding on itself. Currency traders love a reliable trend and almost none has been as reliable as a sinking pound lately. {snip}

Source: Daily Telegraph

Be careful out there!

Full disclosure: net short the British pound

(This is an excerpt from an article I originally published on Seeking Alpha on February 24, 2016. Click here to read the entire piece.)