{edited June 17, 2016 to add more commentary and clarity}

Warren Buffett, CEO of the legendary Berkshire Hathaway, rightfully sits among the most respected and highly regarded business leaders in American history. When Buffett talks, his words matter: his opinions can shape minds and drive business practices. Buffett’s influence and potential for tremendous good turn Berkshire’s annual shareholder meeting into a mega-event. The annual confab is entertaining, educational, sobering, and inspirational all at the same time.

The 2016 mass migration to Omaha, Nebraska was broadcast and streamed live for the first time by Yahoo Finance. Honestly, I was never interested in following this meeting or the commentary that came out of it until Yahoo (YHOO) advertised this momentous occasion. The video stream caught my attention, and I was riveted.

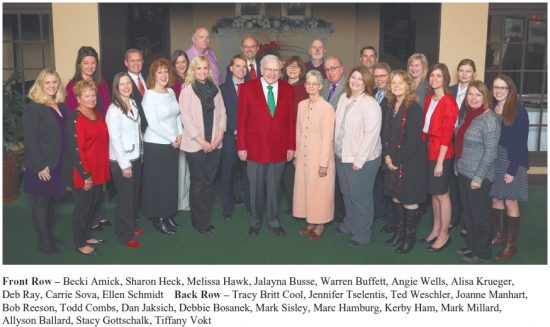

Yet, there was at least one moment that stirred me from my blissful admiration. That moment arrived around the 4:05:00 mark when Buffett and Vice Chairman Charlie Munger answered a shareholder question on diversity (I transcribed the relevant part of the video at the end of this blog post). The shareholder expressed concern that, among S&P 100 companies, Berkshire Hathaway ranked among the four worst companies on diversity based on a 2015 report from Calvert Investments. The shareholder also evoked these images from Berkshire’s 2015 annual report as part of his evidence…

Source: Berkshire Hathaway, Inc. 2015 Annual Report

The shareholder went on to ask whether Berkshire needed to change its staunch policy of excluding diversity as a criteria for hiring leadership and appointing board members. The shareholder also asked whether Berkshire considered diversity when valuing a potential acquisition.

This moment could have shined brightly as a beacon to motivate business leaders around the country to think consciously about promoting workplace inclusion and to question the status quo. Instead, Buffett and Munger went on the defensive and chose to affirm their opposition to thinking purposely and consciously about diversity. At times, Buffet’s defense rambled and even sounded insensitive. Munger’s response was equally frustrating as he recounted a misdirecting story that linked diversity to discrimination. The whole display seemed out of character within the context of otherwise smart and enlightening answers to other shareholder questions. I had to conclude that Buffett and Munger are not quite clear on the “diversity issue” when applied in the corporate and organizational context.

The diversity question recognizes that opportunity suffers when leaders lack the vision to understand the potential improvement from an expanded search for talent. Buffett wasted a lot of time expressing his disdain for consultants who staff company boards. Yet, consultants are certainly unnecessary if management already understands the need for and benefits of diversity. A company DOES need a fundamental dissatisfaction with a status quo of benign neglect. A company DOES need to appreciate how inclusive hiring practices contribute to a healthier business and economic environment. The quest for diversity requires tonal sensitivity.

Buffett insisted that diversity does not need a place at the table by proclaiming Berkshire’s three pillars of criteria for hiring board directors:

- Business savvy

- Shareholder-oriented

- Specially interested in Berkshire

(Note that as of June, 2016, Berkshire’s disclosure on corporate governance guidelines also includes “very high integrity”).

These criteria are perfectly reasonable and laudable. However, in the context of the diversity question, Buffett left unanswered how a fair process can generate such poor marks for diversity. He chose to defend the criteria over the results and thus confirmed his disinterest in diversity. Later in his response, Buffett denounced board members who want to get paid $200K to $300K for 10% of their time and who use the position as a platform for prestige. Yet, these poor hiring decisions have nothing to do with the explicit exclusion of diversity from Berkshire’s hiring process. Buffett’s reference even implies attention to diversity promotes bad boards.

This moment was a ripe opportunity for Buffett to acknowledge some limitations to the process – even if those limitations are as yet unexplained and little understood. Absent that admission, he could have quantified the fairness of the selection process. Instead, Buffett only applauded the company’s selection criteria by proclaiming that “we have found people like that” and left our imaginations and biases to wonder about the fairness embedded in that talent search. In case anyone thinks Buffett needs help in this selection process, he characterized (staffing) consultants as misguided and focused on placing directors whose “big names” bring credit to the hiring institution.

The complaint about consultants delivered an unfortunate segue into a glancing blow at the now maligned biotech firm Theranos. Founder Elizabeth Holmes leads the company with a vision to democratize medicine by making lab testing accessible to everyone. Over the past year or so, she and the company have faced increasing scrutiny from the Wall Street Journal and regulators for the medical practices at Theranos. The Department of Justice is even investigating Theranos for fraud, and Walgreens recently terminated its partnership with the company. Buffett pointed a scolding finger at the board of Theranos as an example where big names fail. Since Buffett used this case as an example of diversity’s failure, the discerning listener can be excused for wondering whether Buffett meant to imply that Theranos is an example of what happens when a woman is allowed to run the show without proper supervision. I am willing to give Buffett the benefit of the doubt because I concluded he does not understand the diversity issue. Such an understanding would have helped him steer very clear of this unnecessary and questionable diversion…or at least helped motivate a relevant connection to the shareholder’s question about diversity.

Buffet’s defense of the status quo for Berkshire headquarters also took an unfortunate fork in the road. Buffett defiantly expressed his hope that 2016’s Christmas picture at headquarters looks exactly the same as 2015’s even though the company may have added another 30,000 employees by then. Buffett acted as though the shareholder asked him to replace his staff. Buffett took another jab at consultants who might claim they could help his staff with their work, such as coordinating the annual shareholder meeting. He curtly ended his comments by criticizing some unknown comparables: “I’ve seen the other kind of operation, and I like ours better. I will put it that way.”

Nothing in this defense addressed the diversity question. Buffett could have described how his headquarters staff came to be dominated by female employees as a starting point for talking about his process of hiring. Instead, he held up the outstanding work of his staff as an implicit challenge: since the staff already produces outstanding work, why consider diversity practices?

Buffett implied that achieving diversity means hiring consultants for advice, lowering quality standards, and eliminating people who are doing good jobs. The question on diversity did not ask or require Buffett to fire anyone to meet a diversity quota. The question did not ask Buffett to lower his standards. The question simply asked Buffett to open his eyes wide and free his mind sufficiently enough to ask why his workforce does not reflect the diversity we should expect in an American company. The diversity question tried to speak the language of business in pointing out that the company is likely forgoing valuable business opportunities by behaving in such an insular manner. We should no longer accept that fairness among friends, associates, and others who look and think like the leader equates to fairness in the absolute.

In other words, the diversity question asks corporate leaders to commit to ensuring their companies are proactively reaching out to a diverse pool of qualified candidates. The diversity question seeks to break the self-reinforcing dynamics of building a workforce out of personal familiarity. I fully understand the benefits of retaining a core group of proven talent. No responsible manager would intentionally let such a team dissolve or contract. However, Buffett’s defense of his dedicated crew of superstars missed the core question: when it comes time to hire someone new, for whatever reason, is Buffett willing to look beyond the limited recommendations born out of personal familiarity? A simple “yes” could have put to rest a lot of concerns. Instead, Buffett’s answer sounds like a resounding “no.”

Buffett demonstrated a similar tone deafness when talking about the extended tenure of Berkshire’s managers. In responding to an earlier shareholder question, Buffett proudly proclaimed that his managers have had very long tenures because they enjoy their jobs and do not work for the money. Buffett also quipped that he constantly reminds the board that the lack of a retirement age has contributed to this low turnover. Yet, Buffett insisted on demonstrating that he rewards this loyalty with a related commitment to managerial stasis. The lack of change at the top comes through loud and clear in the following quote from the end of the 2015 letter to shareholders in the annual report:

“Can you imagine another very large company – we employ 361,270 people worldwide – enjoying that kind of employment stability at headquarters? At Berkshire we have hired some wonderful people – and they have stayed with us. Moreover, no one is hired unless he or she is truly needed. That’s why you’ve never read about ‘restructuring’ charges at Berkshire.”

Mr. Buffett, you need more diversity. Why not in response to the diversity question simply assure the audience that the selection process for replacing departing employees or adding to the workforce includes a pool of qualified candidates that is as broad as practical?

Munger concluded with a story about discrimination and lowering standards that also missed the mark.

Some time ago, Munger did legal work with the Roman Catholic Church in Los Angeles. Munger’s partner informed the Archbishop that he should hire from a pool of good Roman Catholic tax lawyers instead of Munger and himself. The insulted Archbishop explained that he did not look for “the leading Roman Catholic surgeon” when he needed a recent operation. While the crowd took pleasure in this story, I waited in vain for Munger to complete the lesson. Munger should have ended with something like “…and thus Berkshire always strives to hire from an inclusive set of potential candidates.” Instead, Munger left the impression that seeking diversity means targeting a specific affinity group for privilege before qualification. A truly affirmative example of diversity would have featured a law firm asking the Archbishop for a fair and equal opportunity at winning the business despite the lack of church affiliation. By twisting the lesson around, Munger proved himself to be as tone deaf as Buffett.

Diversity is not about stuffing boards with self-interested, unqualified egomaniacs. Diversity is not about removing people from their jobs and replacing them according to some prescribed formula. The diversity question is about understanding the necessary link between the health of American business with the health of the pipeline of opportunity for the broad spectrum of America’s people. I fundamentally refuse to believe that comprehension of the true meaning and value of diversity is beyond the grasp of a man like Warren Buffett. He has otherwise proven himself dedicated to doing the right thing, to promoting confidence and optimism in the strength of America, and to singing the praises of hard work and clarity of thought. I look forward to the day when he and his partners apply these same principles to issues of inclusion and diversity.

My heart-felt claim for Warren Buffett: you are NOT out of options!

Source: FreeStockCharts.com

===========

Here is my transcription of the portion of the video featuring the diversity question and the responses…

Andrew Ross Sorkin from CNBC asked the question on behalf of Arits Galdoz (spelling?). Sorkin indicated that several other shareholders had asked similar questions. I transcribed the conversation as accurately as possible: my disbelief motivated me to confirm exactly what I think I heard…

From Sorkin:

“About two dozen men and women work with you Warren at our corporate office. I see from last year the quality of the picture in the annual report has been improved so congratulations on that. However, looking at it, there is something that comes to anyone’s attention, and it is the lack of diversity among the staff. A 2015 analysis by Calvert Investments found that Coca-Cola (KO) was one of the best companies for workplace diversity while Berkshire Hathaway was one of the worst. You’ve explicitly stated that you do not consider diversity when hiring for leadership roles and board members. Does that need to change? Are we missing any investment opportunities as a result? And do you consider diversity, however defined, of company leadership and staff in the value of a company that you may want to purchase?”

“Based on the 10 diversity criteria in the Calvert report, the overall highest-rated companies are: Bristol-Myers Squibb, Citigroup; Dow Chemical, Eli Lilly; Lockheed Martin; Merck; Microsoft; PepsiCo; Target; and Wells Fargo. (ten companies tied for first place.) The four lowest-rated companies are: Berkshire Hathaway; Simon Property Group; National Oilwell Varco Inc.; and Twenty-First Century Fox. Companies that achieved the most improvement: Philip Morris International; Schlumberger; and Occidental Petroleum.”

Buffett’s response to the diversity question:

“The answer to the last question is no. What was the one before it? [audience laughs and Sorkin repeated the question].

We will select board members, and we lay it out, we’ve done so for years. And I think we have been much more explicit than most companies. We are looking for people who are business savvy, shareholder-oriented, and have a special interest in Berkshire. And we found people like that. As a result, I think, I think we’ve got the best board that we could have. They’re clearly not in it for the money.

I get called by consulting firms who’ve been told to get candidates for directors for other companies. By the questions they ask it’s…clearly they’ve got something other than the three questions we ask in terms of Directors in mind. They really want somebody whose name will reflect credit on the institution which means a big name. One organization recently – the one that did the blood samples with small pricks – they got some very big names on their board. And Theranos [got verification from Munger on pronunciation], the names are great, but we are not interested in people that want to be on the board because they want to make 200 or 300,000 dollars a year for 10% of their time. And we’re not interested in the ones for whom it’s a prestige item and who want to go and check boxes and that sort of thing.

So I think we’ve got…we will continue to apply that test: business savvy, shareholder-oriented, and with a strong personal interest in Berkshire.

And every share of Berkshire that our shareholders own is bought just like everybody else in this room. They haven’t gotten them on option. I have been on boards where they’ve given me stock. I get it for breathing. Maybe half a dozen places, maybe 3 or 4 places, where I was on the board of. We want our shareholders to walk in the shoes, I mean Directors to walk in the shoes of the shareholders. We want them to care a lot about the business. And we want them to be smart enough so that they know enough about business; they know what they should get involved in and what they shouldn’t get involved in.

The people in the office – I’m hoping that when we take the Christmas picture again this year, they’re exactly the same 25 that were there last year although we might have added 30,000 employees elsewhere. Maybe $10B of sales or something like that. It’s a remarkable group of people.

And they, just take this meeting..virtually every one of the 25…they have been doing job after job connected with making this meeting a success and a pleasant outing for our shareholders. It’s a cooperative effort. The idea that you would have some department called annual meeting department. You’d have a person in charge of it and she or he would have an assistant that would go to various conferences about holding annual meetings and they hire consultants to come in and help them run the meeting. We just don’t operate that way. It’s a place where everybody helps each other [audience applauds].

Part of what makes my job, well my job is extraordinarily easy, well the people around me really make it easy. And part of the reason it is easy is because we don’t have any committees. Maybe we have some committee I don’t know about. I’ve never been invited to any committees – I’ll put it that way – at Berkshire. We may have a Powerpoint someplace, I haven’t seen it and I wouldn’t know how to use it anyway. We just don’t do, we don’t have make-work activities. We might go to a baseball game together or something like that. I’ve seen the other kind of operation, and I like ours better. I’ll put it that way. Charlie?”

Munger’s response:

“Well years ago I did some work for the Roman Catholic Archbishop of Los Angeles. And my Senior Partner pompously said you don’t need to hire us to do this. There some plenty of good Catholic tax lawyers. And the Archbishop looked at him like he was an idiot and said ‘Mr. Peeler, last year I had some very serious surgery. And I did not look around for the leading Catholic surgeon.” [Audience laughs]. That’s the way I feel about board members. [Audience applauds. Warren pops open a can of Coke.]”

Full disclosure: long YHOO

With the results Buffett has why should he care about anthing but what gets the best results going forward? Where is the diversity in nba? the team hires the best one for the job. No matter who it is……

My main point was that Buffett had an opportunity to simply state that he is committed to hiring the best from a broadly sourced applicant pool. Instead, Buffett (and Munger) went into this long and painful series of tales and complaints that completely sidestepped the essence of the question being asked by the shareholder. The answer unnecessarily appeared evasive and left me wondering.

I agree with your reference to the NBA. Until 1950, the NBA did not allow Black men to play in the league. After the NBA started sourcing from the broader pool available in the country, we saw diversity at work. Now, with basketball taking on increasing popularity internationally, the NBA’s openness to diversity has raised the game to yet another higher level and has opened opportunities to even more people. Buffett should think in the same way, but he missed this opportunity to confirm that his approach is to source his talent broadly.

My 2020 update on this topic: “Warren Buffett Welcomes More Discussion on Diversity” https://drduru.com/onetwentytwo/2020/05/03/warren-buffett-welcomes-more-discussion-on-diversity/