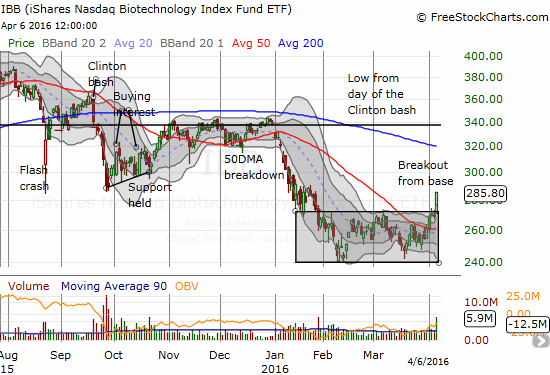

In January of this year, I finally gave up on the near-term prospects of the iShares Nasdaq Biotechnology ETF (IBB) reversing what I called “The Clinton Bash.” After a rapid cascade downward from The Clinton Bash, IBB made three attempts from November to December, 2015 to reverse those losses. Those attempts came to a crashing end when IBB broke down below its 50-day moving average (DMA) as the rest of the stock market sold off to begin 2016.

Three months later, IBB looks like it has FINALLY formed a sustainable base that has in turn generated a breakout. Perhaps the fourth attempt to reverse The Clinton Bash is underway.

Source: FreeStockCharts.com

This is a very bullish breakout that should be bought with confidence (preferably on the next limited pullback). The solid case for this trade is supported by two clear stop-loss points: 1) a close below Wednesday’s low which would mark the potential end of the breakout, or 2) a close below the 50-day moving average (DMA) which could begin a fresh sell-off.

Be careful out there!

Full disclosure: no positions (yet!)