(This is an excerpt from an article I originally published on Seeking Alpha on March 9, 2016. Click here to read the entire piece.)

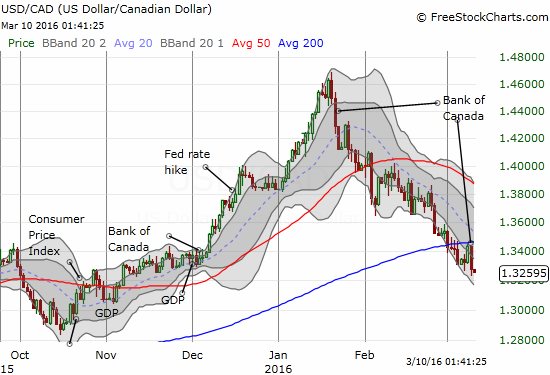

The Bank of Canada decided once again to hold its target overnight interest rate at 0.5%. The overall message from the statement on monetary policy is that economic developments are unfolding just as the Bank expected back in January. With the Bank expecting global growth to strengthen through at least 2017 and anticipating a continuation of the U.S. economic recovery, the Bank signals that further rate cuts are not needed in the short or intermediate-term. On balance, the reported resiliency in Canada’s economic conditions support a stabilization in rates:

{snip}

Source: FreeStockCharts.com

The Bank of Canada attributed recent strength in the Canadian dollar to the recent recoveries in the prices of oil and other commodities and shifting expectations for monetary policy in both the U.S. and Canada. By omitting any commentary on the market’s expectations for policy in Canada, I am assuming the Bank is comfortable with expectations for rate stabilization. {snip}

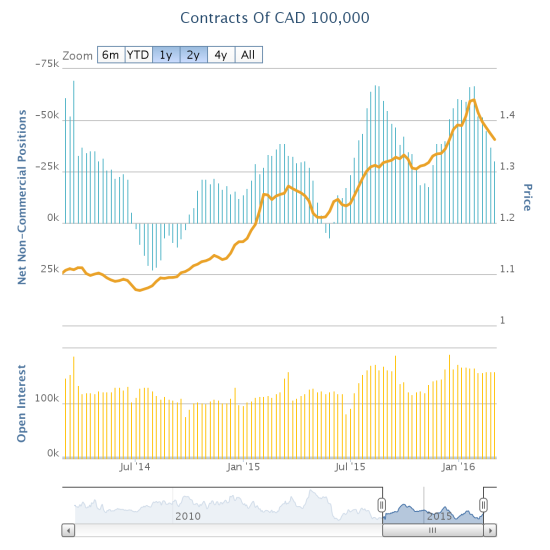

Scope remains for more strength in the Canadian dollar as speculators continue to unwind net shorts. {snip}

Source: Oanda’s CFTC’s Commitments of Traders

Be careful out there!

Full disclosure: long FXC

(This is an excerpt from an article I originally published on Seeking Alpha on March 9, 2016. Click here to read the entire piece.)