ConocoPhillips (COP) announced Q4 and full year 2015 financial results on the morning of February 4, 2016. The news included a capitulation to the on-going deterioration of business conditions in the oil patch: COP slashed its dividend by two-thirds:

“ConocoPhillips (NYSE: COP) today announced it is taking actions to maintain its strong balance sheet in response to both the weak outlook for commodity prices and expected credit tightening across the industry. The actions will position the company to accelerate shareholder value creation as prices recover.

The company announced that its board of directors approved a reduction in the company’s quarterly dividend to 25 cents per share, compared with the previous quarterly dividend of 74 cents per share.”

Chairman and chief executive officer Ryan Lance went on to lament that the decision to cut the dividend was a “difficult one.” Essentially the company is coming to terms with the very real possibility that commodity prices stay lower for longer than originally anticipated.

“The dividend has been, and will continue to be, a top priority. We still intend to provide a competitive dividend, while significantly lowering the breakeven price for the company and substantially reducing the level of borrowing in 2016. Our actions also position us to deliver strong absolute and relative performance as prices recover.”

Up until now, COP had worn a very brave face. In doing so, COP’s cautionary tale reminds us that we cannot assume that company management fully grasps and/or is ready and willing to communicate the true range of operational realities facing the business. (For the sake of argument, I am excluding the chance that, in this case, management actually feared a dividend cut but did not want to confront the possibility).

An irony of COP’s capitulation comes from six months ago when the company announced Q2 2015 financial results on July 30, 2015. At that time, COP made headlines by boldly and emphatically pronouncing that its dividend was safe. Here is Lance as quoted in the the Seeking Alpha transcript of the conference call (emphasis mine):

“So let me give you the punch line of these comments, the dividend is safe. Let me repeat that, the dividend is safe. The business is running well, we have increasing flexibility and can achieve cash flow neutrality in 2017 and beyond at today’s strip price of roughly $60 per barrel Brent. And we have a unique formula for sustainable performance and a portfolio that can deliver.”

To help prove the point, COP increased the dividend by a small amount as part of “…an important message for our shareholders.” Lance exuded confidence in declaring that the company is managing for the short-term, medium-term, and long-term. The company was firmly committed to growing the dividend as a top priority. The balance sheet and affordable growth came in second and third respectively. A moment of clarity for considering a potential bad outcome came later in the call when COP noted it could use debt to fund its dividend if necessary:

“…we still have really solid access to the capital markets to the extent that we – that it’s necessary to go beyond our cash balances to fund our capital and our dividend in the period before 2016 when we get to cash flow neutrality. We certainly have the ability to do that in a very effective way.”

Perhaps those musings represented a warning sign.

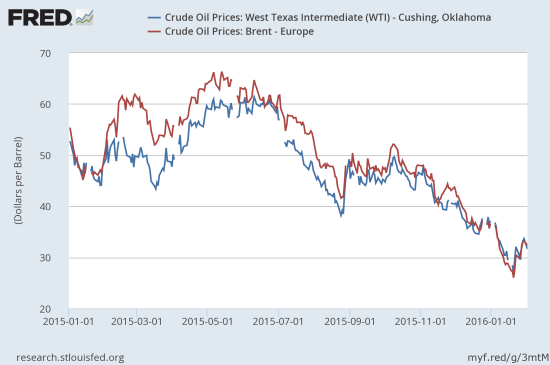

Fast-forward to the Q4 2015 earnings call on October 30, 2015. Oil prices had declined sharply for a month following COP’s July earnings conference call. Prices rebounded sharply from there and had stabilized for the two months going into COP’s call.

Source: US. Energy Information Administration, Crude Oil Prices: West Texas Intermediate (WTI) – Cushing, Oklahoma [DCOILWTICO], retrieved from FRED, Federal Reserve Bank of St. Louis, February 5, 2016.

US. Energy Information Administration, Crude Oil Prices: Brent – Europe [DCOILBRENTEU], retrieved from FRED, Federal Reserve Bank of St. Louis, February 5, 2016.

Hope was in the air. COP increased the dividend and again noted this action demonstrated that the dividend remained a top priority. The next set of quotes come from Jeff Sheets as published in the Seeking Alpha transcript of the call. Here is Sheets reminding analysts that COP could fund the dividend from debt.

“We’re going to, we will first use the cash that’s on our balance sheet and then to the extent that cash from operations and asset sales don’t fully fund capital in the dividend we’ll be looking to increase debt. I mean that it’s just a mechanic of what’s going to end up happening for us. And as we said as we look at the amount of debt that we might need to raise even in some continuations of some pretty tough price environments we feel comfortable that that capacity exists on our balance sheet. And it really exists within a single A credit rating as well.”

Debt-funded dividends remained the worst case scenario for COP. The company was not even contemplating the possibility of rolling back the dividend (emphasis mine):

“We think of a dividend as something that really should only go one direction and there can be some variability in the rate at which dividend increases. But the key to a dividend is to have it be consistent and to grow it over time.

So we haven’t really had significant discussion to talk about trying to adjust the dividend. It’s an important part of our value proposition. It puts a lot of discipline into the system to have that dividend. So you’ve heard us talk about it pretty consistently. You’re going to continue to hear us talk about that as a key component of our value proposition.”

As part of the company’s key value proposition, COP had to cling to its plans and had to insist on infusing hope in the investor-base.

Matt Fox further reassured the audience:

“When we look at what it’s going to take to win in a more cyclical and volatile future we think it’s a diverse low decline production base that gives us stable source of funding to sustain the dividend and we have that.”

So no wonder COP described the decision to roll back the dividend by two-thirds as a difficult one. Based on prior statements, the cut undermines the “value proposition” of holding the stock. The cut could cast doubt on the health of the company’s balance sheet and ability to stabilize its financial results.

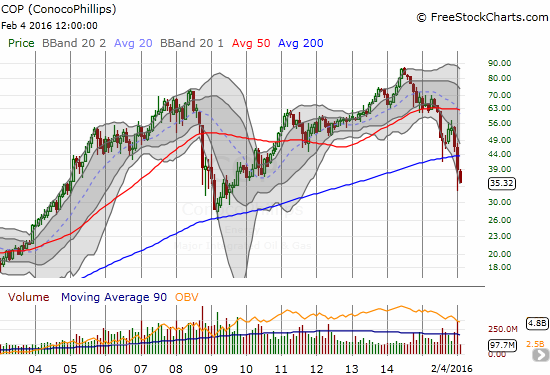

Going into earnings, COP had suffered heavy losses in parallel to the on-going plunge in oil. I am guessing part of the selling in COP was a recognition of increased dividend risks. Yet, the stock still lost 8.6% in the wake of earnings. Fortunately for the stock, there was already just enough buffer built off the recent 6 1/2 year low.

To be fair, forecasting is difficult. Accepting trends that are working against your business, your hopes, and your plans must be just as difficult if not more so. I wrote this cautionary tale as a quick tour through COP’s past three earnings reports just to illustrate the dangers in assuming that management’s task is NOT difficult. Given the experts can fail to notice the train roaring down the tracks of their own industry, one does well to adopt circumspection and to respect the trends.

Be careful out there!

Full disclosure: no positions