(This is an excerpt from an article I originally published on Seeking Alpha on December 3, 2015. Click here to read the entire piece.)

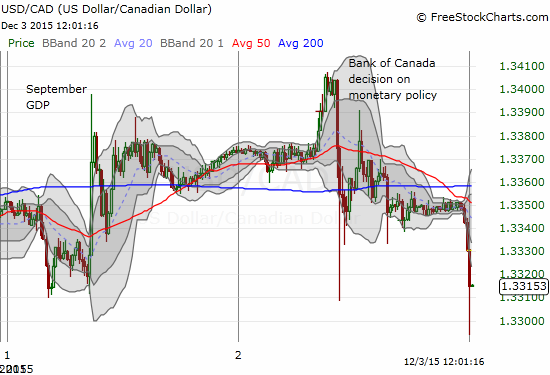

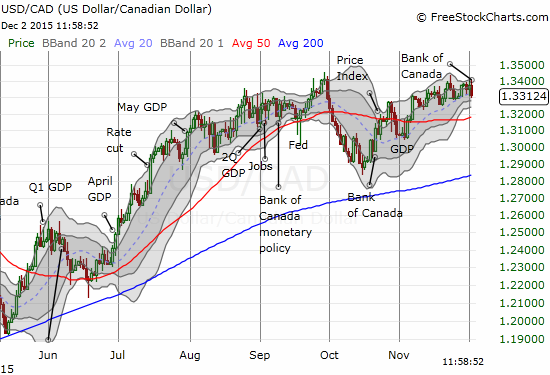

Lost in the flurry of economic and monetary news of the week was the Bank of Canada’s December decision on interest rates. The Bank kept its target rate at 0.5%, and the statement confirmed the Bank is quite comfortable holding tight on its extremely aaccomodative stance. I took particular note of the Bank’s declaration that “policy divergence is expected to remain a prominent theme.”

{snip}

Source for charts: FreeStockCharts.com

At the time of writing the Canadian dollar has picked up fresh strength against the U.S. dollar. I am using this opportunity to open up a fresh short-term short position against the Canadian dollar (long USD/CAD). The Bank of Canada has signaled its intent to use weaker currency to support the economy; this latest statement prvids more confirmation. So, over the short-term I continue to buy dips on USD/CAD and sell into rallies. I maintain a small longer-term position in shares of FXC.

{snip}

Be careful out there!

Full disclosure: long FXC, long USD/CAD

(This is an excerpt from an article I originally published on Seeking Alpha on December 3, 2015. Click here to read the entire piece.)