(This is an excerpt from an article I originally published on Seeking Alpha on November 29, 2015. Click here to read the entire piece.)

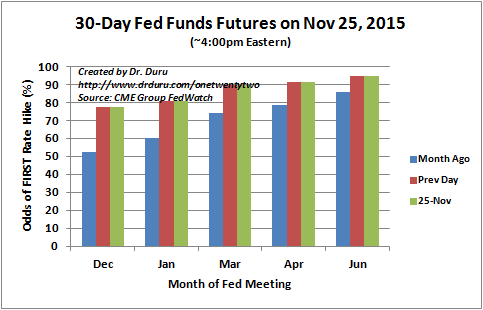

The U.S. Federal Reserve is likely to hike interest rates in December. The Fed and economic data have finally convinced the market of an imminent rate hike, and the high odds allow the Fed to hike rates without worrying about creating any unwanted surprises.

Source: CME Group FedWatch

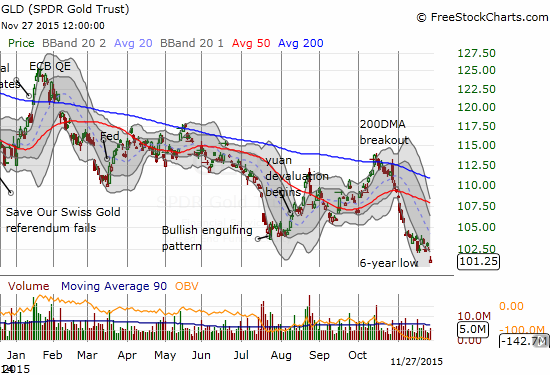

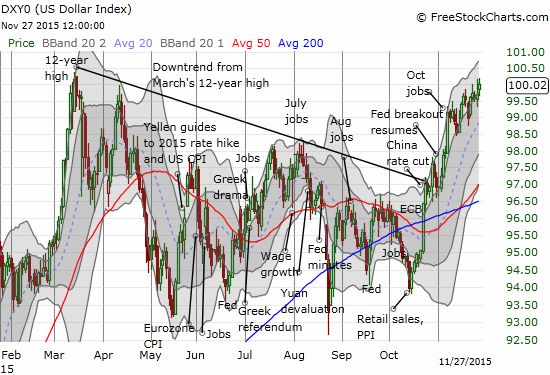

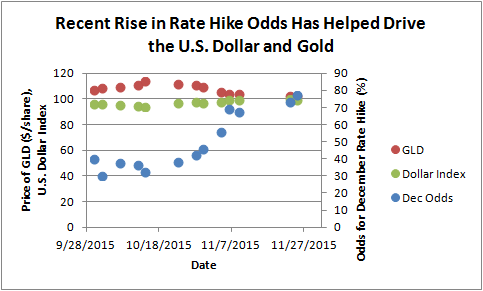

The large jump in odds over the past month have coincided with a steep drop in gold (GLD) and a streak for the U.S. dollar (UUP) that has taken the index close to a fresh 12+ year high.

Source: FreeStockCharts.com

The rate of increase in the odds has to slow down from here if the odds increase at all going into the December Fed meeting. {snip}

Sources of data: Yahoo Finance, FreeStockCharts.com, and CME Group FedWatch

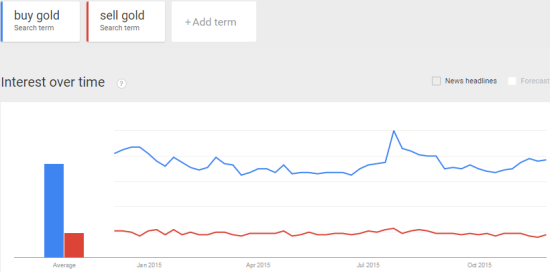

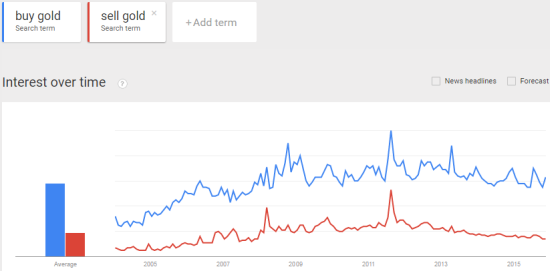

The current situation looks extreme enough to warrant checking in on the sentiment tward gold for clues for future direction. {snip}

Source: Google Trends

Note carefully that the sentiment framework does not require a spike in sentiment before gold tops or bottoms. Instead, it serves as strong evidence supporting a likely turning point. In other words, the gold sentiment framework is sufficient but not necessary for a major move.

{snip}

Be careful out there!

Full disclosure: long GLD, net long the U.S. dollar

(This is an excerpt from an article I originally published on Seeking Alpha on November 29, 2015. Click here to read the entire piece.)