(This is an excerpt from an article I originally published on Seeking Alpha on November 9, 2015. Click here to read the entire piece.)

On November 3, 2015, Thomas Jordan, the Chair of the Swiss National Bank (SNB) spoke in front of the Investment Strategists Association of Geneva on the topic “The SNB’s monetary policy and the Swiss financial centre.” Jordan discussed the challenges of balancing short and long-term considerations for achieving price stability. He emphasized that at times achieving long-term stability incurs short-term costs. Today’s short-term costs come in the form of the SNB’s two “pillars” of monetary policy: negative rates and active intervention in currency markets to weaken the Swiss franc (FXB). The Swiss franc sits at the center of monetary policy given Switzerland’s open economy and the safe-haven status of the currency. The SNB directly leverages its monetary independence through the exchange value of the franc.

The importance of the Swiss franc is underscored by the amount of foreign exchange trading involving the currency.

{snip}

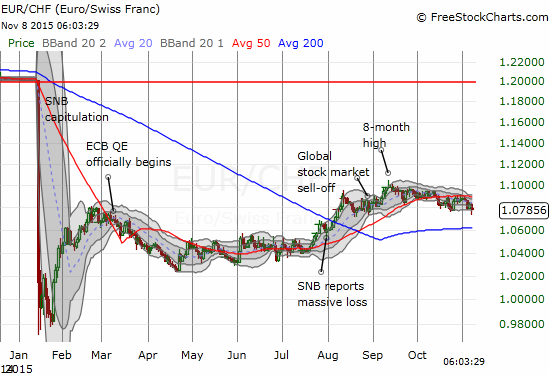

…when it comes to the Swiss franc, markets are still behaving in crisis mode. {snip}

{snip}

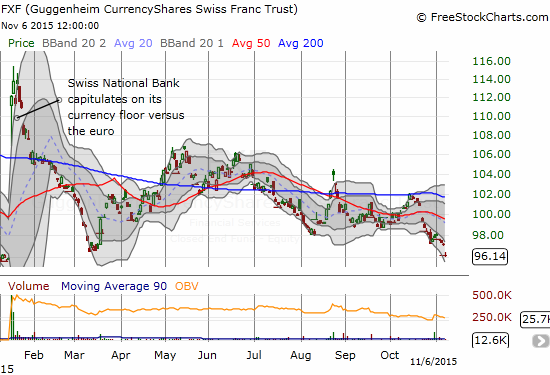

The fresh breakout in the U.S. dollar index has once again brought the CurrencyShares Swiss Franc ETF (FXF) close to a full reversal from the tremendous rise in January.

Source for charts: FreeStockCharts.com

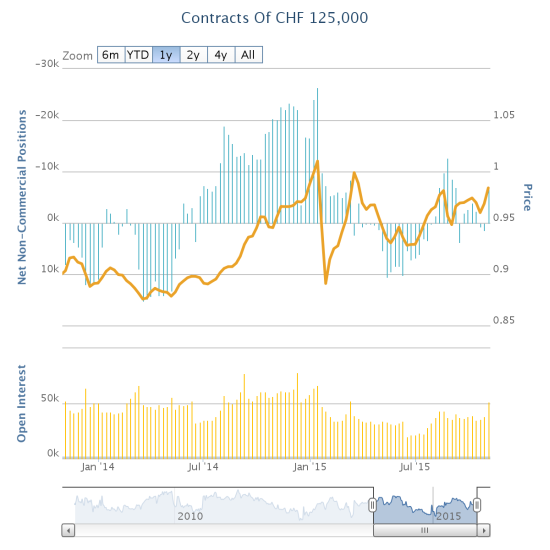

The experience since the August Angst seems to suggest that the SNB’s two pillars are working, albeit very slowly. I continue to prefer to short the Swiss franc particularly after rallies…but only in small doses and for short periods of time. As more and more attention turns to the monetary policy in the U.S. and imminent rate hikes, I expect the Swiss franc to continue to weaken. Speculators have only recently returned to net short positions on the franc. The momentum of a full U.S. dollar breakout could finally encourage speculators to get more aggressive with net short positions.

Source: Oanda’s CFTC’s Commitments of Traders

Be careful out there!

Full disclosure: short the Swiss franc

(This is an excerpt from an article I originally published on Seeking Alpha on November 9, 2015. Click here to read the entire piece.)