(This is an excerpt from an article I originally published on Seeking Alpha on October 25, 2015. Click here to read the entire piece.)

On October 21st, the Bank of Canada issued its latest statement on monetary policy. While the Bank of Canada (BoC) left interest rates unchanged, it slightly lowered its growth forecast over the next two years to “… about 2 per cent in 2016 and 2 1/2 per cent in 2017.” The Bank blamed the persistence of lower oil prices and prices of other commodities. These have worsened Canada’s terms of trade and further damped business investment. Since these are the exact reasons provided for the two rate cuts earlier this year, I believe it is safe to assume that the Bank of Canada remains biased for action on the more accommodative side of monetary policy. I also assume such an assessment led to a sharp loss in the Canadian dollar (FXC) that was consistent with a theme of weakness for the week. {snip}

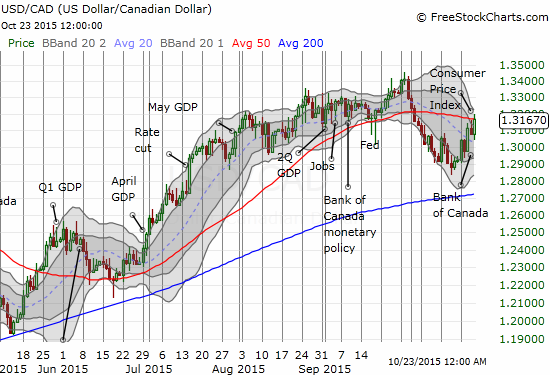

Source: FreeStockCharts.com

As the chart above shows, this is a critical juncture for the Canadian dollar. Going into the week, the Canadian dollar was showing signs of strength unseen since June of this year. USD/CAD was on the verge of fully reversing all its losses from the Bank of Canada’s rate cut in July (a milestone the Bank is certainly loathe to witness). Several points from the complete Monetary Policy Report suggest that the bias for the Canadian dollar in the near-term should remain toward weakness. I provide some important bullet points below along with my editorial.

{snip}

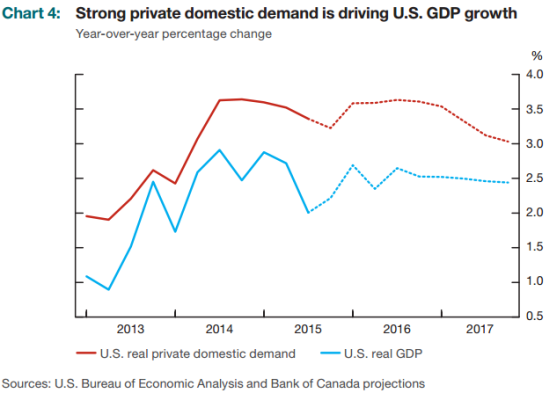

Source: The Bank of Canada Monetary Policy Report, October, 2015

{snip}

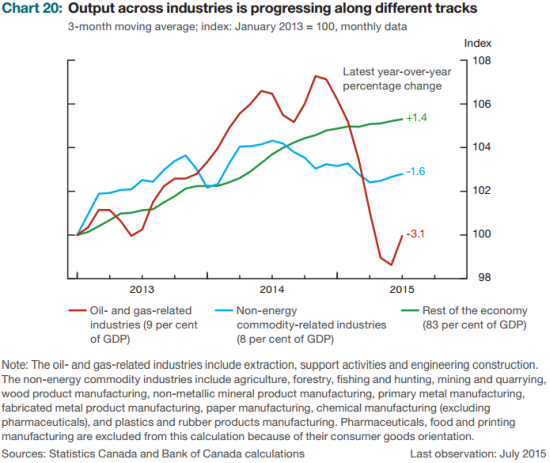

Having said all that, the chart below reveals that the “rest of” Canada’s economy is chugging along OK. {snip}

Source: FreeStockCharts.com

Taken all together, I continue to favor going long USD/CAD for short-term trades. {snip}

Be careful out there!

Full disclosure: long FXC

(This is an excerpt from an article I originally published on Seeking Alpha on October 25, 2015. Click here to read the entire piece.)