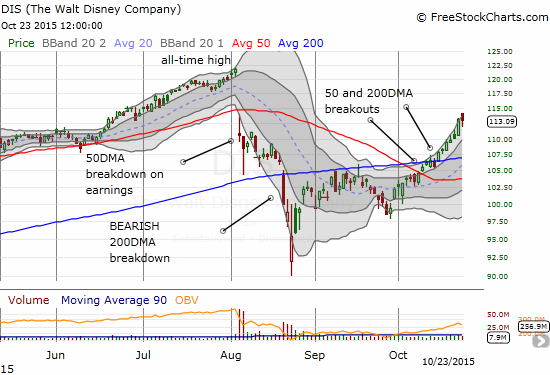

Two months ago I wrote “Disney’s Bearish Breakdown: A Case Study of Risk Management for Long-Term Investors” as a model for how to both respect a bearish development in a stock while staying focused on the long-term potential. Disney has already left those bearish tidings behind and is now ripping higher ahead of earnings on November 5, 2015.

Source: FreeStockCharts.com

Now that Disney is already reclaiming its bullish posture, the trade I made ahead of my post is already profitable. The January $130 2017 call options are up a healthy 26%. However, the trade I REALLY wanted, and the trade I described in my post, has turned into a huge winner. Unfortunately, I waited too long for a more attractive entry price. The trade I described on the January $110 2017 call is now up a whopping 78%…right around the return I targeted in the long-term investment scenario.

So what to do now?

I am definitely holding onto my call options. They are a long-term play that now has a lot more potential runway than I imagined. For new traders/investors, an entry at current levels carries a LOT more risk. As the chart above demonstrates, DIS has gone practically straight up for over three weeks. Friday’s small loss was just the fourth down day over this stretch. Clearly, buyers have returned. All the hand-wringing that followed the August earnings is fading into the rear view mirror. Yet, it just seems reasonable to expect some kind of pullback in the coming days. I can only endorse buying that dip. Another potential play is to dive in now and assume that Disney will barrel into November earnings with strength and lock in profits ahead of those earnings. Again, this is a high-risk strategy.

A recent article (hat-tip to a friend who is a huge Disney bull) from Business Insider called “Eventually, only sports fans will pay for cable” provides some insight as to why the hand-wringing over Disney’s prospects on cable may be fading. This article cites research from analysts at Citi suggesting that Disney’s ESPN is the best positioned content play in a world of declining cable subscribers.

The decline in subscribers is still slow, from a peak of 84% of U.S. households in 2011 to 80% at the beginning of this year, but the ultimate destination of a cable-less populace seems assured….at least in the current bundled business model. Leading the way are new households which never bother subscribing to cable. In an unbundled world, ESPN carries the highest premium potential of all cable channels because of the contrast of the huge popularity of sports versus its more limited availability on other options. The article includes a chart from Citi estimating the unbundled value of each cable station. Disney occupies the top three positions with ESPN #1, the Disney Channel #2, and ESPN2 #3. In other words, almost any time the universe of media companies rocks with fears of cord-cutting, reach for Disney shares on the dip.

There are a LOT of reasons to like Disney. I am just focused a lot more on the potential value of Disney in the (slow but sure) transition to a cable-less world. For more information on cord-cutting see my recent piece: “Saving Money On Cable – Inside the Experience of A Cord-Cutter.”

Be careful out there!

Full disclosure: long DIS call options