(This is an excerpt from an article I originally published on Seeking Alpha on November 19, 2014. Click here to read the entire piece.)

{snip}

An analyst asked this timely question during the November 11, 2014 earnings call for LGI Homes (LGIH). The quote comes from the Seeking Alpha transcript of that earnings call. Charles Merdian – Chief Financial Officer, Treasurer, and Secretary – gave a very non-committal answer by saying the company feels “…pretty comfortable with where we are at right now” although it is “comfortable” going up to the mid-50s for the gross debt to capital ratio. As it turned out, a massive debt offering was indeed right around the corner. {snip}

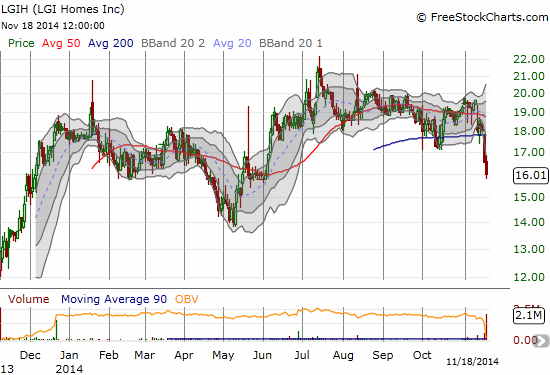

Source: FreeStockCharts.com

LGIH announced that it will use the proceeds to repurchase shares from buyers of convertible notes and use the rest for any of a variety of operational purposes:

{snip}

These funds are timely because the company is facing a shrinking market for finished lots and is now buying more raw land which it will need to develop to maintain its target of 3-5 years of lot inventory. {snip}

The opportunity in buying the dip on LGIH comes from what I think is temporary selling pressure related to the convertible. {snip}

The fundamentals supporting a purchase assume that LGIH can continue its strong growth profile. {snip}

LGIH expects to close out 2014 on a strong note and will provide 2015 guidance at a later date.

{snip}

Be careful out there!

Full disclosure: long LGIH

(This is an excerpt from an article I originally published on Seeking Alpha on November 19, 2014. Click here to read the entire piece.)