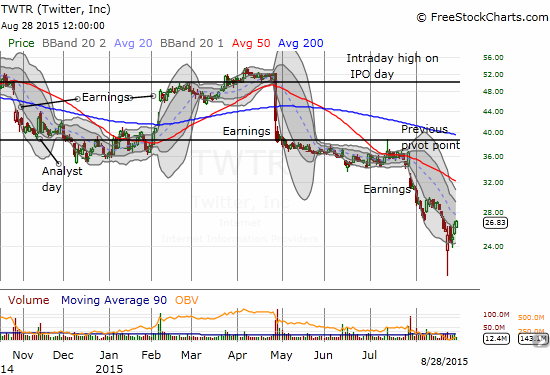

The big correction of August 24, 2015 (flash crash?) indiscriminately plunged stocks across the board. Twitter (TWTR) went as low as $21.01 before bouncing back and closing at $26.23. TWTR has steadily climbed along with the rest of the wobbly, recovering stock market. The lowest CLOSE for TWTR during this period, and its all-time low, is $24.38.

Source: FreeStockCharts.com

For reference, TWTR priced 70 million shares at $26 per share for its IPO on November 7, 2013. The stock opened for trading at $45.10.

Source: Forbes

So, if you have been patient all this time, you can finally grab Twitter for around its IPO price. However, perhaps you really wanted the kind of discount (and buffer) that the all-time intraday low of $21.01 offered. It is still possible to get the discount by selling put options. At current options pricing, you can effectively buy TWTR for less than $20.

Put options provide the buyer the right, but not the obligation, to sell a stock at a given price called the strike price. The seller of the put option is on the hook for that right. That is, the put-seller has the OBLIGATION to buy the stock at the strike price if the put buyer decides to exercise the right. Options also have expiration dates, so the buyer’s decision to exercise or sell outright must occur before that expiration date. A seller may also chose to close out the option (buy to cover) before expiration. The closer the put gets to expiration the less valuable it becomes (aka time decay) for a given underlying stock price and “implied volatility” – good for the seller, bad for the buyer.

The put option for TWTR expiring on January 20, 2017 at the strike price of $25 sells for $540/$595 (bid/ask). Let’s split the difference and call it $565. TWTR closed Friday’s trading at $26.83 per share. If TWTR stays at the current price, the January 2017 $25 put option expires worthless. The put-seller makes money until TWTR falls below $19.35 per share (not including commissions) which equals $25 minus $5.65. This math means that for each put option the seller has potentially bought 100 TWTR shares for a net $19.35 per share. If TWTR falls below $19.35 at expiration, the put buyer will happily sell stock at $25 as s/he makes money from that point and lower. If TWTR closes on January 20, 2017 at $25 or above, the seller keeps the entire $565 premium. In between $25 and $19.35 the seller keeps a portion of the premium.

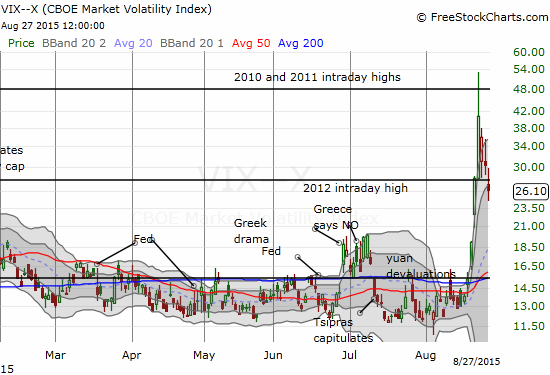

I came up with this idea very late in the week. As I was sorting through my trades and strategies for the market’s sell-off, it suddenly occurred to me that I was not taking full advantage of the surge in volatility by selling now expensive put options. In case you missed it, volatility surged a massive amount at the end of the market sell-off. This chart is from Thursday, August 27th’s close. The volatility index, the VIX, closed Friday at essentially the same spot.

Source: FreeStockCharts.com

According to ETrade, TWTR’s January 2017 $25 put reached as high as $7.44 during this period. As I noted after Monday’s sell-off, market makers seemed unwilling to offer up options for trading until the dust settled a bit after Monday’s open. I was unable to get ANY options traded (I was scrambling for call options) until around 30 minutes or so post-open. Market makers were waiting for good reason! The VIX quickly fell from a high of 52.3 to close the day at 40.7 – representing a massive change (reduction) in option values for a given stock price.

TWTR is attractive for put-selling for at least two related reasons. Most importantly, I think TWTR has SOME value at least around its IPO price. I am betting that TWTR’s business model can stabilize and achieve success within the next 16 months. Anything can happen of course, but I am a lot more willing to take the risk at $19.35 than $26.86. Selling a put expiring way out in January, 2017 allows me to relax through whatever swings are ahead and gives me the option to profit (potentially) well ahead of expiration if TWTR goes on another run in this time.

Secondly, TWTR’s premium is very high, so it makes for a very attractive sell (and a poor buy) at far out dates. At $19.35, I effectively got TWTR for a 28% discount. I doubt this kind of discount will last as the market settles down over time. For comparison, Google (GOOG) currently trades at $630 per share. The January 2017 $630 put option on GOOG is roughly similar to the January 2017 $25 TWTR put option (the strike price closest to the current trading price). The GOOG put option sells for $77.90/$79.40 – let’s say $78.20. Yes, that is a VERY healthy premium, but it only delivers a 12% discount on Google’s shares. In other words, TWTR holds roughly double the premium GOOG holds. This expense is of course for very good reason: TWTR is trading near all-time lows while GOOG is trading near all-time highs. The market has a LOT more confidence in GOOG’s ability to avoid another deep sell-off than TWTR.

So what is the catch? I have already discussed the possibility of losing money on the put option. The other catch is that the upside for the put-seller is capped by the premium collected at the time of sale. If TWTR is trading back to $50 by the time of expiration, the put-seller still only collects $565. This is a scenario I am willing to tolerate, and I would consider such a rally a “good problem” to have given the risks inherent in a speculative stock like Twitter.

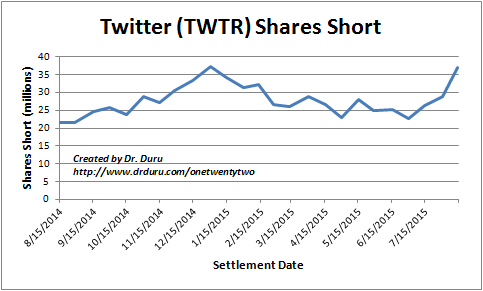

Finally, market sentiment is not as bad as I was expecting against Twitter. “Only” 6.7% of its float is sold short according to Yahoo! Finance. However, short interest has soared in recent weeks as Twitter has mightily struggled. It takes a serious contrarian to look at the chart below and project out a positive outcome!

Source: NASDAQ.com

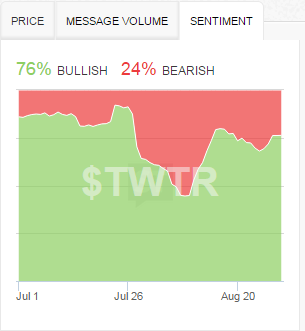

At least my favorite herd, the stock fanatics on StockTwits, are still very bullish on TWTR…

Source: StockTwits.com

(Incredibly, James B. Stewart, a columnist at The New York Times, a staff writer at The New Yorker, and a professor at the Columbia University School of Journalism, recently reported that value investor William Miller is currently kicking the tires on Twitter. More on Stewart’s column in another post…)

For an example of a long-term CALL buying strategy, see my recent piece on Disney called “Disney’s Bearish Breakdown: A Case Study of Risk Management for Long-Term Investors.”

Be careful out there!

Full disclosure: short TWTR put option