(This is an excerpt from an article I originally published on Seeking Alpha on August 17, 2015. Click here to read the entire piece.)

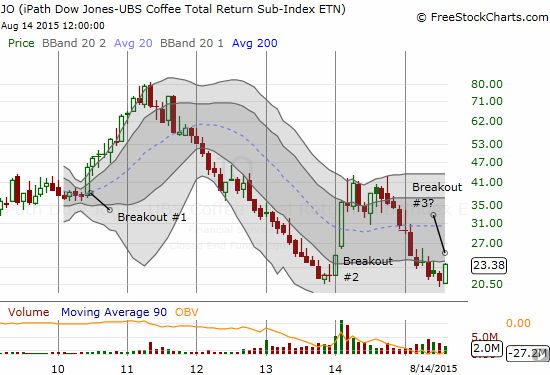

The crash in commodities continues nearly unabated against a wide swath of commodities. The selling has become so extreme that I have started moving from following the trends downward to watching for trend breaks. An early candidate for trend-breaking is the iPath Bloomberg Coffee SubTR ETN (JO).

Source: FreeStockCharts.com

{snip}

The past breakouts were not just technical accidents. In both cases, coffee slammed into severe production issues that caused severe supply shortages relative to demand. (I wrote about the late 2010 and early 2011 price spike in “Coping with Destabilizing Coffee Prices“). Per the latest entry in the blog for the International Coffee Organization (IOC) dated August 10, 2015 titled “Coffee Prices Fall to 18-Month Low as Supply Concerns Fade – Coffee Market Report July 2015“:

{snip}

In other words, the margin for error in the coffee market is getting dangerously thin. {snip}

{snip}

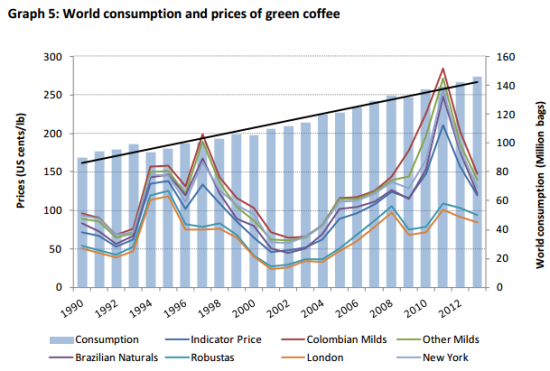

My prime interest in coffee comes from the Commodities Crash Playbook. {snip} Coffee demand is very robust. World consumption has grown essentially linearly since at least 1990.

Source: The International Coffee Organization in “Factors to achieve a balanced market“, September 8, 2014

Notably, prices have not followed demand ever higher. Instead, there is a definitive cyclical behavior in price that investors must respect. This requirement was one of the important changes I added to the Commodities Crash Playbook. In “Factors to achieve a balanced market“, the ICO explains coffee’s market dynamics this way:

{snip}

Be careful out there!

Full disclosure: long JO

(This is an excerpt from an article I originally published on Seeking Alpha on August 17, 2015. Click here to read the entire piece.)