(This is an excerpt from an article I originally published on Seeking Alpha on July 8, 2015. Click here to read the entire piece.)

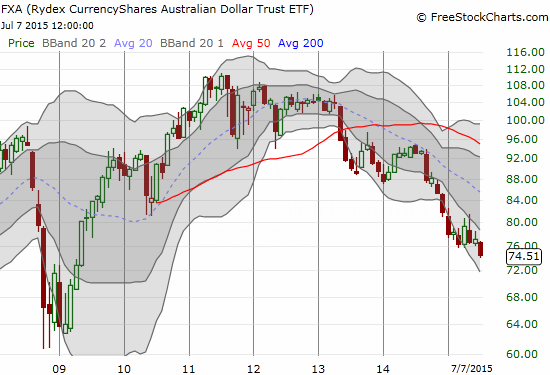

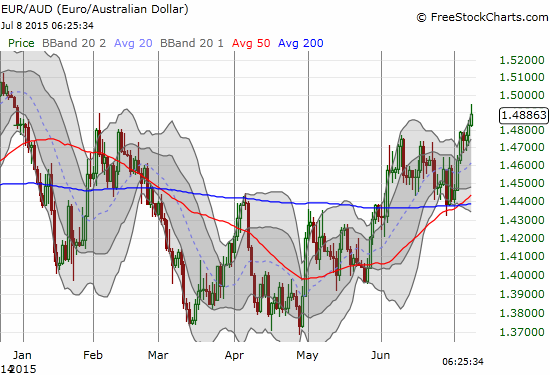

Against my previous expectations, the Australian dollar (FXA) continues to shrink.

First the Chinese government panicked with successive rate cuts and next direct manipulation in its stock markets. Now it seems that retail investors in China are ready to throw in the towel as the Shanghai Composite Index (SSEC) continues to fall. From CNBC:

{snip}

Whenever I hear a market system compared to a feedback loop, my ears perk up. I am assuming Hong really meant to describe the selling as a positive feedback loop or even better to call it a self-reinforcing feedback loop. Selling begets selling as traders conclude that the downward trend from the top is the new reality. {snip}ssssssssss

{snip}

Australia is of course heavily dependent upon China as its largest export market for commodities. The resumption of selling in iron ore underpins the renewed weakness in the Australian dollar and adds more confirmation of pressures in China. {snip}

The soaring odds of a rate cut for the August meeting of the Reserve Bank of Australia’s (RBA) is providing a near final confirmation of the self-reinforcing loop between China and the Australian dollar. {snip}

{snip}

Source for charts: FreeStockCharts.com

Be careful out there!

Full disclosure: net long the Australian dollar

(This is an excerpt from an article I originally published on Seeking Alpha on July 8, 2015. Click here to read the entire piece.)