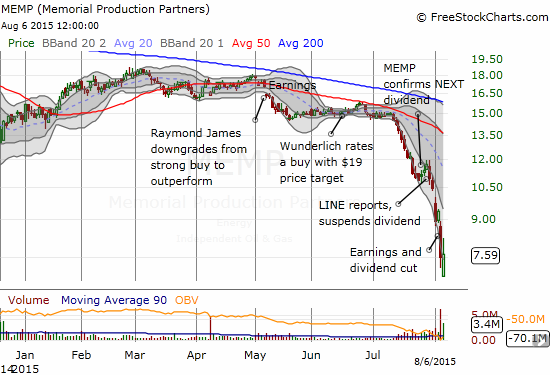

It turned out that technicals were indeed all I needed to follow for trading Memorial Production Partners (MEMP).

As I described in an earlier piece, I successfully navigated a trade in MEMP by closing out my position and locking out profits after a break of support at the 50-day moving average (DMA). It was purely a technical play given the fundamental story I believed told me that MEMP could and would be a long-term hold. Fast forward to July 30th and the elimination of dividends at Linn Energy (LINE) sent the Master Limited Partnership (MLP) sector reeling, including MEMP. I put aside the technical red flags waving along with the on-going breakdown and saw the selling in MEMP as overdone. I nibbled twice and paid the price.

Source: FreeStockCharts.com

In other words, MEMP became the classic falling knife where a bottom is near impossible to predict. New all-time lows are never good; they are even worse when they come in rapid succession. Without a crystal ball, it is typically best to wait until buyers start showing up and confirm their interest by taking the stock out of its downtrend. Earnings provides another easy technical milepost: do not buy until all post-earnings losses are reversed. This gives a buy point at $9.50 and above. However, MEMP will likely still be trapped in a downtrend at that point. Aggressive buys cannot occur until that downtrend breaks.

Value investors may protest buying at higher prices. Then another approach would be to buy now and to stop out on fresh all-time lows. There is potential good news here in that buyers stepped up bigtime today (August 6, 2015) in driving MEMP off its latest all-time low with heavy buying volume. However, the fade off the highs of the day tarnished things a bit. Since I have already nibbled twice, I am content to wait until firmer signs of buying interest get confirmed.

Now, putting the technicals aside, I close with some key points from the earnings conference call as reported in Seeking Alpha’s transcript of the session. My bottom-line take is that MEMP still has a strong balance sheet. The company is still positioned as one of the best in the space. Its readiness and ability to continue acquiring assets is a major positive. MEMP’s next buying spree will secure productive assets at a steep discount. These purchases should pay huge returns somewhere off into the future when oil has started a sustained recovery. While investors wait, MEMP will still pay a healthy dividend that seems secure for the time-being. This yield SHOULD provide a sustained floor for the stock.

MEMP has hit the reset button with its dividend cut, and I am doing the same. I am moving forward with the lessons behind me and renewed discipline ahead.

From the earnings conference call, MEMP prepared investors for a “lower and longer commodity cycle.” This tone is much different than the one oil companies sounded in the last earnings cycle where confidence was brewing that the March lows were THE bottom for oil. In anticipation of the hard times ahead, MEMP cut its dividend by 45% to $0.30 per unit per quarter starting with November’s payout. MEMP described this move as “…balancing its cost of capital and long-term leverage while also providing sustainable long term distribution coverage.” MEMP has drawn its line of coverage at $40 for crude and $2.25 for natural gas.

The dividend cut also frees up cash for acquisitions: “…there are deals to be made. We continue to evaluate numerous transactions of various assets. In fact we have reviewed over $3 billion worth of transactions since the first quarter of 2015.” MEMP is serious about continuing to buy assets! The company even confidently claimed that it can “…compete with private equity for doing deals.”

Natural Gas Liquids (NGLs) are a problem

MEMP was forced to revise its pricing models for NGL lower. NGL production is roughly 18% of total production.

Hedge book

The hedge position is one of the most important parts of MEMP’s earnings announcement…

“Since inception we’ve maintained a long-term focus regarding our hedging philosophy and we are very well hedged for 2019. As of July 31, the mark-to-market value of our hedges was approximately $609 million, a significant asset in this market. We’ve been systematically building this hedge position over the last four plus years and believe we are one of the best hedged companies in the industry…”

From the earnings announcement:

| Hedge Summary (1) | |||||

| Year Ending December 31, | |||||

| 2015 (2) | 2016 | 2017 | 2018 | 2019 | |

| Natural Gas Derivative Contracts: | |||||

| Total weighted-average fixed/floor price | $4.13 | $4.14 | $4.06 | $4.18 | $4.31 |

| % of expected 2015 production hedged | 88% | 85% | 80% | 73% | 67% |

| Crude Oil Derivative Contracts: | |||||

| Total weighted-average fixed/floor price | $91.14 | $86.87 | $84.70 | $83.74 | $85.52 |

| % of expected 2015 production hedged | 81% | 82% | 89% | 92% | 47% |

| Natural Gas Liquids Derivative Contracts: | |||||

| Total weighted-average fixed/floor price | $42.35 | $35.64 | $37.55 | – | – |

| % of expected 2015 production hedged | 84% | 86% | 17% | – | – |

| Total Derivative Contracts: | |||||

| Total weighted-average fixed/floor price | $7.46 | $7.14 | $7.52 | $7.89 | $6.84 |

| % of expected 2015 production hedged | 85% | 84% | 70% | 64% | 49% |

| (1) Updated hedge schedule as of August 5, 2015 | |||||

| (2) Represents July to December 2015 | |||||

Repurchasing

MEMP has repurchased a good amount of shares already. Going forward, the company is authorized to buy another $81.7M worth but such action is far from a guarantee. Again, from the earnings announcement:

“Since MEMP’s last update on February 25, 2015 and pursuant to its previously announced common unit repurchase program, as of July 31, 2015, MEMP had repurchased approximately 1.6 million units for a total consideration of approximately $24.4 million. These repurchase amounts are not indicative of MEMP’s go-forward repurchasing plan, and any future repurchases will be at management’s discretion. The repurchase program does not obligate MEMP to repurchase any specific dollar amount or number of common units and may be discontinued at any time. As of July 31, 2015, MEMP had up to approximately $81.7 million of authorized repurchases remaining under its repurchase program.”

MEMP has also repurchased some of its high-yield debt. The company was not specific on the prospects for future buybacks of debt.

G&A costs

Of all things, analysts on the conference call really hammered away on MEMP’s relatively large G&A costs. MEMP explained that its large acquisitions have come with additional G&A costs. Morever, the company claimed that its G&A costs compare favorably to the industry on any per metric basis. I do not think analysts were mollified on this point.

Wrap-Up

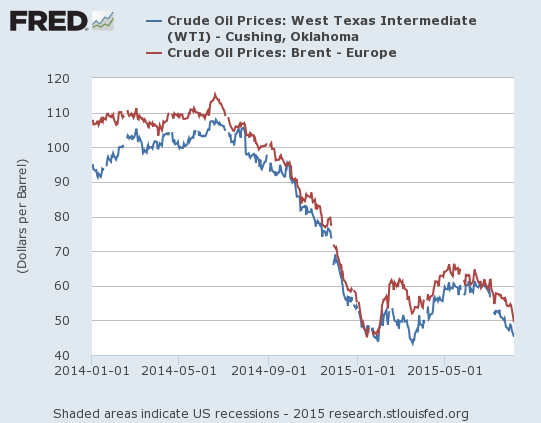

It is now very dangerous trying to predict a bottom in oil prices. The Federal Reserve is supposedly committed to a 2015 rate hike. I now suspect some of the on-going bleeding and panic in the oil patch, and commodities in general, comes from big funds and institutional investors finally getting serious about getting out of the Fed’s way. I think it is overdone. However, it has paid to just follow the trend. My various shorts and put options on commodity-related plays have provided a healthy cushion, albeit not complete!

For a sobering review of oil’s collapse see “Deducing The Crash In Oil: How Would Sherlock Holmes Drill Beneath The Headlines?” and read my commentary below the article.

Source: US. Energy Information Administration, Crude Oil Prices: West Texas Intermediate (WTI) - Cushing, Oklahoma [DCOILWTICO], retrieved from FRED, Federal Reserve Bank of St. Louis, August 7, 2015; US. Energy Information Administration, Crude Oil Prices: Brent - Europe [DCOILBRENTEU], retrieved from FRED, Federal Reserve Bank of St. Louis, August 7, 2015.

Be careful out there!

Full disclosure: long MEMP