(This is an excerpt from an article I originally published on Seeking Alpha on August 4, 2015. Click here to read the entire piece.)

{snip}

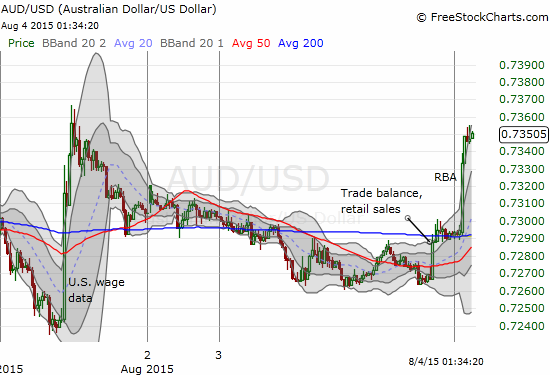

The Reserve Bank of Australia (RBA) issued its monetary policy decision for August. The RBA left rates unchanged just as the market expected. The rest of the statement was boilerplate and nothing new…except the reference to the Australian dollar (FXA). The RBA dropped the typical “…further depreciation seems both likely and necessary, particularly given the significant declines in key commodity prices” and instead simply noted “the Australian dollar is adjusting to the significant declines in key commodity prices.”

This change in content is mysterious: it says nothing about whether the RBA still thinks the currency will and SHOULD still decline at a time when it seems the RBA needs the market to do the RBA’s heavy-lifting more than ever. The statement even implies that “further depreciation” is no longer likely and necessary; perhaps the on-going collapse in commodities is due for a much needed rest and bottoming. {snip}

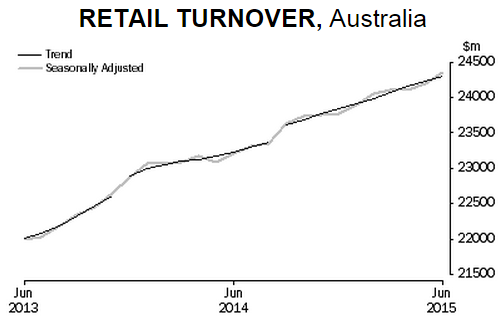

{snip} Retail sales suggest that the Australian consumer is still managing to hang in there. {snip}

Source: The Australian Bureau of Statistics (ABS)

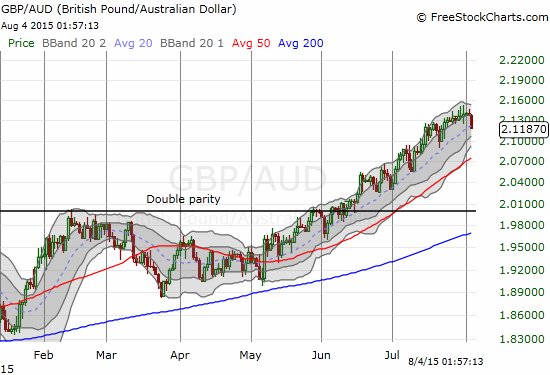

The ABS reported data on Australia’s trade balance that showed a decline from May to June but nowhere near April’s disastrous print. Exports even climbed, but imports increased even more. {snip}

Source for currency charts: FreeStockCharts.com

Be careful out there!

Full disclosure: long and short various currencies versus the Australian dollar

(This is an excerpt from an article I originally published on Seeking Alpha on August 4, 2015. Click here to read the entire piece.)