It was an awful week for oil-related plays as oil’s price continued to drop and one energy company after another, including the titans Exxon(XOM) and Chevron (CVX), failed to provide investors much in the way of reassurance. This calamity was quite a contrast to the much higher optimism from earnings just three months ago.

The all-time low on the United States Oil ETF (USO) is receiving a major challenge thanks to the renewed plunge in the price of oil. Surprisingly, the CBOE Crude Oil Volatility Index (OVX), an index built off USO, is nowhere near the highs it achieved when USO was last cratering to these levels. I am interpreting this as a sign that the market currently believes USO has little additional downside. Of course, the market could be very wrong with so many uncertainties ahead on the demand (think China) and supply side of oil (think inventories, geopolitics, and monetary policy). Although OVX was not as high as I would have liked, I still started into the USO rangebound trade in place of my earlier simple trading scenarios for USO. Given the market’s reaction to the onslaught of bad news from oil-related companies, I am bracing myself for at least one more wave of panicked exits from oil ahead.

Linn Energy (LINE) delivered a harsh dose of reality for investors in high-yielding oil and natural gas Master Limited Partnerships (MLPs). During its earnings announcement on Thursday, July 30, LINE announced it would suspend its dividend entirely in order to pay down debt. In the long-run, this decision is an extremely smart swap, but right now, panic rules.

Incredibly, LINE has lost 71% just in the last three months. For high-yield investors, this is a nightmare scenario that completely blows up years of patient dividend collection and reinvestment. I have duly noted that perhaps, just perhaps, the market is starting to tell us that there is truly nowhere to hide from low yields (and low returns?!?)

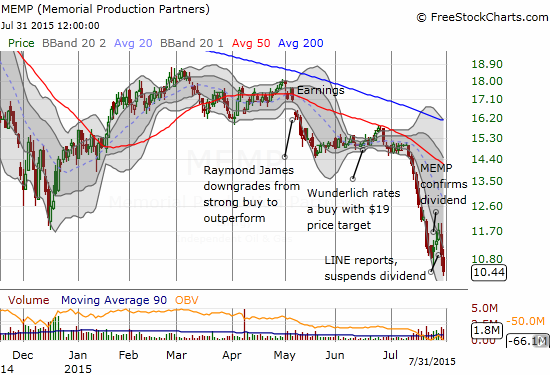

The panic was complete enough to spread to Memorial Production Partners (MEMP). As I have pointed out in earlier pieces touting MEMP, production hedges out about 4 years makes this company very attractive. Seeking Alpha author and E&P investor Daniel Jones calls MEMP “…one of the best-hedged (if not THE best-hedged) E&P operator in this space.” The subsequent selling in MEMP is happening even AFTER the company already affirmed its next dividend payout.

I used MEMP’s announcement to double down on my recently purchased shares.

$MEMP announced maintaining dividend. Now at 20%. Doubled down here. =gulp= #120trade

— Duru A (@DrDuru) Jul. 27 at 07:09 AM

I now await this week’s earnings (August 5th) with full radar up. Jones has done the math and concludes that MEMP will need to cut its dividend DESPITE the hedges if oil prices stay this low for a sustained period. However, he is overall optimistic about MEMP, so I am assuming he is poised to buy if the market further discounts MEMP. Here is what he had to say in “The Simple Math Behind Memorial Production Partners: Dividend Cut Guaranteed“:

“Right now, the picture for Memorial looks pretty positive since management is virtually guaranteed to see positive cash flow through 2018. If the energy market doesn’t recover by then, however, there could be some meaningful problems for the business, but i don’t think it’s likely that prices will stay anywhere near this low for such a long timeframe.

Regardless of how you look at it, though, anything shy of an almost immediate recovery in energy prices will result in the company having to cut its dividend relatively soon, which could be a net negative for investors who rely on the business for its hefty yield. If, on the other hand, prices do increase soon, then Memorial will be a great prospect for both income-sensitive and value-oriented investors, meaning that the best way to play this is to ask yourself the likelihood of rising energy prices near term. If you believe that higher prices are probable near term moving forward, Memorial is great both from a yield perspective and an appreciation-potential perspective, but if you expect the downturn to be prolonged, then you could experience a very bumpy ride along the way.”

Jones mixes up forming an opinion with predicting the future – that is, YOUR particular opinion on the future of oil prices has absolutely NO impact on what actually happens going forward. However, I do agree with the underlying premise. MEMP is a fantastic value play at these levels. If you choose to jump in, do not over-extend yourself and keep some powder dry to take advantage of the market’s (panicked) discounting mechanism going into over-drive.

Be careful out there!

Full disclosure: long MEMP and CVX, short puts on USO, short call spread on USO