(This is an excerpt from an article I originally published on Seeking Alpha on July 31, 2015. Click here to read the entire piece.)

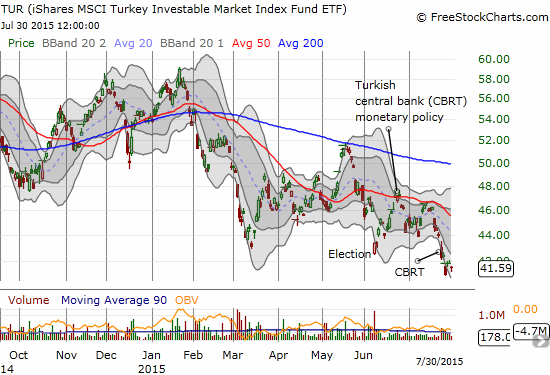

A month ago, I pointed out how the Turkish lira had reversed all its post-election losses. I argued that the lira was due to resume its weakness as the Central Bank of the Republic of Turkey (CBRT) seemed content to wait out inflation pressures rather than act monetarily.

I closed out the trade today (July 30, 2015) as the lira approached its historic low against the U.S. dollar (historic high on USD/TRY). While the trade turned out OK, I paid out a good chunk of the profits to roll (or carry or interest). The trade took a lot longer than I anticipated, so I learned another great lesson on the importance of timing especially against high-yielding currencies. As a result, I am also now more interested in monitoring the possibilities for going the other way, that is bullish the lira, going forward.

Source: FreeStockCharts.com

{snip}

In last week’s monetary policy decision, the CBRT decided once again to leave interest rates steady. The market responded by selling the lira as the CBRT reiterated familiar language:

{snip}

I noted that the CBRT does not raise the specter of higher rates to fight the inflationary impact of a depreciating currency. Instead, the CBRT is looking to increase liquidity in foreign exchange.

The CBRT describes monetary conditions as already tight, so there seems little interest in hiking rates to address inflationary pressures. Emphasis mine in the related quote below from the monetary policy statement:

{snip}

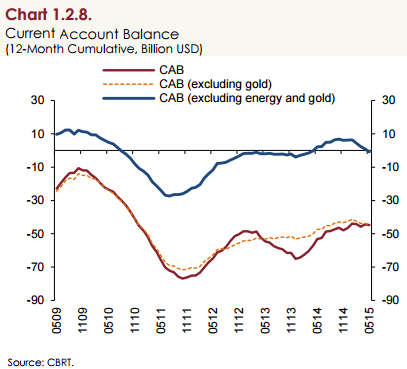

Source: The Inflation Report 2015-III from the Central Bank of the Republic of Turkey

Given the CBRT thinks that today’s tight conditions are already working against inflationary pressures, it seems unlikely that a rate hike is in the cards anytime soon. Moreover, Turkey has tight monetary policy even as overall economic conditions are precarious:

{snip}

Overall, I get the sense that the CBRT is more worried about economic weakness than inflation. This is not a bias conducive to the higher rates that might sustainably strengthen the lira.

{snip}

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: no positions

(This is an excerpt from an article I originally published on Seeking Alpha on July 31, 2015. Click here to read the entire piece.)