(This is an excerpt from an article I originally published on Seeking Alpha on July 28, 2015. Click here to read the entire piece.)

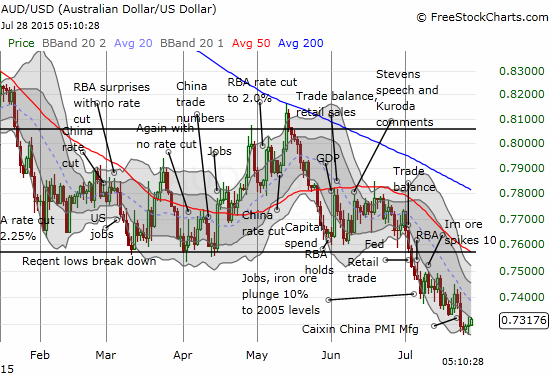

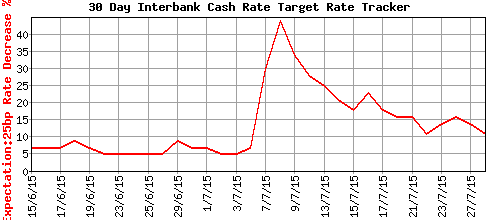

When I last wrote about the Australian dollar (FXA), it was wavering at the 0.74 support level against the U.S. dollar. More importantly, market expectations for an August rate cut from the Reserve Bank of Australia (RBA) were soaring. Now, the 0.74 support level has given way and rate expectations have cooled off significantly.

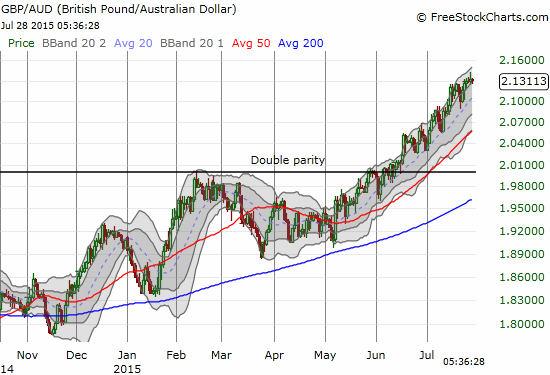

Source: FreeStockCharts.com

Source: ASX RBA Rate Indicator

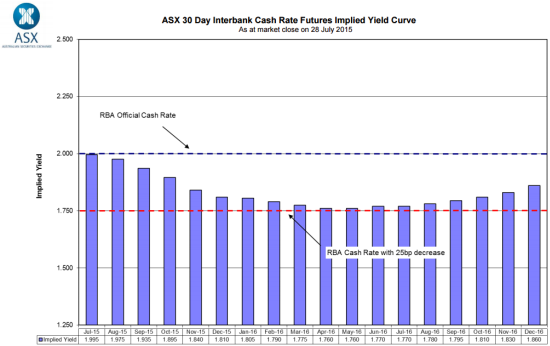

Markets are also expecting just one more rate cut going forward, perhaps as far out as early 2016…

Source: ASX 30 Day Interbank Cash Rate Futures Implied Yield Curve (as at market close on July 28, 2015)

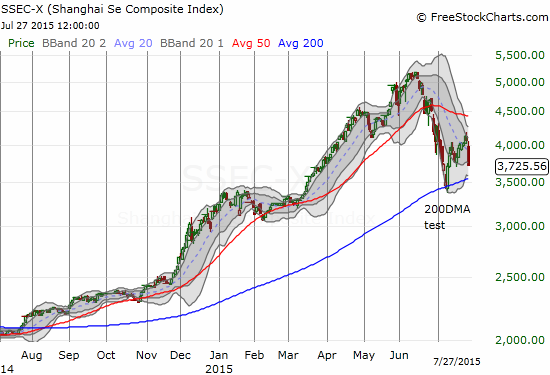

The plunge in rate expectations is a big surprise since it comes at the same time that China is roiling with its Shanghai Composite Index (SSEC) still breaking down…

Commodities-related stocks like Caterpillar (CAT) have confirmed in earnings that the mining sector important to Australia continues to implode…

Source: FreeStockCharts.com

And Fortescue Metals Group (FSUGY), a domestic iron ore miner, confirmed on July 23, 2015 what many analysts have feared and projected: China’s steel consumption has peaked. {snip}

Source: ASX – prices in Australian dollars

{snip} The Flash China General Manufacturing Output Index printed at a 16-month low for July. {snip}

As if all that were not enough, on Friday, July 24th, the Standard & Poor’s tip-toed around a potential downgrade of Australia’s top-rated debt….:

{snip}

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: long and short the Australian dollar against several currencies

(This is an excerpt from an article I originally published on Seeking Alpha on July 28, 2015. Click here to read the entire piece.)