(This is an excerpt from an article I originally published on Seeking Alpha on April 20, 2015. Click here to read the entire piece.)

In my last post on the Canadian dollar (FXC), I claimed that it was time to start buying Canada while at the same time cautioning about an over-extension in the currency in reaction to the latest statement on monetary policy. The Canadian dollar managed to continue gaining strength over the next two days. However, the reaction to Friday’s (April 17th) strong economic numbers finally demonstrated what can happen when a currency gets over-extended.

{snip}

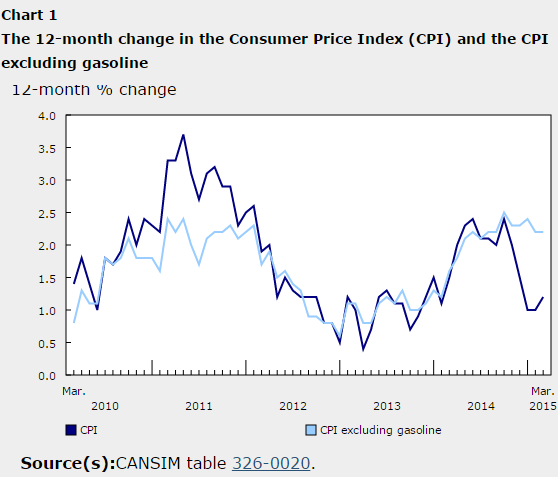

Despite the Canadian dollar’s reversal in the wake of the economic news, I think the data further bolsters the case for an end to the Canadian dollar’s earlier weakness. The economic news on Friday seems to confirm my earlier conclusion that the Bank of Canada will not be cutting rates again and that its next move will likely be to reverse the rate cut, perhaps as early as 2016. {snip}

Source: Statistics Canada

Retail sales in February rebounded after two consecutive months of declines. {snip}

Oil is of course the major wildcard for Canada. Note well that the Canadian dollar’s weakness against the U.S. dollar topped out exactly where oil last bottomed out on March 18th, shown below as a bullish surge from the lows by the United States Oil ETF (USO).

Source for charts: FreeStockCharts.com

{snip}

Be careful out there!

Full disclosure: long USD/CAD, long FXC

(This is an excerpt from an article I originally published on Seeking Alpha on April 20, 2015. Click here to read the entire piece.)