(This is an excerpt from an article I originally published on Seeking Alpha on June 8, 2015. Click here to read the entire piece.)

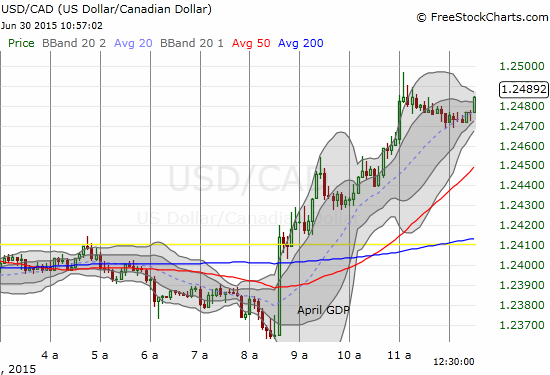

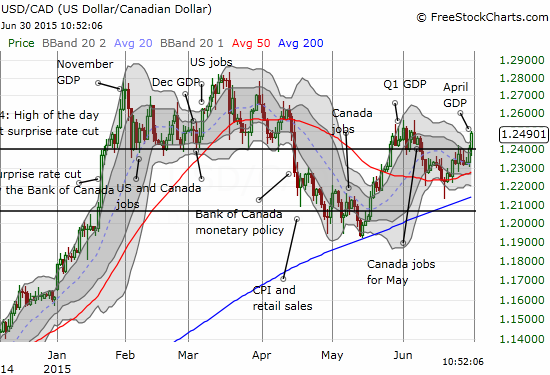

Statistics Canada released its monthly GDP report for April as time counted down on Greece’s June 30th debt deadline. While the news from the report could not steal headlines, it was significant enough to push the Canadian dollar (FXC) through the now important 1.24 pivot versus the U.S. dollar. {snip}

Source: FreeStockCharts.com

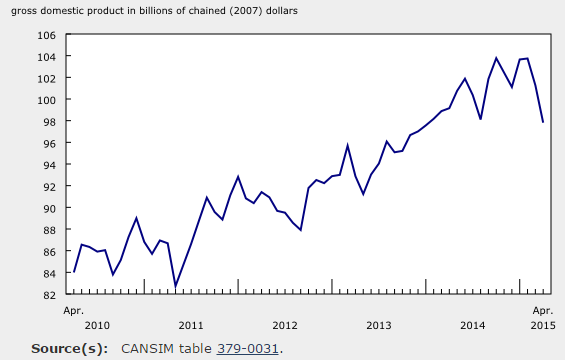

The 0.1% decline in April’s GDP was the fourth consecutive monthly decline. This included a fourth consecutive monthly decline for manufacturing output. While the Bank of Canada anticipated a weak first half of the year, traders clearly found no solace in more confirmation of the Bank’s expectations. {snip}

Source: Statistics Canada

The service sector remains a bright spot for GDP. {snip}

I remain committed to the bullish position on the Canadian dollar as I have explained in earlier posts. This is the one currency on which I try to take a longer view (whether it is bearish or bullish). {snip}

Be careful out there!

Full disclosure: short USD/CAD

(This is an excerpt from an article I originally published on Seeking Alpha on June 8, 2015. Click here to read the entire piece.)