(This is an excerpt from an article I originally published on Seeking Alpha on Feb 25, 2015. Click here to read the entire piece.)

As every other major central bank has done, the Federal Reserve has taken a crack at estimating the economic impact of the collapse in oil prices. In its semi-annual report to Congress, the Monetary Policy Report for February 24, 2015, the Fed assigned supply factors as the dominant driver for declining oil prices.

{snip}

The Fed’s assessment is very consistent with other major central banks. {snip}

Like other central banks, the Fed is also optimistic about the impact of lower oil prices on the economy:

{snip}

With oil prices (USO) well off their 5-year lows, it seems a bottoming process may now be underway for oil.

Sources: US. Energy Information Administration, Crude Oil Prices: Brent – Europe [DCOILBRENTEU], retrieved from FRED, Federal Reserve Bank of St. Louis, February 24, 2015. US. Energy Information Administration, Crude Oil Prices: West Texas Intermediate (WTI) – Cushing, Oklahoma [DCOILWTICO], retrieved from FRED, Federal Reserve Bank of St. Louis, February 24, 2015.

As I noted earlier this month, earnings season brought general optimism about future oil prices. This new-found optimism seemed to support the first big rush off oil’s lows. Oil-related companies experienced a fresh rally that seemed to confirm some kind of bottom. {snip}

Source: FreeStockCharts.com

{snip}

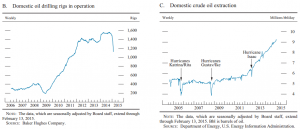

I purposely use the phrase “bottoming process” rather than “a bottom” because U.S. oil production has raced higher throughout the price decline. The Fed’s Monetary Policy Report includes telling charts showing how the count of operational oil drilling rigs has plunged since December, 2014 while oil production has happily continued increasing at a pace in place since 2012.

Click for larger image…

Source: Federal Reserve Monetary Policy Report, February 24, 2015

{snip}

Assuming that the decline in oil prices is mainly a supply-driven dynamic, then it stands to reason that a bottom will not occur until production from the marginal producers actually falls notably. Even stabilization at current levels may not do the trick. Until then, I would not be surprised if oil retests its recent lows or even briefly breaks those lows.

Another central bank to monitor for clues on oil’s decline and its impact is the Bank of Canada (BoC). {snip}

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: long ERY shares, long XLE call options

(This is an excerpt from an article I originally published on Seeking Alpha on Feb 25, 2015. Click here to read the entire piece.)