(This is an excerpt from an article I originally published on Seeking Alpha on June 8, 2014. Click here to read the entire piece.)

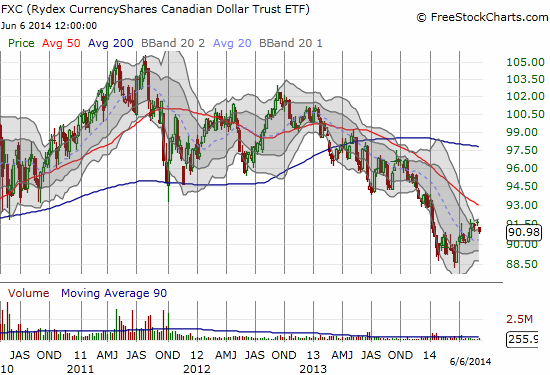

On June 4th, the Bank of Canada hit the “repeat button” by maintaining its target for the overnight rate at 1%. The rest of the statement was not a repeat: it included a slight increase in bearishness from the Bank of Canada which may in turn foretell a weaker Canadian dollar (FXC) in the future, especially when combined with net labor market dynamics that continues to stagnate.

Inflation has reached the Bank of Canada’s target. Instead of celebrating an accomplishment that other central banks are struggling to hit, the Bank of Canada dismissed this turn of events as temporary:

{snip}

{snip} I suspect the Bank still expects a lower exchange rate given it continues to look forward to an exchange-related boost to exports:

{snip}

The most significant part of the June statement came in the downgrade in the Bank’s assessment of risks given economic prospects which suddenly do not look as good as previously anticipated:

{snip}

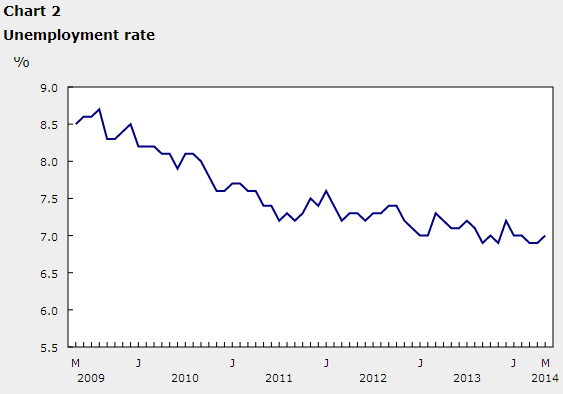

Source: Statistics Canada, Labour Force Survey, May 2014

{snip}

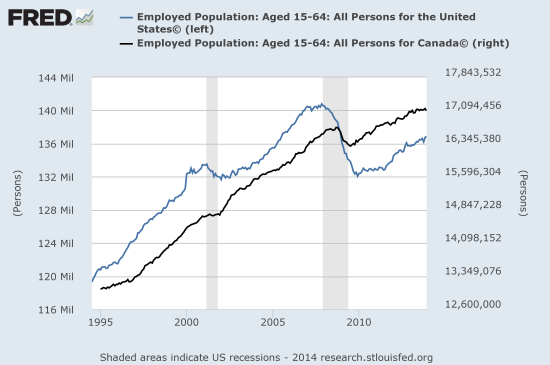

Source: St. Louis Federal Reserve through Organisation for Economic Co-operation and Development (OECD), “Main Economic Indicators – complete database”, Main Economic Indicators (database), (Accessed on June 7, 2014). Copyright, 2014, OECD. Reprinted with permission.

Currency markets are all about relative differences and the post-recession advantage of Canada has long since been priced into the exchange rates. Now, and going forward, the U.S. economy is the more dynamic one with more potential upside. Moreover, Canada still needs a lower exchange rate to get back on track with export growth. So, my bet continues to stay bearish on the Canadian dollar, and I continue to buy the dips for short-term/swing trades.

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: long USD/CAD

(This is an excerpt from an article I originally published on Seeking Alpha on June 8, 2014. Click here to read the entire piece.)