(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

T2108 Status: 27.3% (low of 23.8% which broke last week’s close and levels last seen in October, 2014)

T2107 Status: 39.8% (new 6+ month low)

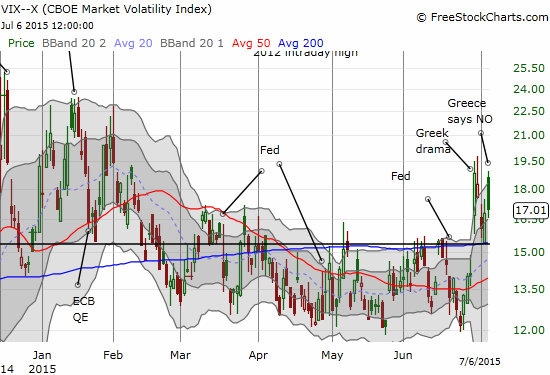

VIX Status: 17.0 (faded from an open of 18.6)

General (Short-term) Trading Call: Bullish

Active T2108 periods: Day #178 over 20%, Day #2 under 30% (underperiod), Day #5 under 40%, Day #31 under 50%, Day #48 under 60%, Day #247 under 70%

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

Commentary

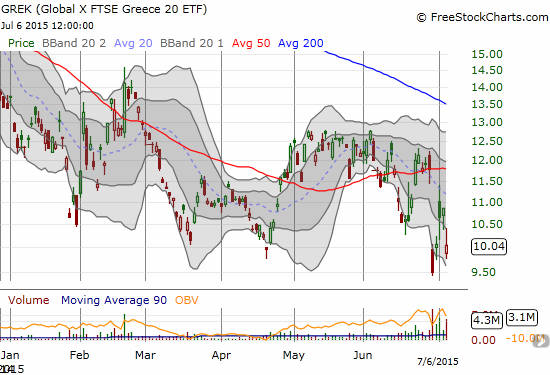

In the immediate wake of the Greek decision to say “no” to the bailout referendum, the S&P 500 futures fell 1.5%. I had this reaction…

If I traded S&P 500 futures, I would be a buyer here. $SPY Hope to get a chance on Monday to double down on fading volatility too.

— Dr. Duru (@DrDuru) July 5, 2015

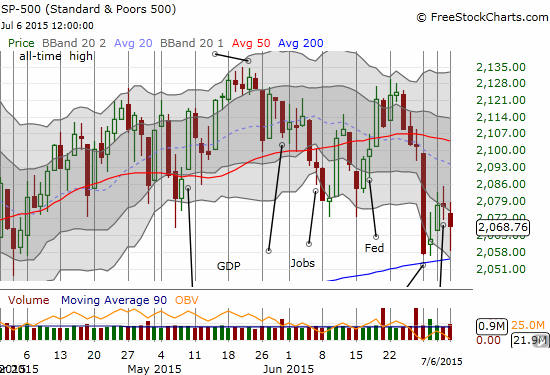

It touched off some interesting discussions on StockTwits and on Twitter. In the end, my “paper trade” worked with the S&P 500 (SPY) actually going into the green for a hot minute on the day. It ended down after beating out another test of its 200DMA support.

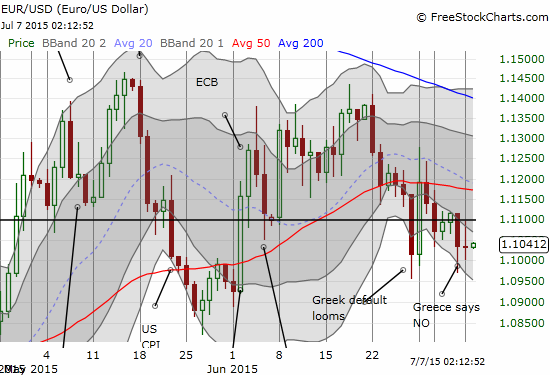

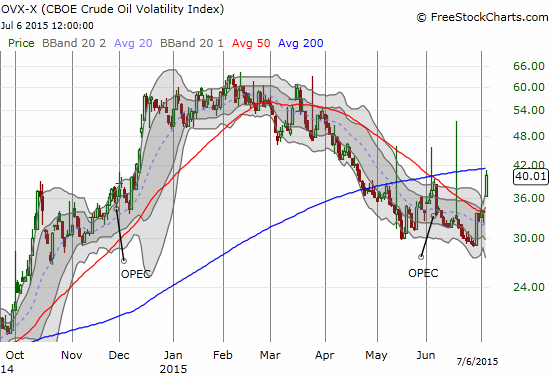

I decided NOT to play the S&P 500 on the day in favor of waiting for a true oversold condition. T2108 got close, bit no cigar. It closed at 27.3% after trading as low as 23.7%. I DID go after volatility and doubled down on my put options for ProShares Ultra VIX Short-Term Futures ETF (UVXY). If this trade fails at THESE levels, I will definitely get my chance to load up on call options on ProShares Ultra S&P500 (SSO) on true oversold conditions. Volatility ended up behaving just as I would have hoped. A rattling lid remains on top of the pressure cooker as the VIX at the open and at its highs did not even come close to challenging last week’s high and faded for most of the day. The VIX still hovers above the 15.35 pivot. Note that the exact vote DID matter contrary to my technical discussion from the last T2108 Update. I am also wondering whether the VIX will stay elevated until earnings seasons gets into full swing.

This was a day for pictures. So I will tell the rest of the story on the day with a few key charts.

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

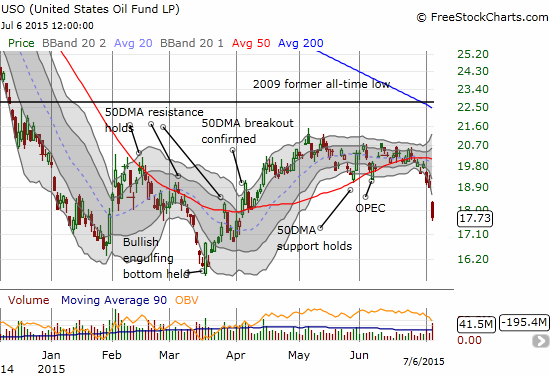

Full disclosure: net short the euro, long UVXY put options, long USO call options