(This is an excerpt from an article I originally published on Seeking Alpha on June 2, 2015. Click here to read the entire piece.)

On May 27th, the Federal Reserve Board published the second annual results of its Survey of Household Economics and Decisionmaking (SHED). {snip} Based on the Fed’s survey results, I concluded that 2015 will not provide any improvement on first-time buyer numbers although existing homeowners seem to be well-situated (in aggregate).

{snip}

{snip} The main point is that the respondents should sufficiently correspond to the different housing decisions, choices, and plans made in the general population.

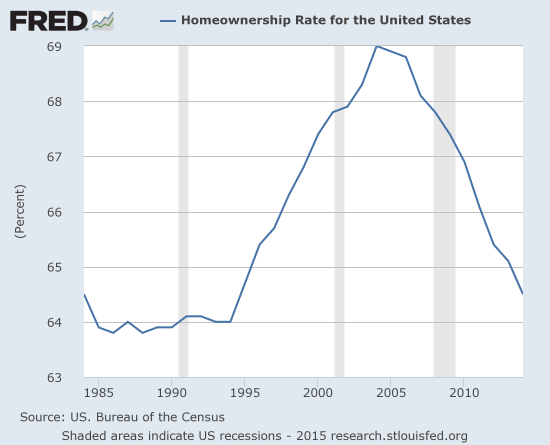

Source: US. Bureau of the Census, Homeownership Rate for the United States [USHOWN], retrieved from FRED, Federal Reserve Bank of St. Louis, May 31, 2015.

Despite the historic decline in the rate of homeownership, renters overwhelmingly prefer to own even if current circumstances prevent them from doing so. {snip}

Thirteen percent of renters aged between 18 and 29, part of the important millennial demographic, indicated they hope to buy a home. This percentage places them above the average 9% and signifies the importance of their success for the housing market.

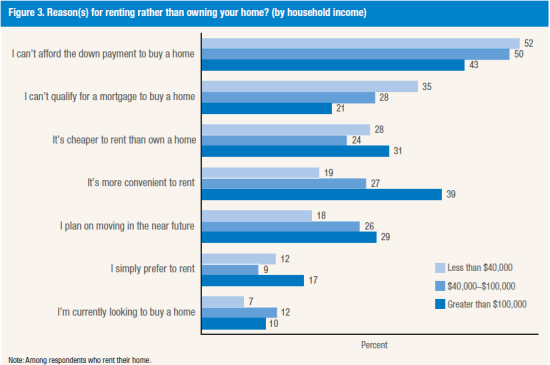

{snip} Affordability is more of an issue for renters as a reason for renting over owning in 2014 than in 2013. {snip}

Source: Report on the Economic Well-Being of U.S. Households in 2014 (May 2015), Board of Governors of the Federal Reserve System

Financial issues are also making it hard for renters to pay their rent, thus making it very unlikely they will become homeowners anytime soon. {snip}

Overall SHED indicated an on-going strong desire among people to own a home. {snip}

Current homeowners seem to be relatively settled, but the population of people transitioning from ownership to renting and back to ownership will be a key cohort to track. The youngest adult demographic is clearly at the early stages of considering the possibilities of homeownership, but they are also one of the more important given renters in this age group are a bit more inclined than than the average to shop for a home. Finally, the financial situations of many renters, the people who should be the homebuyers of the future, demonstrate that the housing recovery still has a ways to go.

Be careful out there!

Full disclosure: no positions

(This is an excerpt from an article I originally published on Seeking Alpha on June 2, 2015. Click here to read the entire piece.)