(This is an excerpt from an article I originally published on Seeking Alpha on April 27, 2015. Click here to read the entire piece.)

One of my tenets from the (revised) “Commodity Crash Playbook” is to respect momentum and trends in commodity trading and investing…

{snip}

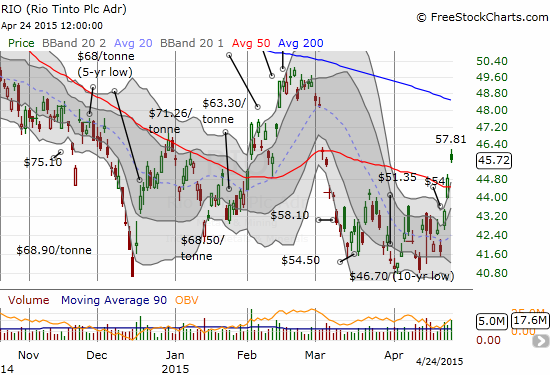

Iron ore has become a fascinating case in point. The trend for iron ore prices and iron ore related equities has definitively pointed downward. The path downward has been relentless. The last several months of the decline have not even featured the standard notable and sharp relief rally…until now. {snip}

Source: Barchart.com

Given the duration of the selling, one should suspect that negative sentiment was getting stretched. We may one day even look back on the S&P’s creditwatch warning on April 13th on iron ore majors as one of those washout moments where sellers finally exhaust themselves (on the equity side). Similarly, the lingering chatter and rumors about the possibilities for Glencore making a play for Rio Tinto (RIO) make RIO a stock that could explode to the upside at anytime (like its 20% gain at one point in the wake of rumors last October). That move exhausted buyers on the upside.

The latest catalyst in this tinderbox came in the form of just a few sentences from BHP’s latest operations report that I still believe have been grossly misinterpreted. {snip}

Reinforcing feedback loops are powerful in commodities and form the basis for sustained price action. The feedback loops in play over the past 18 months or so have been particularly destructive. Even though I believe iron ore has yet more downside as a part of that downward tug, I think it makes sense to respect the potential for a constructive feedback loop in the short-term. {snip}

{snip}

All three stocks are well over-extended right now, especially VALE. {snip}

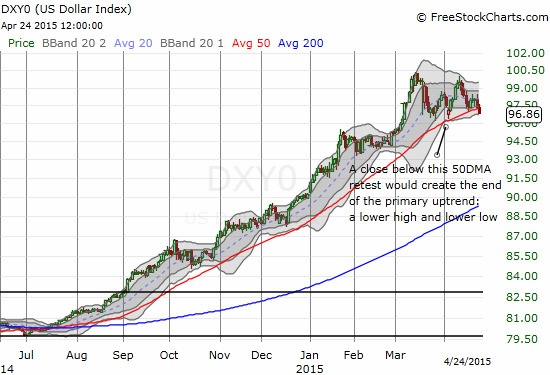

{snip} Next up, the Federal Reserve meeting on Wednesday, April 29th. If the Fed so much as blinks on its presumed intention to hike rates this year, I strongly expect commodities, iron ore included, to soar. The U.S. dollar (UUP) looms large over almost all commodity-related investments and trades.

Source for charts: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 27, 2015. Click here to read the entire piece.)

Full disclosure: long VALE, short BHP, long RIO call and put options