This is a quick post on five charts that caught my eye on Tuesday, May 19th. All charts annotated at and downloaded from FreeStockCharts.com.

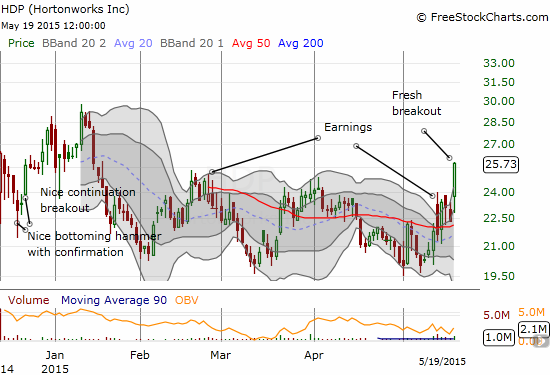

Hortonworks, Inc. (HDP) has struggled to make a good post-IPO impression. The first earnings report underwhelmed and led to a fresh all-time low. The last earnings report was initially well-received and then faded to a slightly negative close. However, on Tuesday, May 19th, HDP made a tremendous 15% surge that not only resumes momentum for the stock but also represents a breakout. All it took was a Barclays upgrade to outperform and a price target of $30.

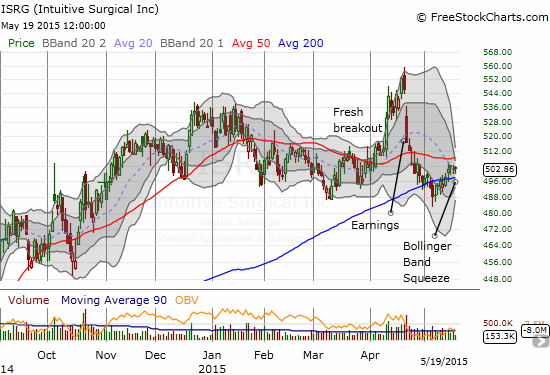

Intuitive Surgical, Inc. (ISRG) is the stock I want to love. The last earnings report was uninspiring and traders and investors bailed fast. The selling finally ended around 200-day moving average (DMA) support. Now, a Bollinger Band (BB) squeeze is developing. I would love to anticipate a breakout here. However, given the poor post-earnings performance, I will instead follow the break out of the BB squeeze in whatever direction it moves.

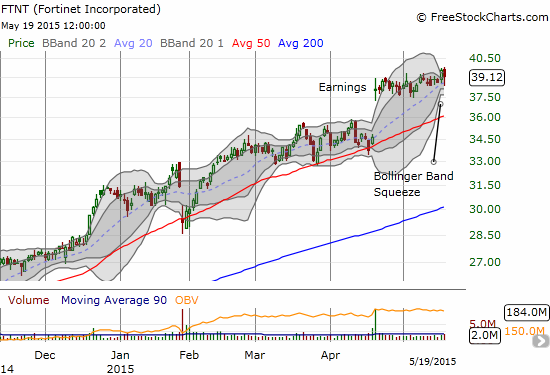

Fortinet Inc. (FTNT) is another BB squeeze candidate. Its technical profile is much better than ISRG here. The stock gapped up nicely post-earnings and has consolidated ever since. This setup makes FTNT look like a coiled spring – ready to break out and resume the very strong upward trend in the stock.

Ever since Jim Cramer hyped up the IPO for Box, Inc. (BOX), I have been wary of betting this is eventually a single digit stock. I now have put options after the stock has slowly but surely sagged despite periodic hype fests from Cramer gushing over the stock. It is rarely a good sign when an IPO comes right out the box, so to speak, with a very poor earnings report, especially one that immediately retests post-IPO lows. The chart below shows a pattern of lower highs. It seems only a matter of time before a lower low occurs.

Finally, Wix.xom (WIX) is the stock that has really called me to return. I was hoping for a pullback from a strong response to the last earnings report. The current breakout makes such a pullback unlikely. So, instead, I will have to buy back into this one on momentum. Note the persistence of strong (high volume) buying since earnings.

Be careful out there!

Full disclosure: long BOX put options

Addendum: I forgot to note that WIX is back to levels where it traded when it proposed to do a follow-on offering. It was poorly received at the time. I suspect it is best to sit on WIX for a while and perhaps buy when they decide to dump some stock.