(This is an excerpt from an article I originally published on Seeking Alpha on October 9, 2014. Click here to read the entire piece.)

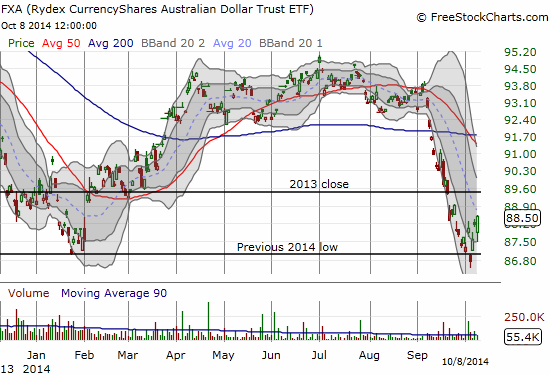

Not even another poor jobs report – unemployment rate up from 6.0% to 6.1% and a loss of 29,700 employed persons – could keep the Australian dollar (FXA) down. During the Asian currency trading session the Australian dollar took a quick tumble and made almost as quick a recovery, resuming its momentum for the week.

The Reserve Bank of Australia (RBA) may soon wish it had taken the ripe opportunity this week to tip its currency over the edge. Instead, the statement on monetary policy earlier this week made no such attempt. After the market’s relieved reaction to the release of the minutes from the Federal Reserve’s September policy meeting, the Australian dollar darted ahead to a new high for the week that seems to have put polish on a bottom (for now).

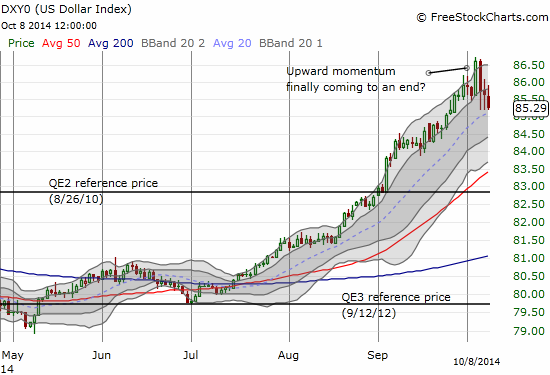

The Fed minutes did not contain any fundamental surprises, but it was notable in the various references to the U.S. dollar’s (UUP) exchange rate. The speed and sharpness of the U.S. dollar index’s rally since July has been remarkable, so perhaps it is not surprising that even the Fed would take an opportunity to take note along with financial markets.

{snip}

While the Fed does not say the dollar’s rise reduces the need or urgency to raise rates, the market’s reaction to the minutes seems to imply that interpretation. {snip}

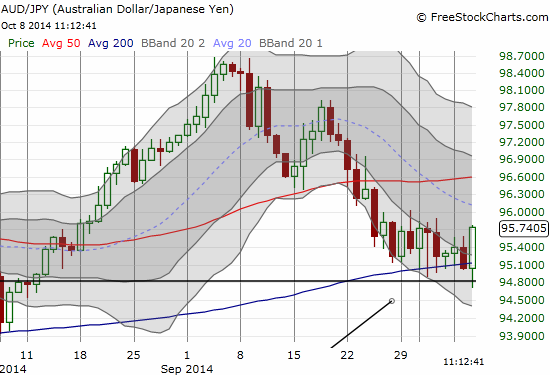

Lost in the noise over the U.S. dollar is the relative trading between the Australian dollar and the Japanese yen (FXY). Just like the AUD/USD currency pair, AUD/JPY powered through an initial hiccup to the poor jobs report. The recent resilience in AUD/JPY helped me confirm the (short-term?) buying opportunity when the S&P 500 dropped into oversold conditions.

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on October 9, 2014. Click here to read the entire piece.)

Full disclosure: net long Australian dollar, net long the U.S. dollar