(This is an excerpt from an article I originally published on Seeking Alpha on May 1, 2015. Click here to read the entire piece.)

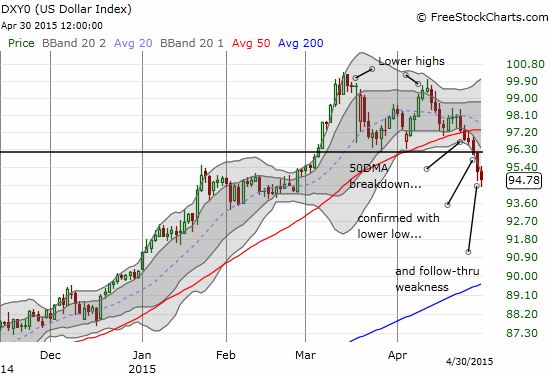

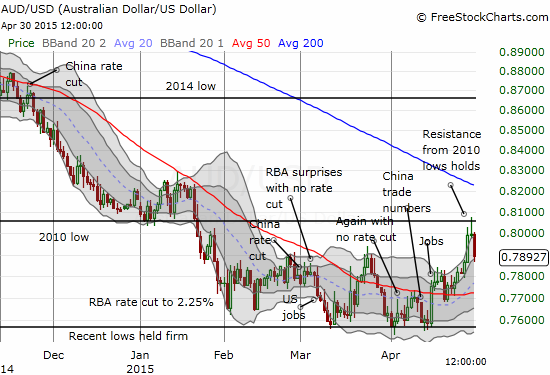

While the U.S. dollar (UUP) was experiencing fresh bout of weakness, the Australian dollar (FXA) was surprisingly even weaker. Although I explained in an earlier piece that the Australian dollar was over-extended against several currencies, I did not expect anything more than a mild pullback. After all, punching through the 0.80 level on AUD/USD looked like a display of strength as part of a near 2-week run-up since a surprisingly strong jobs report.

Source: FreeStockCharts.com

Somehow, I missed until the time of writing (the evening of April 30th) that a single article in the Sydney Morning Herald was credited for driving weakness back into the Australian dollar. {snip}

Aussie dollar crushed by talk of an RBA cut #forex (via @BusInsiderAU) http://t.co/pxIaBLHIsE

— Greg McKenna (@gregorymckenna) April 30, 2015

McKenna referred to “Reserve Bank to cut interest rates in May in face of weak economy.” The title alone looks definitive and predictive. I am guessing many traders freshly selling the Australian dollar barely looked past the headlines. If they had, they would have found at least one VERY odd feature of this article: not only did the author fail to name a source for his confidence, but also he chose not to use that ubiquitous yet anonymous generator of insider information “a source who did not want to be named.” {snip} Lacking references or a source, the author instead constructs credibility from the certainty of his language; a technique I find even less convicing that a conveniently planted whisper or two from the RBA.

The author creates credibility by making exceptionally definitive statements that could only come from someone with direct contact with a member of the Reserve Bank of Australia (RBA) or related insider. {snip}

While I can quibble about the author’s approach and lack of sourcing, I have an even bigger problem with the premise of cause and effect. The author believes from his RBA-informed source that rates must be cut to prevent the Australian dollar from climbing even higher. After the RBA cut rates to 2.25% on February 2nd, the Australian dollar plunged to new multi-year lows. it bounced right back the following day. The RBA failed to cut rates in March, and the Australian dollar proceeded to decline to fresh, albeit very marginal, multi-year lows. Those same lows were tested twice before the currency launched into a new two-week run-up, triggered by a surprisingly strong employment report. These points are shown in the above chart.

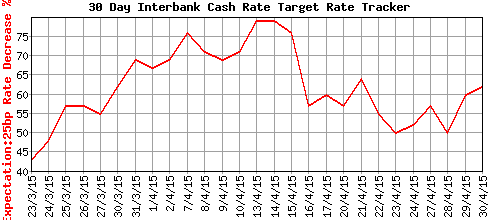

In other words, the last rate cut was ineffective in driving the Australian dollar lower. Why then should the RBA conclude that the next one will do any better? If anything, I contend that the RBA is trapped by a market that is trying to anticipate the END of the rate cycle, not the beginning of a new path downward. {snip}

Source: ASX RBA Rate Indicator

McKenna raised another good point in all this intrigue in a piece he called “Is there another RBA leak that needs investigating?” {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on May 1, 2015. Click here to read the entire piece.)

Full disclosure: net long the Australian dollar