(This is an excerpt from an article I originally published on Seeking Alpha on March 31, 2015. Click here to read the entire piece.)

{snip}

This quote was buried in footnote #14 of Janet Yellen’s speech at a research conference called “The New Normal Monetary Policy” sponsored by the Federal Reserve Bank of San Francisco. Despite its relative obscurity in the speech, the quote exemplified to me the “on the other hand” quality of monetary policy: Yellen has been quite careful to present multiple possibilities in every consideration for monetary policy. That is, if the economy does X, then the Fed MIGHT do Y. On the other hand, if the economy does A, then the Fed MIGHT do B. Yellen and the Fed have tried to keep the market trained on the data rather than any automatic formulas of what may or may not happen.

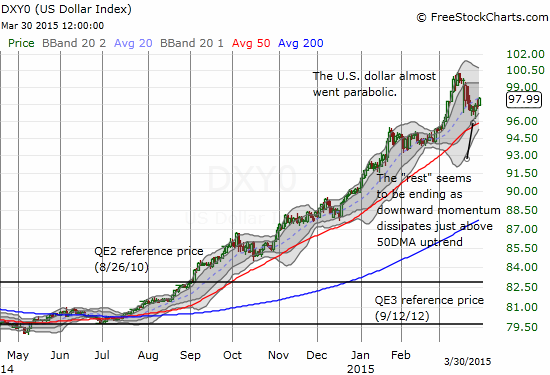

When it comes to the direction of the U.S. dollar (UUP), this concept is particularly relevant because it requires considerable circumspection when judging the drivers of strength in the U.S. dollar. If this quote is correct, the strength of the U.S. dollar represents NOT an expectation of economic strength embodied in “policy divergence,” but instead in the expectation that the U.S. will soon be a valuable refuge from even worse conditions on the rest of the globe. In other words, the U.S. dollar could continue rising, ironically enough, because economic bears on the one hand AND bulls on the other hand find the currency attractive at this point in the cycle.

{snip}

If you want to insist on being bearish on the U.S. dollar, you need to at least wait until the feverish trend has definitively ended rather than try to predict the very top of the move. {snip}

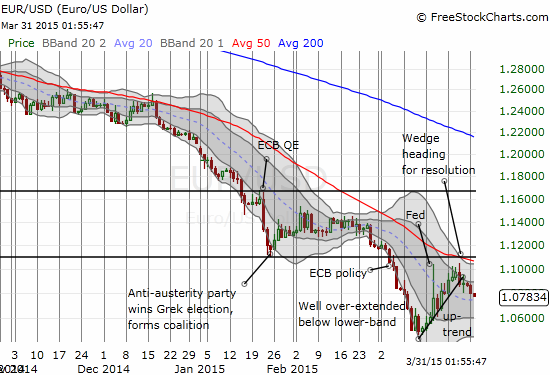

The euro (FXE) is the largest component of the U.S. dollar index. This currency then is a core piece of the dollar trend. {snip}

Source: FreeStockCharts.com

Adding to the tailwind for the U.S. dollar is that the Federal Reserve, unlike so many other major central banks, is not overtly obsessed with the level of currency. {snip}

Of course, in this “on the other hand” regime for policy, stubborn dogma is a hindrance, flexibility is a must. Fortunately, the trend remains a friend and ready to guide those willing to heed the message.

{snip}

Be careful out there!

Full disclosure: net long the U.S. dollar, short the euro

(This is an excerpt from an article I originally published on Seeking Alpha on March 31, 2015. Click here to read the entire piece.)