(This is an excerpt from an article I originally published on Seeking Alpha on March 26, 2015. Click here to read the entire piece.)

{snip}

The response was swift. The The Australian Competition and Consumer Commission (ACCC) released a statement indicating it will investigate the context and nature of comments made by Andrew Forrest, founder of Australian iron ore miner Fortescue, at an AustCham event in Shanghai on March 24th, 2015. Forrest directly and overtly suggested that iron ore’s largest producers should cap production in order to drive pricing higher. From Reuters:

{snip}

These comments arrive on the airwaves shortly after fellow pressured CEO Lourenco Goncalves of Cliffs Natural Resources (CLF) asked the industry to “rethink” its production plans for iron ore.

Fortescue’s CEO Nev Powers quickly came to defense of Forrest. From the same Reuters article:

{snip}

Given the steep penalties that the ACCC may charge even for signalling the desire for collusion, the quick defense is quite understandable. Yet, there is absolutely nothing in “modern economics’ that suggests what is going on in the iron ore market is irrational.

The dynamics at work are quite simple and well-understood. {snip}

{snip} The biggest beneficiaries of higher prices from here would be the owners of capital and NOT Australians or consumers in general. At higher prices, none of these miners will hire substantial numbers of new workers. {snip}

Before I cast too much aspersion on Forrest for his anti-competitive comments, I want to offer for comparison related commentary by the Premier of Western Australia, Colin Barnett…{snip}…it is no surprise he is now lashing out at miners for driving prices down. From ABC News Online:

{snip}

Short of using a coercive power of the government to regulate production, the only way to effect the Premier’s desire for higher prices is to convince the industry to cooperate on capacity planning and output. {snip}

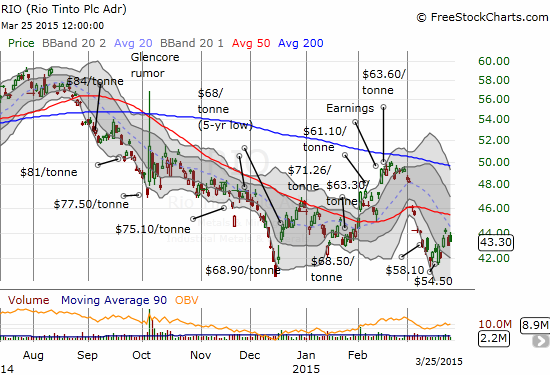

This pattern suggests a bottoming could finally be underway even though last month RIO failed a critical test at resistance from its 200-day moving average. I remain bearish on iron ore miners because the dynamics at work are not showing any sign of abating. I am anticipating at least one leg lower in the near future. However, I fully recognize that as the negativity and the pressure continues to build on industry participants, a final washout moment gets closer and closer.

{snip}

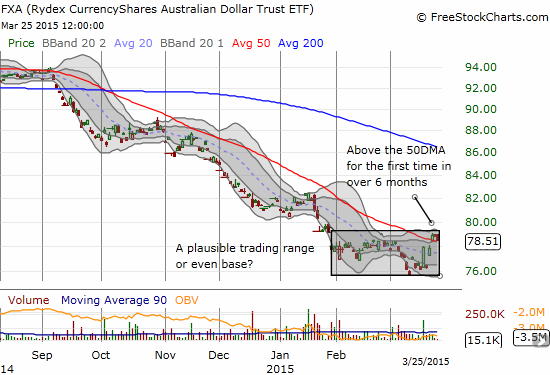

Source for charts: FreeStockCharts.com

Be careful out there!

Full disclosure: long RIO put options, net short the Australian dollar

(This is an excerpt from an article I originally published on Seeking Alpha on March 26, 2015. Click here to read the entire piece.)