(This is an excerpt from an article I originally published on Seeking Alpha on February 12, 2015. Click here to read the entire piece.)

KB Home (KBH) has made good on its promise to focus more on short-term monetization. Since reporting disappointing earnings on January 13, 2015, KBH has already announced six openings, grand openings, and new communities, all in time for the Spring selling season.{snip}

The momentum has culminated in a preliminary orders report that includes some very strong numbers for KBH:

{snip}

The company went on to applaud its “positive revenue outlook for the remainder of the year, particularly in the third and fourth quarters.” Notably absent was any information on gross margins, the biggest concern that investors had coming out of KBH’s last earnings report. {snip}

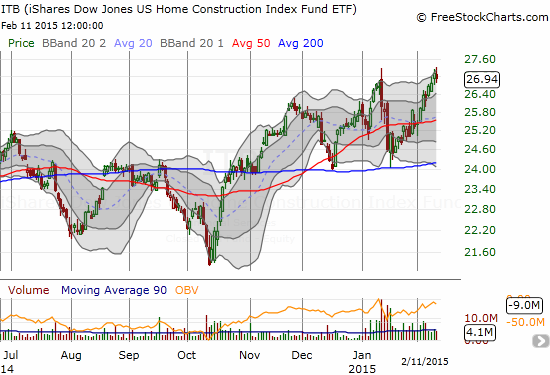

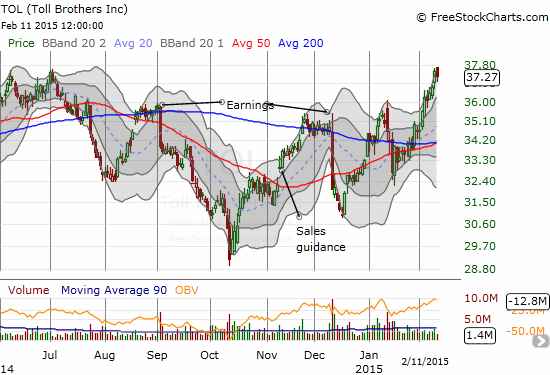

For context, home builders in general have enjoyed a strong rally since mid-January. {snip}

The rally in ITB has been supported by a series of earnings reports that provided great relief to the bad news KBH delivered on January 13th. As I suspected at the time, KBH’s problems were more company-specific than indicative of general industry woes.

{snip}

Source for charts: FreeStockCharts.com

Be careful out there!

Full disclosure: long TOL call options

(This is an excerpt from an article I originally published on Seeking Alpha on February 12, 2015. Click here to read the entire piece.)