(This is an excerpt from an article I originally published on Seeking Alpha on February 11, 2015. Click here to read the entire piece.)

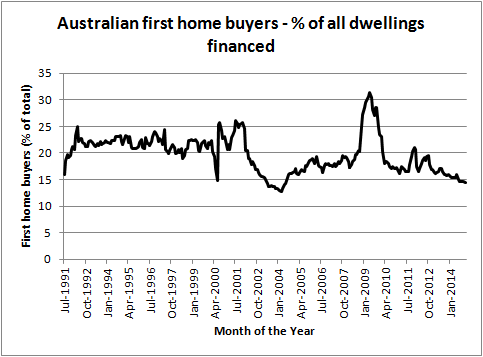

The Australian Bureau of Statistics released its December, 2014 data on housing finance in Australia. The data show that first-time home buyers continue to decline as a percentage of all dwellings financed. The last time the share was lower than December’s 14.5% reading was June, 2004.

Source: Australian Bureau of Statistics

This decline in the share of first home buyers coincides with a continued increase in investor-driven activity in Australia’s housing market. These investors are likely steadily squeezing out first-timers as affordability declines. {snip}

Investor demand is likely helping to accelerate housing prices in Australia’s most populous cities: Sydney and Melbourne.

Source: Reserve bank of Australia Statement on Monetary Policy

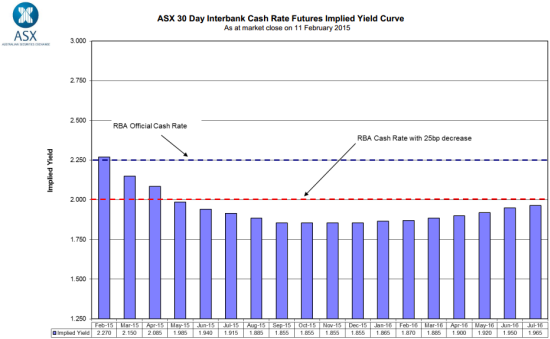

The RBA is finally starting to worry about the robust growth in housing prices – particularly the activity of investors – as it attempts to balance the Australian economy with lower interest rates:

{snip}

One sign of a potential housing bubble is a fall in rent relative to housing prices that makes renting an exceptionally better value than buying. This is exactly what may be starting to happen in Australia:

{snip}

With consumer price inflation at 1.7% for 2014, the RBA does not technically have a lot of room to continue lowering interest rates to drive the currency down. So I was surprised that the Statement on Monetary Policy did not contain any stronger language about the persistent over-valuation of the Australian dollar. {snip}

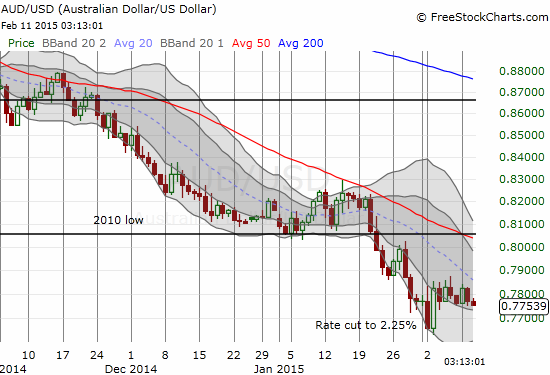

Source: FreeStockCharts.com

{snip}

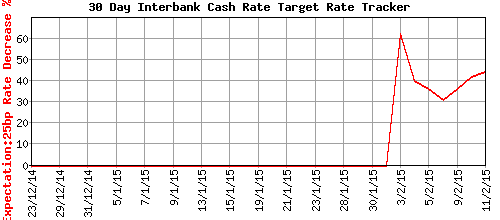

Source: ASX RBA Rate Indicator

{snip}

Source: ASX 30 Day Interbank Cash Rate Futures Implied Yield Curve

While the market waits for the RBA’s next pronouncements, I am guessing the exchange rate will be buffeted by the gyrations in commodity prices, iron ore and oil in particular. {snip} Together, these bounces have likely helped the Australian dollar stay off its lows…for now.

Be careful out there!

Full disclosure: net short the Australian dollar

(This is an excerpt from an article I originally published on Seeking Alpha on February 11, 2015. Click here to read the entire piece.)