(This is an excerpt from an article I originally published on Seeking Alpha on August 17, 2014. Click here to read the entire piece.)

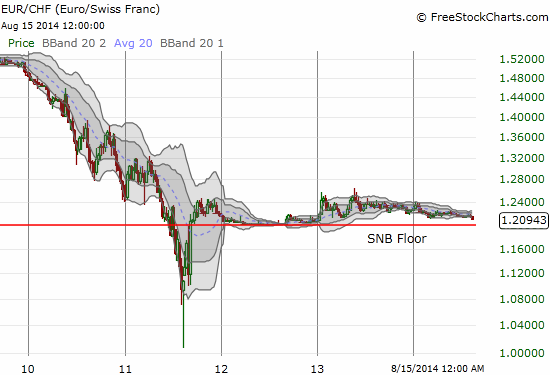

In August, 2011, the Swiss National Bank (SNB) took a series of extreme measures to attempt to arrest an accelerating strengthening in the Swiss franc (FXB). These measures culminated in establishing a 1.20 floor against the euro (FXE) on September 6, 2011:

{snip}

The Swiss franc did continue to weaken for another two months until the market ever so slowly moved to test the SNB’s resolve. {snip}

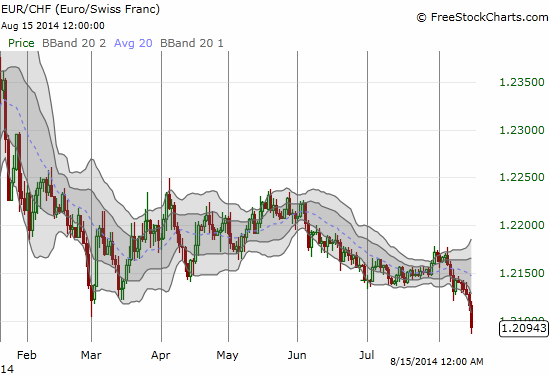

In 2013, EUR/CHF delivered two small run-ups: the first maxed at 1.257 and the second maxed at 1.264. Ever since then, the franc has been a very “boring” currency as EUR/CHF has steadily drifted lower (franc strengthening). Over the last two weeks, the franc’s strength has suddenly accelerated, for example, sending EUR/CHF to a 19-month low.

Source: FreeStockCharts.com

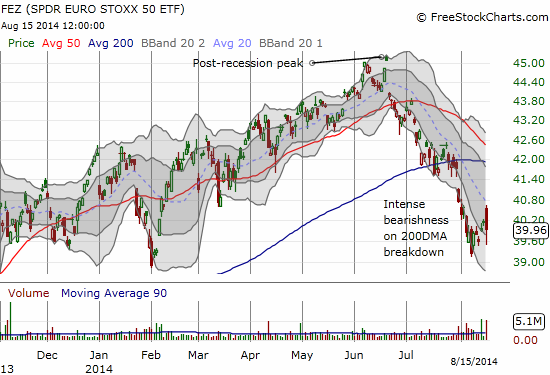

It is easy to assume and claim that this sudden bout of strength is “safe haven” buying as a response to the increasing tensions in the Ukraine. {snip}

Source: FreeStockCharts.com

Whatever the reason, it seems a perfect storm may be building over the franc once again that just might test the SNB’s resolve in coming weeks or months depending on how the potential catalysts listed above play out. Currency traders at least seem to lack any reason to “allow” the franc to depreciate in the near-term.

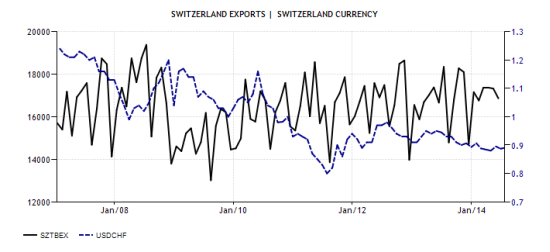

On August 13, 2014, Bloomberg ran a story on the franc’s strength titled “Mighty Franc Poses Challenge for Made-in-Switzerland Label.” The story contained several examples of Swiss companies losing profits and revenues due to the franc’s strength. However, the article never mentioned the currency’s impact on the economy as a whole. As it turns out, the franc’s strength has not sent Switzerland’s exports heading south. The chart below charts exports priced in millions of Swiss francs on the left axis versus the value of USD/CHF on the right axis.

Source: TradingEconomics.com

{snip}

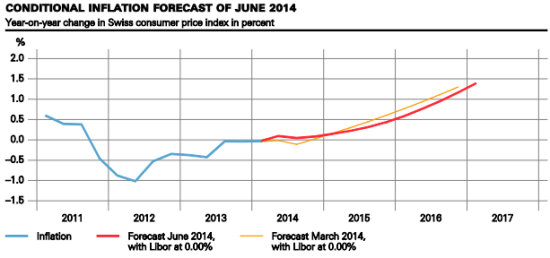

Source: SNB Monetary policy assessment of 19 June 2014

Switzerland’s GDP growth has yet to return to pre-recession levels. Yet, overall, the Swiss are enjoying a remarkable combination of conditions: ultra-low interest rates, a strong (almost impervious) currency, relatively stable export values, and no inflation.

The Swiss franc has been a relatively “boring” currency for a long time now. That stasis may soon change…

Be careful out there!

Full disclosure: net long Swiss franc

(This is an excerpt from an article I originally published on Seeking Alpha on August 17, 2014. Click here to read the entire piece.)