(This is an excerpt from an article I originally published on Seeking Alpha on November 17, 2014. Click here to read the entire piece.)

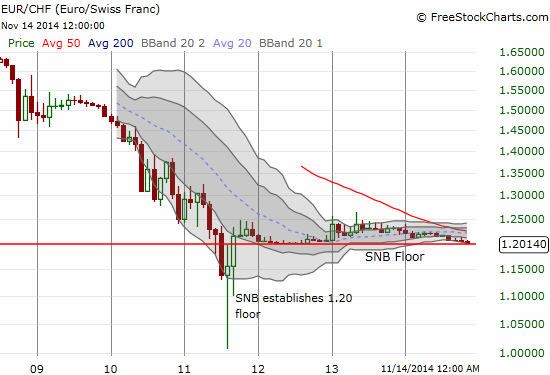

The euro (FXE) versus the Swiss franc (FXF) currency pair has dropped steadily all year on its way to a rendezvous against the 1.20 floor:

Since the end of the financial crisis, the Swiss National Bank (SNB) has insisted that its currency is extremely over-valued but to no avail. It took the 1.20 floor just to devalue the Swiss franc out of parity with the euro in 2011. The franc’s strength accelerated into that decision as if the market intended to force the SNB’s hand after so many prior threats from the SNB.

The SNB’s hand may be forced again. This time political forces – courtesy of the Swiss People’s Party (SVP) referendum called “Save Our Swiss Gold” – have aligned against the SNB. The SVP is the same party that successfully passed a referendum earlier this year called “Stop Mass Immigration.” The gold referendum will force the SNB to hoard gold and likely drive significant strength into the Swiss franc. {snip}

Traders should drool at the prospects of such an initiative. A major market player may be forced by law to execute well-known, clearly defined purchases. The SNB only has about 7.8% of its reserves in gold (a total of 1,040 tonnes), so the forced buying would be significant. The price of gold gets clear support and a currency gets backing by a physical commodity (or asset) which will tend to make the currency stronger. Yet, this is a case where there is just a small chance of a very big outcome. The referendum only has a small chance of becoming law because there are more procedures lying in wait even if the Swiss people pass this change to its Constitution. {snip}

This is also a case where the two elements of the trade are in completely opposite conditions. {snip}

The timeframe for the trading/investing opportunities is also different.

{snip}

Source for charts: FreeStockCharts.com

So, overall, given the low odds of a change to the status quo, I like starting to fade the Swiss franc ahead of the referendum vote. {snip}

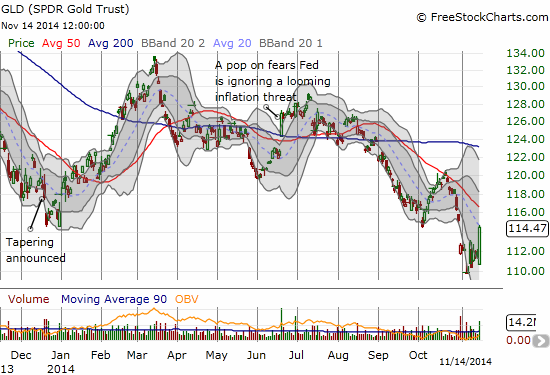

I also like adding to gold here almost regardless of the prospects for the referendum. At the beginning of the year, I projected that gold would keep going lower for the year.{snip}

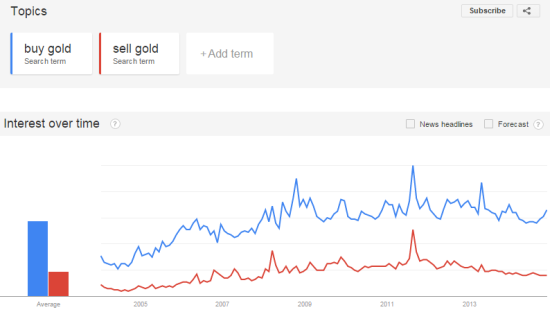

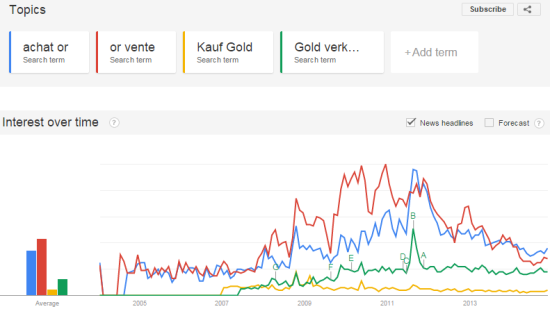

I conclude with a quick sentiment check on gold using Google trends. {snip}

Source: Google trends

{snip}

Be careful out there!

Full disclosure: long AUD/CHF, long GLD, long GG

(This is an excerpt from an article I originally published on Seeking Alpha on November 17, 2014. Click here to read the entire piece.)