(This is an excerpt from an article I originally published on Seeking Alpha on November 6, 2014. Click here to read the entire piece.)

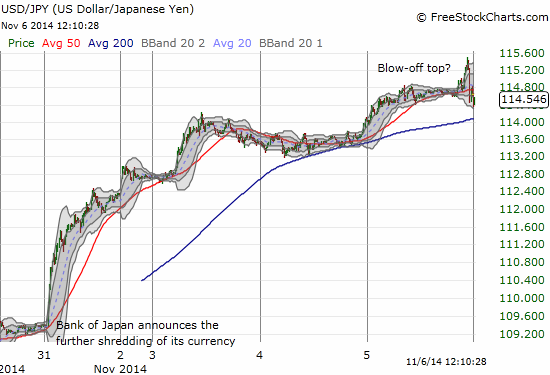

The pressure is building on the Australian dollar (FXA). If it were not for the fresh collapse in the Japanese yen (FXY), the proverbial risk trade would be looking very shaky.

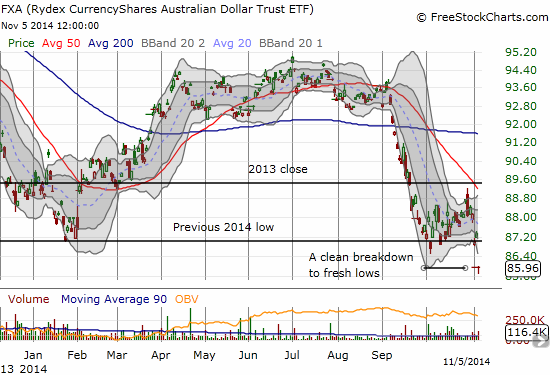

As the U.S. dollar (UUP) continues its current climb, it is applying pressure on major currencies across the board. On November 5, CurrencyShares Australian Dollar ETF (FXA) finally gave in.

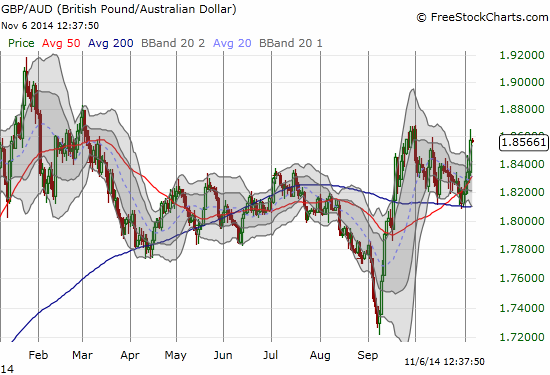

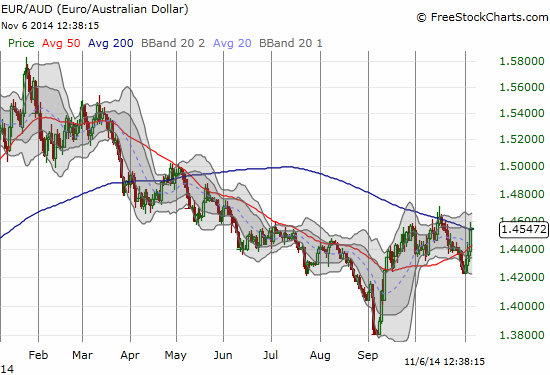

I was bearish the Australian dollar for quite some time until American equity markets reached what I thought was a bottom supported by resilient trade in the Australian dollar versus the Japanese yen (AUD/JPY). The Bank of Japan’s massive expansion of its quantitative and qualitative easing program last week had me thinking that ALL manner of risk trades would be supported – not just stocks, but high-yielding currencies like the Australian dollar as well. This assumption has not proven out. For example, the Australian dollar has rapidly lost ground to BOTH the euro (FXE) and the British pound (FXB) since the Bank of Japan’s announcement.

{snip}

{snip}

{snip}

The Australian dollar broke down at an intriguing juncture. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on November 6, 2014. Click here to read the entire piece.)

Full disclosure: net short the Australian dollar, net short the Japanese yen, net long the U.S. dollar