(This is an excerpt from an article I originally published on Seeking Alpha on October 31, 2014. Click here to read the entire piece.)

It seems somehow appropriate in these extraordinary times for central banking that less than two days after the U.S. Federal Reserve officially ends quantitative easing (QE) through its bond purchasing program, the Bank of Japan (BoJ) ups the ante by doubling down on its massive quantitative and qualitative easing (QQE) program.

In a surprise move, the BoJ announced at Friday’s Monetary Policy Meeting (Japan time) that it will:

{snip}

In making this surprise announcement, the BoJ lamented that price pressures have recently declined thanks in part to the April hike in consumption taxes and the plunge in oil prices. The BoJ explained that it felt compelled to take pre-emptive action before the decline in price pressures caused regression back toward the “deflationary mindset.”

{snip}

{snip}

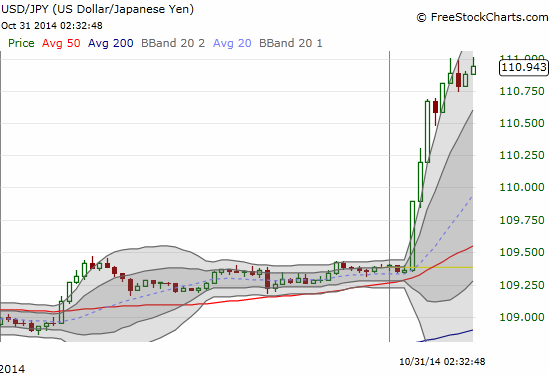

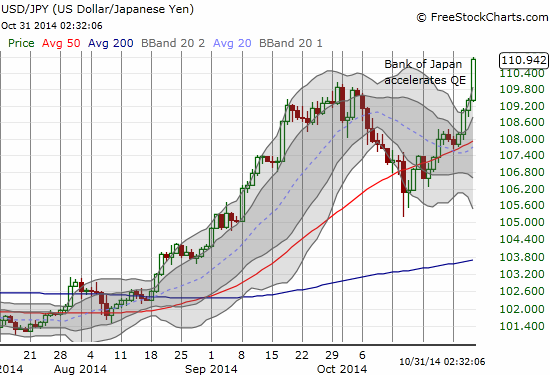

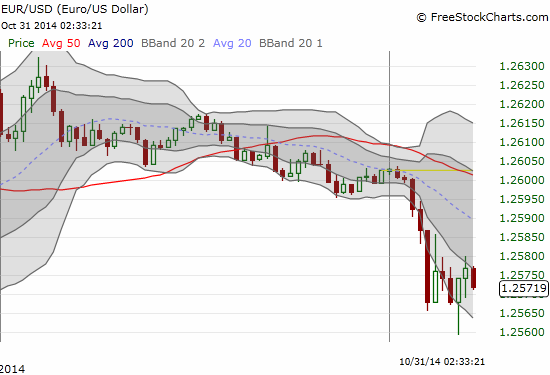

Source of charts: FreeStockCharts.com

Other major currencies also fell against the U.S. dollar in the immediate wake of the BoJ announcement. I strongly suspect that after the initial surprise wears off and major institutions have repositioned themselves, carry trades and similar risk trades will benefit even more than the U.S. dollar.

{snip}

With the gap in monetary policy between the BoJ and the U.S. Fed further diverging, I am expecting USD/JPY to experience an extended rally over time. The timing of the BoJ was brilliant as the Federal Reserve will not have the chance to “nullify” the BoJ with its own ramp in dovish talk for almost two months at the mid-December policy meeting. {snip} The BoJ seems to have put a resounding confirmation on my conclusion early last week that the October correction marked a definitive bottom.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on October 31, 2014. Click here to read the entire piece.)

Long SSO shares and call options; long USD/JPY, short EUR/JPY and GBP/JPY