The U.S. dollar (UUP) is at 11-month highs. The dollar index is finally showing the strength many expected from the beginning of 2014 in anticipation of strong economic numbers and subsequent rate hikes.

The chart above shows that the U.S. dollar index has been on a relative tear since bouncing off its QE3 reference price (the QE reference prices are where the dollar traded at the time the Fed announced QE). This move really accelerated on Tuesday and Wednesday of this week (August 18th and 19th) in the face of strong U.S. housing data. However, this recent history of such rapid moves in the U.S. dollar is not pretty. Especially with the dollar extending above its upper-Bollinger Band (BB), traders should expect a notable pullback.

In particular, Jackson Hole 2014 edition is coming up. This symposium is hosted by the Federal Reserve Bank of Kansas City. It will provide a forum for Federal Reserve Chair Janet Yellen to pedal softly and disappoint folks who are bidding the dollar up in anticipation of some kind of rate hawkish talk.

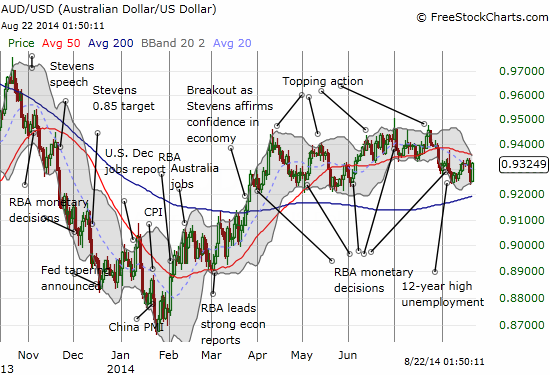

Now if I am wrong, and Janet Yellen delivers for the U.S. dollar, all bets are off. In such a case, I will be particularly interested in ramping up my bets against the Australian dollar with an emphasis on AUD/USD. Reserve Bank of Australia governor Glenn Stevens will likely be the happiest man in the crowd to see the Federal Reserve finally definitively steer toward a normalization of monetary policy.

In any case, the dollar still looks good to trade between the rails of the QE2 and QE3 reference prices. Only a breakout (upside or downside) is a truly significant move at this point.

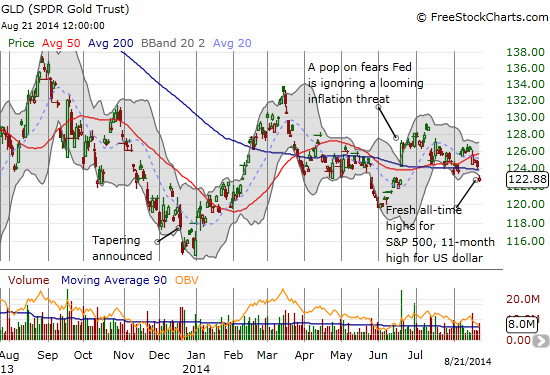

Finally, gold has finally buckled under the pressure of the rising U.S. dollar. As expected, SPDR Gold Shares (GLD) has now completely reversed the premature pop that was presumably in response to a media-driven fear that the Fed was somehow getting behind the curve on inflation.

Source for charts: FreeStockCharts.com

Mind you, I remain bullish gold, but I remain sober in observing that there are simply no near-term catalysts to drive it higher on a sustainable rally. The best I am willing to believe is that 2013’s sell-off has ended in a sustainable bottom.

For your “edutainment”, I have included this short clip from CNBC’s Rick Santelli. I think he is a bit nuts, and the nuttiness seems to grow as the markets refuse year-after-year to bow down to his desires, wishes, and ideologies. But I LOVE this defense of technical analysis relative to trading the “fundamentals” of monetary policy. Quite relevant as Jackson Hole kicks off with the U.S. dollar over-extended in the near-term…

Be careful out there!

Full disclosure: net short the U.S. dollar, long GLD

Thanks for including the Santelli video; I too enjoyed his defense of T/A. (Maybe a few of us should email a link to it to Seeking Alpha ;-).

To play devil’s advocate: there are as many ways to interpret a chart as there are to interpret a FOMC statement. Charts don’t give press conferences at which they “answer” questions, but one can compare charts of related entities to see whether a movement is broad-market or entity-specific.

I think Santelli in his nutty way was essentially saying there is little difference. In this segment at least I don’t think he was saying that technicals are clearly superior – although I guess he came close by comparing chart-reading to anticipating that someone will always knock three times on a door!

I often say fundamental followers are in teh end technicians but don’t know it. After all the business and product analysis, in the end, it comes down to are earnings trending up or down? The technician takes over from there and asks is the market betting on earnings growth or contraction…? 🙂