Last week’s edition of Forex Setup Week featured three major trends: a looming breakdown in the British pound (FXB), a fresh 200-day moving average (DMA) breakout for the U.S. dollar over the Canadian dollar (FXC), and a resilient Australian dollar.

The British pound did indeed fail its critical test against the U.S. dollar and broke down below the 200-day moving average (DMA). It has weakened against major currencies across the board. The U.S. dollar could not hold its breakout against the Canadian dollar. The Australian dollar continued to strengthen against all the major currencies I follow, adding yet more confirmation of last week’s bullish continuation of the bounce from oversold conditions. In other words, it was one of my tougher weeks in a long while for the ol’ forex account. (Fortunately, it followed a pretty good week: the market giveth and the market taketh away…)

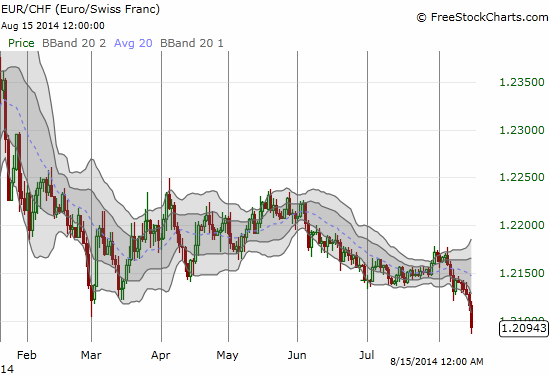

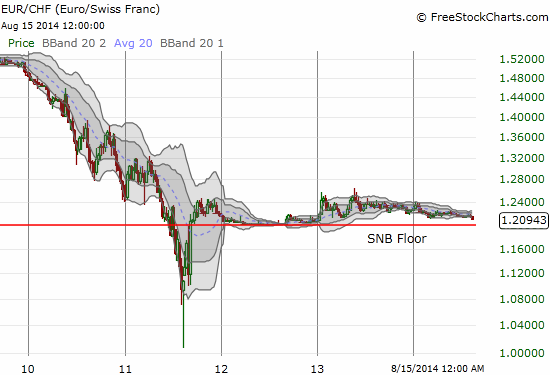

This week, I am increasing my monitoring of the Swiss franc (FXF). The Swiss franc has steadily and very slowly gained strength for several months. That strength accelerated in the past two weeks as seen here against the euro (FXE):

Source: FreeStockCharts.com

The Swiss franc has been a relatively “boring” currency for quite some time, so last week’s move to early 2013 levels caught my attention. I am now more actively watching how this trade resolves. Even more importantly, I am looking out for any larger implications of this move.

Be careful out there!

Full disclosure: net long the Swiss franc, long British pound, long USD/CAD, net short the Australian dollar