Currency markets have been providing some excitement during the past several weeks. Some will ascribe it to lower liquidity, but I think that explanation is too easy. Major adjustments are likely underway in sentiment and positioning, so traders will do well to review charts on at least a weekly basis to assess the bigger picture and storylines…especially when major, longer-term trends at the 200-day moving average (DMA) are involved.

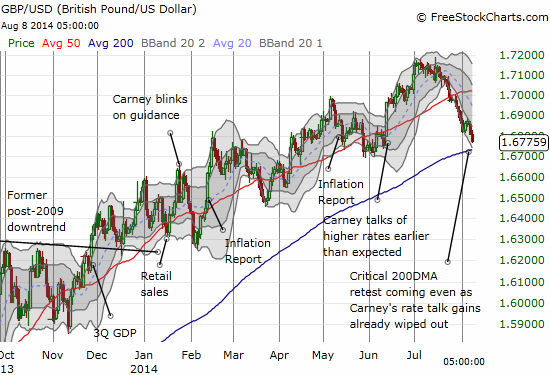

The British pound (FXB) is heading for a critical retest as GBP/USD careens toward its 200-day moving average (DMA).

I thought the reversal of June’s gains would mark the end of the reversal. Instead, the 200-day moving average (DMA) is looking like a more important marker than last week’s manufacturing PMI or interest rate decision from the Bank of England. The pound’s weakness is distributed across all the major currencies I follow. Typically I deal with this situation by reserving one of those currency pairs to make the reverse (hedging) bet against my core positioning. Admittedly, I got caught this time being extra bullish with my bets sprinkled across ALL the major currencies!

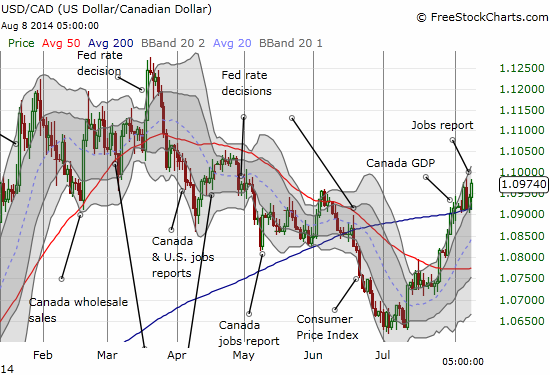

Patience has paid off against the Canadian dollar (FXC) as the U.S. dollar stages a major comeback. Resistance at the 200DMA is quickly melting away against USD/CAD.

I dare not anticipate that my 1.16 upside target will still get tapped by the beginning of 2015 but at least I have taken advantage of the earlier weakness in USD/CAD. I have accumulated a sizeable position that is now working quite well.

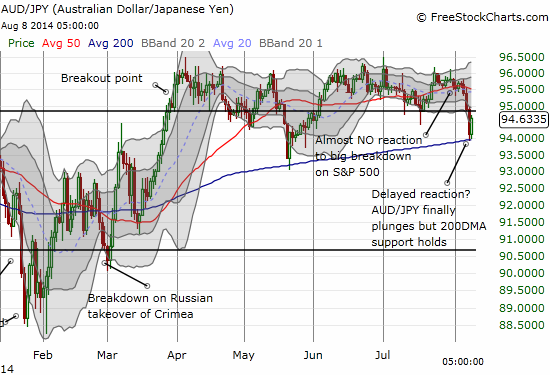

The Australian dollar (FXA) is under pressure again. However, it survived a major test by bouncing off 200DMA support on Friday, August 8th.

Source for charts: FreeStockCharts.com

I have used AUD/JPY as a pretty good gauge this year of underlying risk attitudes and sentiment. Friday’s bounce is a major confirmation of the bullish divergence that preceded the stock market’s continued bounce from oversold conditions. Until AUD/JPY breaks support here, I have to assume the general bias in the market has turned bullish again.

Be careful out there!

Full disclosure: long the British pound, long USD/CAD, net short the Australian dollar

Nwanne,

Been taking interest in your work across many trading sites. I trade forex very and probably good at it for now. USDCAD could still see 10650 area b4 potentially moving higher.Cable could still see 10600 before another attempt up and aussie could be locked up in a range of 9200/50 and 9500/600 for months. I dont usually consider cross pairs as audjpy or eurgbp as they are mere derivative of the majors. For example as I am short cable and long aussie I have no problem of shorting gbpaud. It is important not to watch cross pairs imo bcos there is no currency as EURGBP or AUDJPY so big traders and companies look at real currencies not derivatives.

Cheers and have a wonderful day !

Thanks for reading! Funny – you are positioned exactly opposite of me across the board.

I hear you on the derivatives, but I find them useful from time-to-time, especially as temporary hedges. AUDJPY in particular has been my best tell in 2014 for risk appetites.

Thanks for your response.

First there was a typo above in regard to cable. I expect it towards 16000 ( not 10600) as above. Likely a slow grind down. Apologies.

Second I trade derivatives as they tend to offer strongest trend. As in your example audjpy (I’d be happy to be long this pair as I expect usdjpy to oscillate btw 10100 and 10400; and audusd btw 9250 and 9550) should be rally from here hence audusd is within the low of its band. Thus audjpy is a classical form of mathematical equivalence relation. They are usually useful especially when usd(DXY) directional bias is muted. In reality AUDJPY is actually equivalent to these two trades ( long audusd and long usdjpy)

Cheers

Ah, derivatives. You are definitely more advanced than I am on forex trading! 🙂 What do you mean by “mathematical equivalence relation”? And I figured you meant 16000 on cable. In fact, I think that’s what my eyes saw anyway….

Haa. No I dont think I am more advanced than you do in forex.

A relation is an equivalence relation if it is shows reflex, symmetry and is transitive. That is the union of at least two relations equals a single one. It follows that for example the union of AUDUSD and USDJPY is equivalent to AUDJPY. That is instead of one to separately long AUDUSD and USDJPY at the same time one would rather long AUDJPY only. But the market watches the majors as they relate to USD mostly. This means that the only realistic reason to get long say CADJPY is to be convinced firstly that USDCAD is headed down and/or USDJPY is headed up. Therefore the call on CADJPY should be derived from USDCAD & USDCAD not necessarily CADJPY on its own.The implication is that long CADJPY would fail if USDCAD is headed higher and/or USDJPY is headed lower

Got it. That makes sense. I just never heard that term before. Now I know.

Nwanne,

Cable landed at 16000 as we speculated. Aussie lost that 9200 so looking nicely downwards towards 8500 to ultimately 7200. USDCAD failed to get follow thru at 10800 within the last few weeks and geared to 11670 and higher. The issue is actually the dollar which is gaining strength on on multi-year rally but we wont see much downside in Eurusd or cable. That is the USD strength to be visible in AUD and CAD more than EUR and GBP. Therefor using equivalence relation of transitivity a huge rally is in play for cross rates as EURAUD, GBPAUD snd so on surpassing the recent highs.

I hope you are fine.

Your Igbo brother 🙂

You love that transitivity stuff! 🙂

I am doing well. Seems we are on the same page again. I also see the next phase of dollar strength against high-yielding currencies. Emerging markets should now take a leg down. Let’s see though whether the Fed tries to soft pedal on Wednesday. Every major central bank so far has balked when faced with strength in their currencies…

Dollar rally cant be influenced by FED here. Removing the dollar the flow is in play into Eur and GBP. The second leg of Euro rally has begun and will be noticeable in EURYEN, EURAUD, EURNZD. It will come as strange but this time both strength in Dollar and EURO gonna play out. The dollar strength to play out big time in the usdyen and to an extent in AUD and CAD