(This is an excerpt from an article I originally published on Seeking Alpha on August 1, 2014. Click here to read the entire piece.)

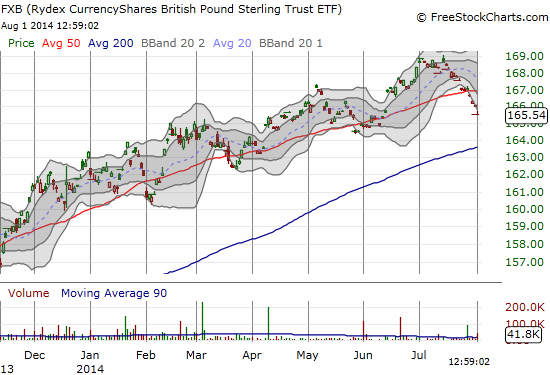

The British pound (FXB) has experienced a steep and near continuous decline ever since it hit new multi-year highs in July against the U.S. dollar.

{snip}

Source: FreeStockCharts.com

After a strong June, expectations were very high for July’s UK Manufacturing PMI. The PMI came in at a strong 55.4 in July but under expectations for 57.2. This is the lowest PMI in a year. The good news is that this is now the 17th month in a row that the PMI has been over 50, representing on-going strength in manufacturing conditions. The case for the Bank of England to raise rates sooner than later remains well intact, suggesting the British pound’s erasure of June’s rate-hope gains is a buying opportunity.

The underlying fundamentals for the UK economy remain strong according to the July PMI:

{snip}

Job growth remains robust:

{snip}

Perhaps most importantly, price pressures are still on the rise:

{snip}

All these data points support a rate hike sooner than later to get off the zero lower bound. The British pound is thus a buy here on the pullback.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on August 1, 2014. Click here to read the entire piece.)

Full disclosure: net long the British pound