At the time of writing, Windstream Holdings, Inc. (WIN) is surging 23.3% on news that the company received a favorable ruling from the IRS to convert to a REIT. From the press release:

“Windstream (Nasdaq: WIN), a leading provider of advanced network communications, today announced plans to spin off certain telecommunications network assets into an independent, publicly traded real estate investment trust (REIT). The transaction will enable Windstream to accelerate network investments, provide enhanced services to customers and maximize shareholder value. The transaction will allow the REIT, which will own Windstream’s existing fiber and copper network and other fixed real estate assets, to expand its network and diversify its assets through acquisitions. The company’s board of directors approved the plan following the receipt of a favorable private letter ruling from the Internal Revenue Service…

The tax-free spinoff will enable Windstream to realize significant financial flexibility by lowering debt by approximately $3.2 billion and increasing free cash flow to accelerate broadband investments, transition faster to an IP network and pursue additional growth opportunities to better serve customers. As a result of the transaction, Windstream will offer faster broadband speeds and more robust performance to consumers. The company said it would expand availability of 10 Mbps Internet service to more than 80 percent of its customers by 2018. It also said it would more than double the availability of 24 Mbps Internet service by 2018, expanding to more than 30 percent of its customers. The REIT will be positioned to provide an attractive dividend to shareholders and grow revenue through lease escalation, capital investment and acquisitions.”

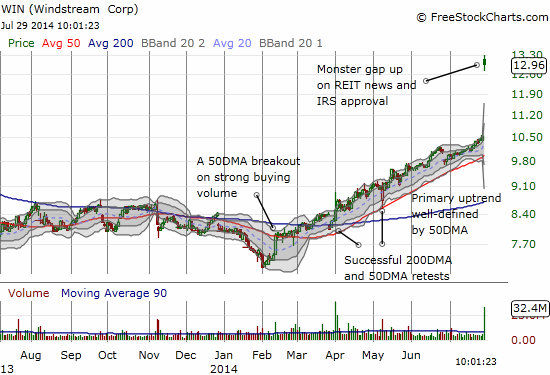

WIN is a high-dividend paying stock that has been on a tear since early February and a nasty five-year low. This punctuated a downtrend in place since early January, 2011 and accelerated in May, 2012. The two trends are great examples of the benefits of following trends with the uptrend providing the best opportunity.

On the downtrend, WIN moved widely from lows to highs and shorts had to have stomachs of steel to hang on. As is often the case with shorting, fading at resistance worked best for this downtrend channel. The uptrend that finally developed was a distinct contrast with its orderly march higher and very neat and successful retests of important support at the 50 and 200-day moving averages (DMAs). I have the benefit of hindsight of course, but if I were short the stock, the extended trading range for most of 2013 would have encouraged me to bail at some point. Bolder shorts who were patient enough to hold on for the 2014 low could have bailed just based on the stock’s history of swinging wildly from lows to highs. Certainly, the breakout above the 50 and then 200DMA should have put shorts on notice with the first successful retest being the final warning. The last 50DMA breakout was different than the others in 2013 as it was accompanied by heavy buying volume – an early warning signal.

Source: FreeStockCharts.com

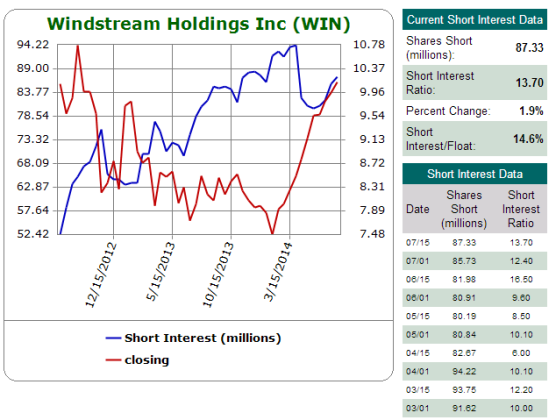

The downtrend caught the attention of a growing number of shorts. In almost two years, shares short grew about 44%. Soon after the 2014 low, shorts finally began to back off; these early exiters perhaps saw the writing on the wall. Perhaps they bailed on the technical signal of 2013’s consolidation range breaking to the upside.

Source: Schaeffer’s Investment Research

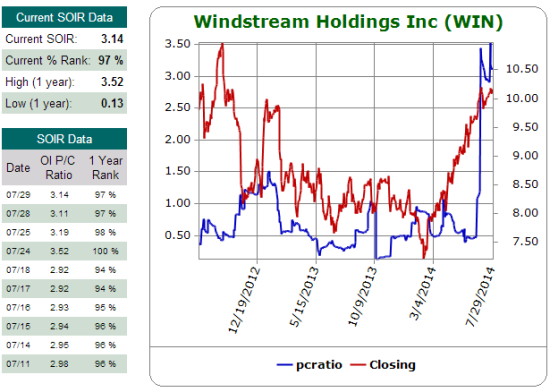

To make things interesting and more complicated, some ill-timed bear(s) or someone looking for major protection, sent the put/call ratio soaring in June. Open interest on the August $9 put soared from near nothing to over 10,000 on June 18th. This formed a distinct contrast to the 14,000 options of open interest in the January $10 call. These calls were in steady accumulation from early 2013 and well into this year.

Source: Schaeffer’s Investment Research

Source for options charts: Etrade.com

The trader(s) loading up on puts last month made a classic error in fighting the trend. However, I can imagine if I saw it happen in the moment, I might have jumped to the conclusion that someone “knows” something very bearish to WIN. Yet, the trader(s) steadily accumulating long-term calls were doing so despite the downtrend. In a way, the extended record of this buying could have outweighed the very short-term signal of the panic rush to grab puts expiring in a month. This represents a very mixed lesson and knowing who was the “smart” trader/investor is only clear with hindsight. Options trading is always difficult to interpret; doing so is much more an art than a science!

In my case, I had invested in WIN based on the dividend. At the time, I was on the lookout for high-yielding plays, especially in telco/communications, that offered discounts from sell-offs. WIN obliged back in May, 2012 and I was in. (I know, I know. The irony of a habitual contrarian giving a lecture on trend-following!) I felt brilliant at the time because the stock soon bottomed and rallied over the next month. My decision to hold since then was mostly based on using the high dividend as a buffer. I WISH I could say that I used the interesting technical and sentiment analysis above. It would have greatly informed my thinking on the stock! At least I held through the uptrend despite constant nagging in my head to sell. Instead, I decided to let the trend run its course…hoping that I would get a “good enough” signal whenever the trend came to an end.

Regardless, it was a no-brainer for me to sell into today’s surge and lock in profits; combined with the juicy dividend, this turned into a great longer-term trade/investment. No need to be a pig here. I still find WIN interesting and will definitely consider re-entering if the stock suffers another severe setback as its history suggests is bound to happen. However next time, I will conduct a more thorough (and more typical) battery of technical tests.

Be careful out there!

Full disclosure: no positions