(This is an excerpt from an article I originally published on Seeking Alpha on July 9, 2014. Click here to read the entire piece.)

When gold (GLD) spiked higher last month (June 19, 2014), some heralded the move as proof that the Federal Reserve was falling behind inflationary pressures.

Source: FreeStockCharts.com

I characterized the move as premature but perhaps confirmation that the relentless selling in 2013 marked a bottom for gold. If 2013 is indeed a bottom, I have mixed feelings since I started the year looking forward to adding to positions at lower prices. But such a bottom would vindicate my insistence right at 2013’s first low in July that investors should ignore the “noise” and continue accumulating positions.

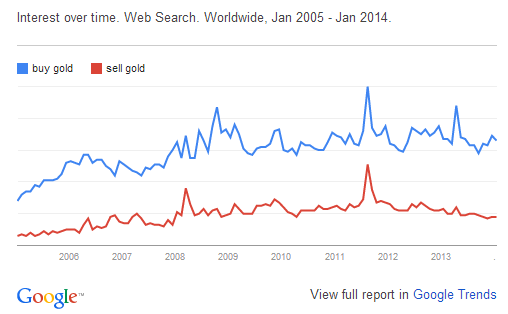

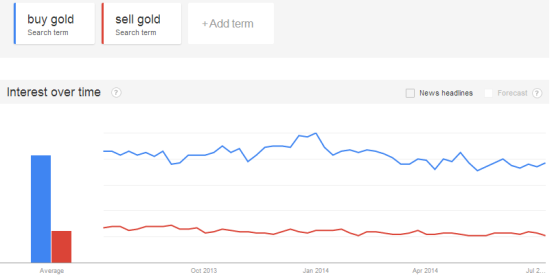

In these past pieces on gold, Google search trends have provided useful tools for assessing the character of sharp or otherwise extreme moves in the price of gold. {snip}

{snip}

Source for Google trends data: Google Trends

At a bare minimum, it seems reasonable to conclude that June’s move higher was insignificant in the overall collection of gold moves in recent years. If so, it also then seems reasonable to expect gold to eventually reverse (fade) most of June’s move without any fresh and new catalyst that provides more sustained interest. Either way, this episode provides one more opportunity to confirm the validity of this method for assessing gold sentiment in short to intermediate timeframes. Stay tuned…

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 9, 2014. Click here to read the entire piece.)

Full disclosure: long GLD